Ryanair 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 Ryanair annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

1

CONTENTS

2

Financial Highlights

4

Chairman‟s Report

5

Chief Executive‟s Report

9

Summary Operating and Financial Overview

11

Directors‟ Report

15

Corporate Governance Report

27

Report of the Remuneration Committee on Directors‟ Remuneration

28

Statement of Directors‟ Responsibilities

30

Independent Auditor‟s Report

32

Presentation of Financial and Certain Other Information

34

Detailed Index*

36

Key Information

42

Principle Risks and Uncertainties

55

Information on the Company

77

Operating and Financial Review

81

Critical Accounting Policies

95

Directors, Senior Management and Employees

103

Major Shareholders and Related Party Transactions

103

Financial Information

113

Additional Information

122

Quantitative and Qualitative Disclosures About Market Risk

127

Controls and Procedures

130

Consolidated Financial Statements

186

Company Financial Statements

192

Directors and Other Information

193

Appendix

*See Index on page 34 for detailed table of contents.

Information on the Company is available online via the Internet at our website, www.ryanair.com.

Information on our website does not constitute part of this Annual Report. This Annual Report and our 20-F

are available on our website.

Table of contents

-

Page 1

...on the Company 77 Operating and Financial Review 81 Critical Accounting Policies 95 Directors, Senior Management and Employees 103 Major Shareholders and Related Party Transactions 103 Financial Information 113 Additional Information 122 Quantitative and Qualitative Disclosures About Market Risk 127... -

Page 2

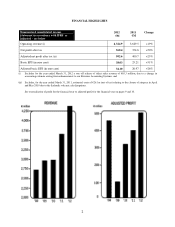

...% +26% Excludes for the year ended March 31, 2012 a one off release of ticket sales revenue of â,¬65.3 million, due to a change in accounting estimate arising from enhancements to our Revenue Accounting Systems, and (ii) Excludes, for the year ended March 31, 2011, estimated costs of â,¬26.1m (net... -

Page 3

2012 Key Statistics Scheduled passengers Fleet at period end Average number of employees Passengers per average no. of employees 75.8m 294 8,438 8,983 2011 72.1m 272 8,063 8,942 Change +5% +8% +5% +1% 3 -

Page 4

...76 million passengers. We took delivery of 25 (net) new aircraft and we had a year-end fleet of 294 Boeing 737-800's. We opened 6 new bases and 330 new routes bringing the total number of routes operated to over 1,500. We improved our industry leading passenger service with better punctuality, fewer... -

Page 5

... delay the inevitable sale of Stansted Airport. Ryanair is working with the Competition Commission to expedite the long delayed sale of Stansted which will, we believe, bring about much needed competition, lower costs and better passenger service at Stansted, and reverse 5 years of traffic declines... -

Page 6

... high fares charged by our competitor's incl. Air France, British Airways, Easyjet and Lufthansa. Ryanair's growth and profitability is not based solely on price. In addition to the lowest fares in every market last year, Ryanair also delivered: 1. 2. The best punctuality - 91% of flights on-time... -

Page 7

...and OLT Express in recent months) Ryanair is proud of its long-standing record of job creation and internal promotions. Our shareholders Unlike other airlines, Ryanair continues to deliver significant returns for shareholders. In Ryanair the Board and Management team hold a significant stake in the... -

Page 8

...Chairman, my fellow Board members, our Managers and all the team at Ryanair for their hard work over the past 12 months, which has helped us deliver another year of low fare traffic growth and record profits for the benefit of our passengers, our people and our shareholders. Yours sincerely Michael... -

Page 9

......104.0 Aircraft rentals ...90.7 Route charges ...460.5 Airport and handling charges ...554.0 Marketing, distribution & other ...180.0 Icelandic volcanic ash related cost ...3,707.0 Total operating expenses Operating profit - 617.9 continuing operations Other income / (expense) Finance income ...44... -

