Sara Lee 2009 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2009 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

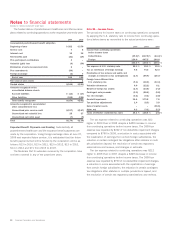

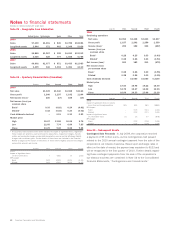

Notes to financial statements

Dollars in millions except per share data

84 Sara Lee Corporation and Subsidiaries

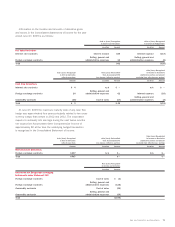

Note 23 – Geographic Area Information

United States Netherlands Spain Other Total

2009

Sales $7,100 $1,151 $÷«845 $3,785 $12,881

Long-lived assets 2,844 371 463 1,348 5,026

2008

Sales $6,860 $1,267 $÷«995 $4,090 $13,212

Long-lived assets 3,026 428 777 1,555 5,786

2007

Sales $6,602 $1,077 $÷«871 $3,433 $11,983

Long-lived assets 3,409 346 1,004 1,351 6,110

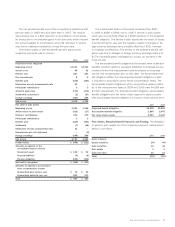

Note 24 – Quarterly Financial Data (Unaudited)

Quarter First Second Third Fourth

2009

Net sales $3,349 $3,340 $3,028 $3,164

Gross profit 1,240 1,197 1,142 1,204

Net income (loss)1230 (17) 165 (14)

Net income (loss) per

common share

Basic10.33 (0.02) 0.24 (0.02)

Diluted10.32 (0.02) 0.24 (0.02)

Cash dividends declared – 0.11 0.11 0.22

Market price

High 15.07 13.55 10.64 9.75

Low 12.05 7.74 6.80 7.85

Close 13.29 9.42 8.25 9.58

1The quarterly financial data shown above includes the impact of significant items. Significant

items include exit activities, asset and business dispositions, impairment charges, transfor-

mation and accelerate charges, accelerated depreciation, pension partial withdrawal liability

charges and curtailment gains. Further details of these items are included in the Financial

Review on page 18. The impact of these items is shown where negative amounts are charges

and positive amounts are income.

Quarter First Second Third Fourth

2009

Impact of significant items

on net income (loss) 7 (161) (7) (213)

EPS impact

Basic 0.02 (0.23) (0.01) (0.31)

Diluted 0.01 (0.23) (0.01) (0.31)

Quarter First Second Third Fourth

2008

Continuing operations

Net sales $3,054 $3,408 $3,243 $3,507

Gross profit 1,157 1,292 1,259 1,350

Income (loss)1200 182 234 (657)

Income (loss) per

common share

Basic10.28 0.25 0.33 (0.93)

Diluted10.28 0.25 0.33 (0.93)

Net income (loss)1200 182 211 (672)

Net income (loss)

per common share

Basic10.28 0.25 0.30 (0.95)

Diluted10.28 0.25 0.30 (0.95)

Cash dividends declared – 0.1050 0.1050 0.2100

Market price

High 17.54 16.95 16.22 15.00

Low 14.75 15.67 12.32 12.15

Close 16.69 16.23 13.66 12.18

Quarter First Second Third Fourth

2008

Impact of significant items on income

(loss) from continuing operations $(1) $24 $81 $(863)

EPS impact

Basic – 0.03 0.11 (1.22)

Diluted – 0.03 0.11 (1.22)

Impact of significant items

on net income (loss) (1) 23 57 (878)

EPS impact

Basic – 0.03 0.08 (1.24)

Diluted – 0.03 0.08 (1.24)

Note 25 – Subsequent Events

Contingent Sale Proceeds In July 2009, the corporation received

a payment of 95 million euros, as the contingencies had passed

related to the 2010 annual contingent payment from the sale of the

corporation’s cut tobacco business. Based upon exchange rates in

effect on the date of receipt, the payment was equivalent to $133 and

will be recognized in the first quarter of 2010. Further details regard-

ing these contingent payments from the sale of the corporation’s

cut tobacco business are contained in Note 16 to the Consolidated

Financial Statements, “Contingencies and Commitments.”