Sara Lee 2009 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2009 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

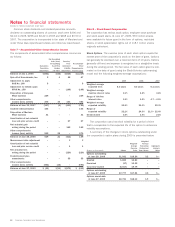

Notes to financial statements

Dollars in millions except per share data

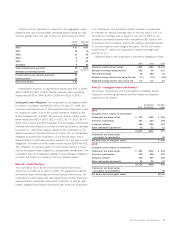

North American Foodservice Property and Goodwill

In 2008, steps

were taken to market and identify potential buyers for the U.S. direct

store delivery foodservice beverage business (DSD) that is part of the

North American Foodservice segment. In June 2008, the corporation’s

board of directors authorized management to negotiate and sell DSD

under certain criteria. As part of this process, the corporation received

a non-binding offer for the business which was less than the carrying

value. Utilizing the net purchase price, the corporation conducted an

impairment review of DSD and recognized a pretax impairment charge

of $49 in the fourth quarter of 2008, of which $38 and $11 were

related to property and goodwill, respectively. The after tax impact

of the impairment charge was $33. The remaining assets of this

reporting unit were classified as held for sale at the end of 2008.

During 2009, the corporation completed the disposition of the

DSD business and received $42.

2007

North American Retail Property

In 2007, the corporation decided to

exit a commodity meats hog slaughtering operation being conducted

at a facility that is part of the North American Retail segment. Certain

of the activities performed at the location were transferred to more

efficient third-party suppliers and others were eliminated as part of

the shutdown of this plant. Based upon our consideration of the

results of a third-party appraisal and internal estimates of cash

flows to be generated through the date of disposition, the corpora-

tion concluded that it was necessary to recognize an impairment

charge of $34 for this asset group in 2007. The after tax impact

of this impairment charge was $22.

North American Fresh Bakery Trademarks

In 2007, as part of the

corporation’s transformation plan to improve operating efficiency and

profitability, the North American Fresh Bakery business began to focus

its marketing, advertising and promotion spending on a select number

of brands. As a result of these plans, the corporation assessed the

recoverability of certain trademarks impacted by this strategy. The

corporation determined that the undiscounted cash flows over the

remaining lives of the trademarks did not recover the carrying value

of the assets. Therefore, the corporation calculated the estimated fair

value of the trademarks using the royalty savings method and recorded

an impairment charge of $16 for the difference between fair value and

carrying value. The after tax impact of the impairment charge is $10.

International Beverage Goodwill and Trademarks

In 2007, the

corporation recognized a $118 pretax impairment charge in its

International Beverage operations to record the impairment of $92

of goodwill and $26 of trademarks. No tax benefit was recognized

on the goodwill impairment charge. The after tax impact of the

trademark impairment charge is $17.

International Household and Body Care

In 2007, changes in local

governmental regulations in Zimbabwe included severe foreign

exchange restrictions which inhibit the corporation from declaring divi-

dends and repatriating earnings from the local operation. Due to these

restrictions, the corporation recognized a pretax charge of $4 in 2007.

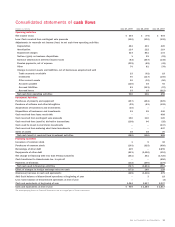

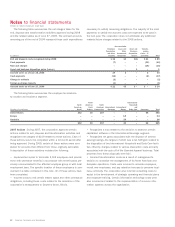

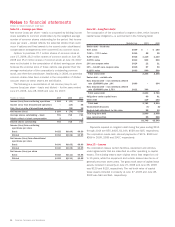

Note 4 – Discontinued Operations

There were no financial results attributable to discontinued operations

in 2009. In 2008, the corporation disposed of its Mexican Meats

operations. In 2007, the corporation disposed of its European Meats

and Branded Apparel Americas/Asia businesses. The results of

these businesses have been reported as discontinued operations.

The amounts in the tables below reflect the operating results of the

businesses reported as discontinued operations. Gains and losses

related to the disposal of these discontinued operations are excluded

from the following tables; however, they are discussed further below.

Pretax

Income Income

Net Sales (Loss) (Loss)

2008

European Branded Apparel $«««««««– $(15) $(15)

Mexican Meats 23811

Total $÷«238 $(14) $(14)

2007

European Meats $«««114 $«««7 $«««3

Branded Apparel Americas/Asia 787 85 59

Mexican Meats 296 (10) (14)

Total $1,197 $«82 $«48

Results of Discontinued Operations Net sales of discontinued

operations were $238 in 2008 and $1,197 in 2007; a full year

of results for the Mexican meats business was not included in

2008 as the business was sold in the third quarter of 2008; and

a full year of results for the European Meats and Branded Apparel

Americas/Asia businesses was not included in 2007 as each of

the businesses was sold in the first quarter of that fiscal year.

The corporation reported income (loss) from discontinued

operations of $(14) in 2008 and $48 in 2007. In 2008, the corpo -

ration recognized a $15 charge related to the settlement of a

pension plan in the U.K. associated with the European Branded

Apparel business, which was sold in 2006.

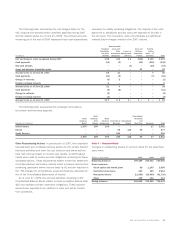

Gain (Loss) on the Sale of Discontinued Operations

The gains (losses) recognized in 2008 and 2007 are summarized in

the following tables. A further discussion of each disposition follows.

Pretax Tax

Gain (Loss) (Charge)/ After Tax

on Sale Benefit Gain (Loss)

2008

Mexican Meats $(23) $«(1) $(24)

2007

European Meats $«18 $«(1) $«17

Branded Apparel Americas/Asia (23) 6 (17)

Philippines portion of European

Branded Apparel 8(2) 6

Other 2810

Total $«««5 $11 $«16

58 Sara Lee Corporation and Subsidiaries