Page 10

...and higher internet related revenues. Total revenue per passenger, as a result, increased by 13%, whilst Load Factor decreased by 1 point to 82% during the year. Total operating expenses increased by 19% to â,¬3,707.0 million, primarily due to an increase in fuel prices, the higher level of activity... -

Page 11

...has its registered offices at Corporate Headquarters, Dublin Airport, Co. Dublin, Ireland. It is a public limited company and operates under the laws of Ireland. Staff At March 31, 2012, the Company's personnel numbered 8,388 people, including 1,636 pilots and 2,867 cabin crew employed on a contract... -

Page 12

...senior key management (defined as the executive team reporting to the Board of Directors) is set out in Note 27 on page 185 of the consolidated financial statements. Executive director‟s service contract Ryanair entered into an employment agreement with the only executive director of the Board, Mr... -

Page 13

... the financial years ended March 31, 2012, 2011 and 2010 the Company made no political contributions which require disclosure under the Electoral Act, 1997. Corporate Governance Statement The Corporate Governance Statement on pages 15 to 26 forms part of the Directors' Report. Post balance sheet... -

Page 14

Annual General Meeting The Annual General Meeting will be held on September 21, 2012 at 9am in the Radisson Blu Hotel, Dublin Airport, Co. Dublin, Ireland. On behalf of the Board Mr. David Bonderman Chairman July 27, 2012 Mr. Michael O‟ Leary Chief Executive 14 -

Page 15

... Irish Corporate Governance Annex is available on the Irish Stock Exchange's website, www.ise.ie. The Board of Directors Roles The Board of Ryanair is responsible for the leadership, strategic direction and overall management of the Group. The Board's primary focus is on strategy formulation, policy... -

Page 16

...this industry, and significant public company experience. Historically, the Company has always separated the roles of Chairman and Chief Executive for the running of the business and implementation of the Board's strategy and policy. Name Role Independent Years on board Audit Remuneration Nomination... -

Page 17

... own level of senior experience gained in their fields of international business and professional practice. When arriving at this decision, the Board has taken into account the comments made by the FRC in their report dated December, 2009 on their review of the impact and effectiveness of the 2010... -

Page 18

...page 176 of the consolidated financial statements. The Board has adopted The Model Code, as set out in the Listing Rules of the Irish Stock Exchange and the UK Listing Authority, as the code of dealings applicable to dealings in Ryanair shares by directors and relevant Company employees. The code of... -

Page 19

.... The Nomination Committee regularly review the structure, size and composition (including the skills, knowledge and experience) required of the Board compared to its current position with regard to the strategic needs of Ryanair and recommends changes to the Board. The Nomination Committee consider... -

Page 20

...the Annual Report, which is filed annually with the United States Securities and Exchange Commission; The Committee regularly reviews Turnbull Risk management reports completed by management; The Committee conducts an annual assessment of the operation of the Group's system of internal control based... -

Page 21

...senior executives of the Company and to administer the stock option plans described below. Senior Management remuneration is comprised of a fixed basic pay and performance related bonuses which are awarded based on a combination of the achievement of individual objectives and the Company's financial... -

Page 22

...the September 2011 Board meeting in respect of the year under review. Shareholders Ryanair recognises the importance of communications with shareholders. Ryanair communicates with all of its shareholders following the release of quarterly and annual results directly via road shows, investor days and... -

Page 23

... of the non-executive directors wishes to attend meetings with major shareholders, arrangements are made accordingly. General Meetings All shareholders are given adequate notice of the AGM at which the Chairman reviews the results and comments on current business activity. Financial, operational and... -

Page 24

... and issue of financial reports to shareholders and the markets, including the Annual Report and consolidated financial statements, is overseen by the Audit Committee. The Company's financial reporting process is controlled using documented accounting policies and reporting formats, supplemented by... -

Page 25

... whereby executive management reviews and monitors the controls in place, both financial and non financial, to manage the risks facing the business. On behalf of the Board, the Audit Committee has reviewed the effectiveness of the Company's system of risk management and internal control for the year... -

