Sara Lee 2009 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2009 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial review

26 Sara Lee Corporation and Subsidiaries

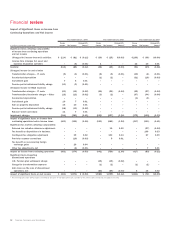

Net Sales Bridge – Components of Change 2008 versus 2007

Price/Mix/ Acquisitions/

Volume Other Dispositions Currency Total

North American

Retail 2.8 % 0.3 % –% –% 3.1%

North American

Fresh Bakery 1.1 8.2 ––9.3

North American

Foodservice (3.9) 4.7 –0.2 1.0

International Beverage 1.5 7.1 –14.3 22.9

International Bakery 0.3 2.7 –13.1 16.1

International Household

and Body Care 4.6 (2.4) 0.1 9.9 12.2

Total business

segments 1.2 % 3.4 % –% 5.7% 10.3%

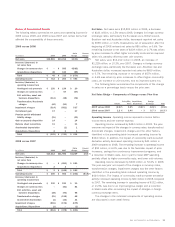

Operating segment income and total income from continuing

operations for 2009, 2008 and 2007 are as follows:

In millions 2009 2008 2007

Income from continuing operations

before income taxes

North American Retail $«260 $÷«155 $÷«80

North American Fresh Bakery 33 60 14

North American Foodservice 54 (302) 135

International Beverage 488 547 317

International Bakery (193) (346) 38

International Household and Body Care 242 315 272

Total operating segment income 884 429 856

Amortization of intangibles (65) (67) (64)

General corporate expenses

Other (238) (254) (352)

Mark-to-market derivative gains/(losses) (18) 22 2

Contingent sale proceeds 150 130 120

Total operating income 713 260 562

Interest expense, net (125) (100) (133)

Income from continuing operations

before income taxes $«588 $÷«160 $«429

A discussion of each business segment’s sales and operating

segment income is presented on the following pages.

The change in unit volumes for each business segment excludes

the impact of acquisitions and dispositions, if any.

The amortization of intangibles in the preceding table relates

to trademarks and customer relationships. It does not include soft-

ware amortization, a portion of which is recognized in the earnings

of the segments and a portion is recognized as part of general

corporate expenses.

Total general corporate expenses, which are not allocated to

the individual business segments, were $256 million in 2009, an

increase of $24 million over the prior year. This increase was driven

by the year-over-year change in mark-to-market derivative gains/

(losses). In 2009, there were $18 million of unrealized mark-to-market

losses incurred on commodity derivative contracts, primarily related

to energy, versus unrealized gains on commodity derivatives of

$22 million in 2008. Other general corporate expenses decreased

$16 million versus the prior year due to lower pension costs and

favorable foreign currency transactions partially offset by increased

professional fees for consulting and special project work. General

corporate expenses were also favorably impacted by approximately

$22 million related to certain nonrecurring items – primarily a

non-income related foreign tax refund and a reduction in contingent

lease accruals.

In 2008, total general corporate expenses of $232 million were

$118 million lower than 2007 due to lower transformation related

costs, a reduction in pension and other benefit plan expenses, the

non-recurrence of costs associated with the corporation’s hedging

program and a $20 million increase in unrealized mark-to-market

gains on commodity derivatives.

The impact of the costs related to exit activities and asset and

business dispositions, transformation and Project Accelerate costs

and impairment charges on the corporation’s business segments

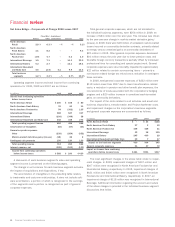

and general corporate expenses are summarized as follows:

In millions 2009 2008 2007

North American Retail $÷÷– $÷34 $118

North American Fresh Bakery 37 3 42

North American Foodservice 106 436 11

International Beverage 32 15 139

International Bakery 245 409 18

International Household and Body Care 10 7 17

Impact on the business segments 430 904 345

General corporate expenses 31 37 72

Impact on income from continuing

operations before income taxes $461 $941 $417

The most significant charges in the above table relate to impair-

ment charges. In 2009, impairment charges of $107 million and

$207 million were recognized in North American Foodservice and

International Bakery, respectively. In 2008, impairment charges of

$431 million and $400 million were recognized in North American

Foodservice and International Bakery, respectively. In 2007, an

impairment charge of $118 million was recognized in International

Beverage. Additional information regarding the amount and nature

of the above charges is provided in the individual business segment

discussions that follow.