Ryanair 2012 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2012 Ryanair annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4

CHAIRMAN‟S REPORT

Dear Shareholders,

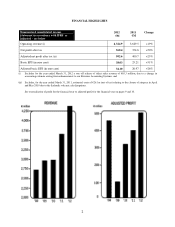

I am very pleased to report a 25% increase in profit after tax to a new record of €503 million. This was a

strong performance despite a €367 million rise in fuel costs which we managed to offset by a 16% rise in

average fares.

During the year Ryanair delivered a number of significant milestones:

We grew our traffic by 5% to 76 million passengers.

We took delivery of 25 (net) new aircraft and we had a year-end fleet of 294 Boeing 737-800‘s.

We opened 6 new bases and 330 new routes bringing the total number of routes operated to over 1,500.

We improved our industry leading passenger service with better punctuality, fewer lost bags and less

cancellations.

We completed a share buyback of €125 million in fiscal 2012 and €68 million in April 2012, and the

board have proposed a dividend of €0.34 per share amounting to approximately €489 million subject to

shareholder approval at the annual general meeting. The combination of the second special dividend

(subject to shareholder approval) and previous share buybacks and dividends will mean that Ryanair has

returned an industry leading €1.53 billion to shareholders over the past 5 years.

Fuel costs as a proportion of our total operating costs have risen to 43% in fiscal 2012. We are 90% hedged

for fiscal 2013, at just over $100 per barrel and we are faced with a further €320 million increase in our fuel bill,

a total increase in 2 years of €687 million. Oil price rises and higher winter airport charges at certain

government owned airports will make it commercially sound to ground up to 80 aircraft rather than suffer losses

operating these aircraft during the winter when yields are significantly lower. Nevertheless, we still expect

passenger volumes in fiscal 2013 to grow by approximately 5% to 79 million passengers.

In the airline industry, we yet again face another challenging year with significantly higher fuel prices and

with European government fiscal deficits resulting in austerity measures and leading to falling European

consumer confidence. As recessionary pressures continue we believe more carriers will exit the industry and we

intend to take advantage of those developments, as we have this year, when we opened a new base in Budapest

following the closure of Malev, and significantly expanded our operations at Barcelona and Madrid following

the closure of Spanair. We believe that the winners will be those airlines with strong balance sheets (we currently

have over €3.8 billion in cash), the lowest costs and a strong sustainable business model.

I would like to take this opportunity to thank Paolo Pietrogrande for his contribution and commitment to

Ryanair as a director over the last eleven years. Although eligible, Paolo has decided not to stand for re-election

at the AGM on September 21, 2012 and we wish him much success in the future.

Notwithstanding the issues we face, the outstanding people at Ryanair continue to work hard on behalf of

shareholders to reduce our costs while at the same time delivering the lowest fares in Europe to our 79 million

passengers. As a result, we still expect to generate significant profits in fiscal 2013 although these are likely to

be lower than we enjoyed in fiscal 2012.

Yours sincerely,

_______________

David Bonderman

Chairman