Page 26

...the Irish Corporate Governance Annex except as outlined below. The Group has not complied with the following provisions of the 2010 Code, but continues to review these situations on an ongoing basis: Non-executive directors participate in the Company's share option plans. The 2010 Code requires that... -

Page 27

... their appointment. Ryanair's Articles of Association require that all directors retire after a fixed period not exceeding three years. Directors can then offer themselves for re-election at the Company's Annual General Meeting. None of the non-executive Directors hold a service agreement with the... -

Page 28

... and the Company will continue in business. Under applicable law and the requirements of the Listing Rules issued by the Irish Stock Exchange, the directors are also responsible for preparing a Directors' Report and reports relating to directors' remuneration and corporate governance that comply... -

Page 29

... listed on page 95 of the Annual Report confirm that, to the best of their knowledge and belief: the consolidated financial statements, prepared in accordance with IFRSs as adopted by the EU, give a true and fair view of the assets, liabilities and financial position of the Group at March 31, 2012... -

Page 30

... statements. The other information comprises only the Ch airman's and Chief Executive's Reports; the Corporate Governance Report; the Operating and Financial Review; Principle Risks and Uncertainties; Critical Accounting Policies; Directors, Senior Management and Employees; Major Shareholders... -

Page 31

... the Company. The Company's balance sheet is in agreement with the books of account. In our opinion, the information given in the Directors' Report and the description in the annual corporate governance statement of the main features of the internal control and risk management systems in relation to... -

Page 32

... euro, the common currency of seventeen member states of the European Union (the ―EUâ€-), including Ireland. Various amounts and percentages set out in this annual report on Form 20-F have been rounded and accordingly may not total. The Company owns or otherwise has rights to the trademark Ryanair... -

Page 33

... and security measures, terrorist attacks, actions of the Irish, U.K., EU and other governments and their respective regulatory agencies, fluctuations in currency exchange rates and interest rates, changes to the structure of the euro, airport handling and access charges, litigation, labor relations... -

Page 34

...4. Information on the Company ...55 Introduction ...55 Strategy...56 Route System, Scheduling and Fares...60 Marketing and Advertising ...61 Reservations on Ryanair.Com ...61 Aircraft ...62 Ancillary Services ...63 Maintenance and Repairs ...64 Safety Record ...65 Airport Operations ...66 Fuel ...68... -

Page 35

... Financial Information ...103 Significant Changes ...109 Item 9. The Offer and Listing...110 Trading Markets and Share Prices ...110 Item 10. Additional Information ...113 Description of Capital Stock...113 Options to Purchase Securities from Registrant or Subsidiaries...113 Articles of Association... -

Page 36

... early 1990s. As of June 30, 2012, the Company offered over 1,500 scheduled short-haul flights per day serving approximately 160 airports largely throughout Europe, with an operating fleet of 294 aircraft flying approximately 1,500 routes. The Company also holds a 29.8% interest in Aer Lingus Group... -

Page 37

... This information should be read in conjunction with: (i) the audited consolidated financial statements of the Company and related notes thereto included in Item 18; and (ii) ―Item 5. Operating and Financial Review and Prospects.â€- Income Statement Data: Fiscal year ended March 31, 2012 2011 2010... -

Page 38

... inflow from operating activities Net cash (outflow) from investing activities ...Net cash (outflow)/inflow from financing activities ...Increase/(decrease) in cash and cash equivalents ... _____ (a) Dollar amounts are translated from euro solely for convenience at the Federal Reserve Rate on March... -

Page 39

... dollar and the euro; (ii) the U.K. pound sterling and the euro; and (iii) the U.K. pound sterling and the U.S. dollar. Such rates are provided solely for the convenience of the reader and are not necessarily the rates used by the Company in the preparation of its consolidated financial statements... -

Page 40

...on the last business day of each month during the relevant period. (c) Based on the composite exchange rate as quoted at 5 p.m., New York time, by Bloomberg. (d) Based on the Federal Reserve Rate for U.K. pound sterling. As of July 13, 2012, the exchange rate between the U.S. dollar and the euro was... -

Page 41

... Flown ...489,759 Number of Airports Served at Period End ...159 Average Daily Flight Hour Utilization (hours) ...8.47 Personnel at Period End ...8,388 Personnel per Aircraft at 30 Period End ...Booked Passengers per Personnel at Period End ...9,038 Fiscal Year ended March 31, 2011 2010 72,062,659... -

Page 42

... of Ryanair's fleet in 2013 will result in an increase, in absolute terms, in Ryanair's aggregate fuel costs. Based upon Ryanair's fuel consumption for the 2012 fiscal year, a change of $ 10 in the average annual price per metric ton of jet fuel at the prevailing euro/U.S. dollar exchange rate would... -

Page 43

...has significant operating revenues and operating expenses, as well as assets and liabilities, denominated in U.K. pounds sterling. In addition, fuel, aircraft, insurance, and some maintenance obligations are denominated in U.S. dollars. The Company's results of operations and financial condition can... -

Page 44

... increased competition. See ―Item 4. Information on the Company-Government Regulation- Liberalization of the EU Air Transportation Market.â€- The airline industry is highly susceptible to price discounting, in part because airlines incur very low marginal costs for providing service to passengers... -

Page 45

... years, in addition to other factors, may also strain existing management resources and related operational, financial, management information and information technology systems, including Ryanair's Internet -based reservation system, to the point that they may no longer be adequate to support... -

Page 46

...provide service to, or increase service at, such airports. Ryanair's future growth also materially depends on its ability to access suitable airports located in its targeted geographic markets at costs that are consistent with Ryanair's ultra -low cost strategy. Any condition that denies, limits, or... -

Page 47

... may change in the future to require such a forced disposition. If eventually forced to dispose of its stake in Aer Lingus, Ryanair could suffer significant losses due to the negative impact on market prices of the forced sale of such a significant portion of Aer Lingus' shares. The United Kingdom... -

Page 48

... details see - ―Change in EU regulations in relations to Employers and Employee Social Insurance could Increase costsâ€-. Ryanair currently conducts collective bargaining negotiations with groups of employees, including its pilots, regarding pay, work practices, and conditions of employment... -

Page 49

... and financial condition. The Company Faces Risks Related to Unauthorized Use of Information from the Company's Website . Screenscraper websites gain unauthorized access to Ryanair's website and booking system, extract flight and pricing information and display it on their own websites for sale to... -

Page 50

... in Ryanair paying higher corporate taxes and would have an adverse impact on our cash flows, financial posit ion and results of operations. See ―- Risks Related to the Company-Tax audits.â€- Change in EU Regulations in Relation to Employers and Employee Social Insurance Could Increase Costs. The... -

Page 51

... of over five hours, the airline is also required to offer the option of a refund of the cost of the unused ticket. There can be no assurance that the Company will not incur a significant increase in costs in the future due to the impact of this legislation, if Ryanair experiences a large number of... -

Page 52

... of additional revenue. As in the past, the Company reacted to these adverse events by initiating system-wide fare sales to stimulate demand for air travel. In addition, reservations on Ryanair's flights to London dropped materially for a number of days in the immediate aftermath of the terrorist... -

Page 53

...business and personal) is discretionary and because Ryanair is substantially dependent on discretionary air travel, any prolonged general reduction in airline passenger traffic may adversely affect the Company. Similarly, any significant increase in expenses related to security, insurance or related... -

Page 54

... market price of the Ordinary Shares and ADRs. On April 19, 2012, the Company obtained shareholder approval to repurchase ADRs as part of its general authority to repurchase up to 5% of the issued share capital in the Company traded on the NASDAQ. See ―Item 10. Additional Information-Limitations... -

Page 55

... model under a new management team in the early 1990s. See ―Item 5. Operating an d Financial Review and Prospect - History.â€- As of June 30, 2012, with its operating fleet of 294 Boeing 737 -800 ―next generationâ€- aircraft, Ryanair Limited offered over 1,500 scheduled short-haul flights... -

Page 56

... in terms of flight punctuality, levels of lost baggage, and rates of flight cancellations. The address of Ryanair Holdings' registered office is: c/o Ryanair Limited, Corporate Head Office, Dublin Airport, County Dublin, Ireland. The Company's contact person regarding this Annual Report on... -

Page 57

...party reservation systems costs. Ryanair generates over 99% of its scheduled passenger revenues through direct sales via its website. Airport Access and Handling Costs. Ryanair attempts to control airport access and service charges by focusing on airports that offer competitive prices. Management be... -

Page 58

... reservation system. Ryanair also sells bus and rail tickets onboard its aircraft and through its website. For the 2012 fiscal year, ancillary services accounted for approximately 20% of Ryanair's total operating revenues, as compared to approximately 22% of such revenues in the 2011 fiscal year... -

Page 59

... 3 lease hand backs in the 2012 fiscal year); (iii) controlling labor and other costs, including through wage freezes for non flight crew employees in 2010 and 2011, selective redundancies and the introduction of Internet check-in; and (iv) renegotiating contracts with existing suppliers, airports... -

Page 60

... consolidated financial statements included in Item 18 for more information regarding the geographical sources of the Company's revenue. Management's objective is to schedule a sufficient number of flights per day on each of Ryanair's routes to satisfy demand for Ryanair's low-fares service. Ryanair... -

Page 61

... regularly contacts people registered in its database to inform them about promotions and special offers via e-mail. RESERVATIONS ON RYANAIR.COM Passenger airlines generally rely on travel agents (whether traditional or online) for a significant portion of their ticket sales and pay travel agents... -

Page 62

...more widely available on favorable terms than similar resources for other types of aircraft. Management believes that its strategy, to date, of having reduced its fleet to one aircraft type enables Ryanair to limit the costs associated with personnel training, the purchase and storage of spare parts... -

Page 63

... non-flight scheduled services, Internet-related services, and the in-flight sale of beverages, food, and merchandise. See ―Item 5. Operating and Financial Review and Prospects-Results of Operations-Fiscal Year 2012 Compared with Fiscal Year 2011 -Ancillary Revenuesâ€- for additional information... -

Page 64

... size 737NG training aircraft to allow for cabin crew and engineering training. Ryanair carries out checks and line maintenance in its single-bay aircraft hangar facility in Bremen. Ryanair has also entered into a 30-year sole-tenancy agreement with Frankfurt (Hahn) airport and has taken acceptance... -

Page 65

... at Glasgow (Prestwick), London (Stansted) and Frankfurt (Hahn). See ―Item 3. Key Information-Risk Factors-Risks Related to the Company-The Company Is Dependent on External Service Providers.â€- SAFETY RECORD Ryanair has not had a single passenger or flight crew fatality in its 27-year operating... -

Page 66

... kiosks at certain airports for the provision of other services. The Company has these kiosks in operation at Dublin, London (Stansted), London (Gatwick), Frankfurt (Hahn), and many of its other bases. The introduction of Internet check-in and kiosks combined with the reduction in the number of bags... -

Page 67

... announced its intention to reduce its London (Stansted)-based aircraft from the then current 40 to 24 during the aforementioned period, and also reduce by 30% the number of weekly Ryanair flights to and from the airport. The Company announced at that time that it expected these cuts to result... -

Page 68

... details Ryanair's fuel consumption and costs for scheduled operations (i.e. it excludes costs related to de-icing and EU emissions trading costs) after giving effect to the Company's fuel hedging activities for fiscal years ended March 31, 2012, 2011 and 2010. The excluded de-icing costs amounted... -

Page 69

... of the Company's current war -related insurance coverage may exclude certain types of catastrophic incidents, which may result in the Company seeking alternative coverage. Ryanair to date has passed increased insurance costs on to passengers by means of a special ―insurance levyâ€- on each ticket... -

Page 70

... Training Center Aircraft Maintenance Aircraft Maintenance Ryanair has agreements with the DAA, the Irish government authority charged with operating Dublin Airport, to lease bag-drop counters and other space at the passenger and cargo terminal facilities at Dublin Airport. The airport office... -

Page 71

... reviews of safety-related procedures, training, and equipment by the national and EU regulatory authorities. Commission for Aviation Regulation. The CAR is currently primarily responsible for deciding maximum airport charges only at Dublin Airport. See ― Airport Operations Airport Charges... -

Page 72

... 10. Additional Information-- Limitations on Share Ownership by Non-EU Nationals.â€- See also ―Item 3. Risk Factors--Risks Related to Ownership of the Company's Ordinary Shares or ADRs-EU Rules Impose Restrictions on the Ownership of Ryanair Holdings' Ordinary Shares by Non-EU nationals and the... -

Page 73

... positions by Eu rope's larger airports is very limited. See ―Item 7. Major Shareholders and Related -Party Transactions Other Financial Information Legal Proceedings EU State Aid-Related Proceedings.â€- The European Union also passed legislation calling for increased transparency in airline fares... -

Page 74

...the common market may not abuse such dominant position. Ryanair is subject to the application of the general rules of EU competition law as well as specific rules on competition in the airline sector. An aggrieved person may sue for breach of EU competition law in the courts of a member state and/or... -

Page 75

...'s aircraft currently comply with these regulations. Certain airports in the U.K. (including London Stansted and London Gatwick) and continental Europe have established local noise restrictions, including limits on the number of hourly or daily operations or the time of such operations. Company... -

Page 76

...shortage of allowances has to be purchased in the open market and/or at government auctions. The Company has estimated its carbon credit requirements in respect of 2012 and has hedged its exposures at a cost of approximately â,¬10 to â,¬15 million. Management believes that this legislation is likely... -

Page 77

...'s current business strategy dates to the early 1990s, when a new management team, incl uding the current chief executive, commenced the restructuring of Ryanair's operations to become a low -fares airline based on the low-cost operating model pioneered by Southwest Airlines Co. in the United States... -

Page 78

... the size of the Company's fleet to 301 aircraft. See ― Liquidity and Capital Resourcesâ€- and ―Item 4. Information on the Company Aircraftâ€- for additional details. BUSINESS OVERVIEW Since Ryanair pioneered its ultra low cost operating model in Europe in the early 1990s, its passenger volumes... -

Page 79

...over the closing price of â,¬1.12 for Aer Lingus shares on November 28, 2008. As the Company was unable to secure the shareholders' support, it decided on January 28, 2009 to withdraw its offer for Aer Lingus. The United Kingdom's Office of Fair Trading (―OFTâ€-) wrote to Ryanair in September 2010... -

Page 80

...94 for Aer Lingus shares as of June 19, 2012. The offer is conditional on competition approval by the European Commission. The Company anticipates that the EU merger review process will be completed between September 2012 and February 2013. The available for sale financial asset balance sheet value... -

Page 81

... in the first quarter of 2013, due primarily to the 27% increase in fuel costs and an increase in other operating costs associated with a higher level of activity in line with the growth of the airline. The Company's cash and cash equivalents, restricted cash and financial assets with terms of less... -

Page 82

... cost of the major airframe overhaul, engine maintenance checks and restitution of major life-limited parts, calculated by reference to the number of hours flown or cycles operated during the year. Ryanair's aircraft operating lease agreements typically have a term of seven years, which closely... -

Page 83

... in the 2011 fiscal year to â,¬886.2 million in the 2012 fiscal year, while ancillary revenues per booked passenger increased to â,¬11.69 from â,¬11.12. Revenues from non-flight scheduled operations, including revenues from excess baggage charges, debit and credit card transactions, sales of rail... -

Page 84

... earned by Ryanair and each component expressed as a percentage of total ancillary revenues for each of the periods indicated: Fiscal Year ended March 31, 2012 2011 (in millions of euro, except percentage data) Non-flight Scheduled ...In-flight Sales ...Internet-related ...Total ...â,¬645.6 â,¬107... -

Page 85

...the 2011 fiscal year, to â,¬554.0 million in the 2012 fiscal year, reflecting the overall growth in passenger volumes and higher charges at Dublin and Stansted airports, partially offset by lower average costs at Ryanair's newer airports and bases. Marketing, distribution and other expenses. Ryanair... -

Page 86

... in the 2010 fiscal year to â,¬801.6 million in the 2011 fiscal year, while ancillary revenues per booked passenger increased to â,¬11.12 from â,¬9.98. Revenues from non -flight scheduled operations, including revenues from excess baggage charges, debit and credit card transactions, sales of rail... -

Page 87

... earned by Ryanair and each component expressed as a percentage of total ancillary revenues for each of the periods indicated: Fiscal Year ended March 31, 2011 2010 (in millions of euro, except percentage data) Non-flight Scheduled ...In-flight Sales ...Internet-related ...Total ...â,¬574.2 â,¬100... -

Page 88

...terms during the fiscal year reflected the additional costs arising from increased line maintenance activity at new bases and costs incurred to satisfy provisions of lease contracts dealing with the condition of aircraft due to be returned in 2010 and 2011. Aircraft rentals. Aircraft rental expenses... -

Page 89

... Company's policy of continuing to place it s deposits with highly rated and guaranteed financial institutions which typically provide a lower yield. Finance expense. Ryanair's interest and similar charges increased 30.2%, from â,¬72.1 million in the 2010 fiscal year to â,¬93.9 million in the 2011... -

Page 90

...2011 and March 31, 2012, 11 were financed through sale-andleaseback financings and the remainder through Ex-Im Bank guaranteed-financing. Ryanair has generally been able to generate sufficient funds from operations to meet its non-aircraft acquisition-related working capital requirements. Management... -

Page 91

...the total number of disposals to 47). To this end, the Company may choose to dispose of aircraft through sale and/or non-renewal of a number of operating leases due to expire between fiscal year 2012 and fiscal year 2013. As can be seen from the delivery schedule table above, delivery of the Boeing... -

Page 92

...(and related assets) in favor of the lenders and Ex-Im Bank, and that Ryanair not suffer a material adverse change in its conditions or prospects (financial or otherwise). Ex-Im Bank's policy on facilities of this type is to issue a binding final commitment approximately six months prior to delivery... -

Page 93

...relevant aircraft, an accounting provision is made during the lease term for this obligation based on estimated future costs of major airframe and certain engine maintenance checks by making appropriate charges to the income statement calculated by reference to the number of hours or cycles operated... -

Page 94

...multiplying the number of aircraft the Company is obligated to purchase under its current agreements with Boeing during the relevant period by the Basic Price for each aircraft pursuant to the relevant contract, with the dollar-denominated Basic Price being converted into euro at an exchange rate of... -

Page 95

... to aircraft financing and related hedging transactions. All of these guarantees are eliminated in the Company's consolidated balance sheet. TREND INFORMATION For information concerning the principal trends and uncertainties affecting the Company's results of operations and financial condition, see... -

Page 96

... Head of Capital Markets at Davy Stockbrokers. Mr. McLaughlin also advised Ryanair during its initial flotation on the Dublin and NASDAQ stock markets in 1997. Mr. McLaughlin serves on the Board of Directors of Elan Corporation plc, and he also serves as a director of a number of other Irish private... -

Page 97

... of the Company's internal accounting controls. Messrs. McKeon, Osborne and McCreevy are the members of the Audit Committee. In accordance with the recommendations of the Irish Combined Code of Corporate Governance (the ―Combined Codeâ€-), a senior independent non-executive director, Mr... -

Page 98

... certain stock or asset purchases when a director, officer or substantial shareholder has an interest. The Company is subject to extensive provisions under the Listing Rules of the Irish Stock Exchange (the ―Irish Listing Rulesâ€-) governing transactions with related parties, as defined therein... -

Page 99

... held a number of senior management positions within the Flight Operations Department over the last 25 years, including Fleet Captain of the BAC1-11 and Boeing 737-200 fleets. Ray was Head of Training between 1998 and June 2002. Prior to joining Ryanair, Ray served as an officer with the Irish Air... -

Page 100

... joining Ryanair he served as Human Resources Manager for Gateway 2000 and held a number of other human resources-related positions in the Irish financial services sector. COMPENSATION OF DIRECTORS AND EXECUTIVE OFFICERS Compensation The aggregate amount of compensation paid by Ryanair Holdings and... -

Page 101

...Flight Attendants*...Total ... 2010 99 276 180 297 2,032 4,284 7,168 * Decrease on prior year due to lower aircraft in operation in March 2012 and cabin crew staff being furloughed. Ryanair's pilots, flight attendants and maintenance and ground operations personnel undergo training, both initial... -

Page 102

... increase the pay of pilots and cabin crew in accordance with the terms of individual base agreements. The remaining employees who were not covered by base agreements had their salary frozen for a period of 12 months. Ryanair's pilots are currently subject to IAA approved limits of 100 flight-hours... -

Page 103

... and ― Limitations on Share Ownership by Non-EU Nationals.â€- MAJOR SHAREHOLDERS Based on information available to Ryanair Holdings, the following table summarizes the holdings of those shareholders holding 3% or more of the Ordinary Shares as of June 30, 2012, June 30, 2011 and June 30, 2010, the... -

Page 104

...Ryanair do not constitute state aid within the meaning of EU rules, because such arrangements are in line with market terms. Ryanair is facing similar legal challenges with respect to agreements with certain other airports, notably Lübeck, Berlin (Schönefeld), Alghero, Pau, Aarhus, Frankfurt (Hahn... -

Page 105

... during the 2009 fiscal year at a total aggregate cost of â,¬407.2 million. Following the acquisition of its initial stake and upon the approval of the Company's shareholders, management proposed to effect a tender offer to acquire the entire share capital of Aer Lingus. This 2006 offer was, however... -

Page 106

... to sell their stakes in Aer Lingus to Ryanair. However, as the Company was unable to secure the shareholders' support it decided, on January 28, 2009, to withdraw its second offer for Aer Lingus. The United Kingdom's Office of Fair Trading (―OFTâ€-) wrote to Ryanair in September 2010, advising... -

Page 107

... to 18.7 million in 2011, resulting in Dublin airport operating at approximately 50% capacity; (3) the change in the Irish government policy since 2006 in that the Irish government has decided to sell its stake in Aer Lingus; (4) the fact that under the terms of the bailout agreement provided by the... -

Page 108

... access to Ryanair's website and booking system, extract flight and pricing information and display it on their own websites for sale to customers at prices which include intermediary fees on top of Ryanair's fares. Ryanair does not allow any such commercial use of its website and objects... -

Page 109

... Offer and Listing - Trading Markets and Share Pricesâ€- below for further information regarding share buy-backs. SIGNIFICANT CHANGES No significant change in the Company's financial condition has occurred since the date of the consolidated financial statements included in this annual report. 109 -

Page 110

...is Ryanair Holdings' depositary for purposes of issuing ADRs evidencing the ADSs. The following tables set forth, for the periods indicated, the reported high and low closing sales prices of the ADRs on NASDAQ and for the Ordinary Shares on the Irish Stock Exchange and the London Stock Exchange, and... -

Page 111

... Shares (London Stock Exchange) (in euro) High Low 2006...2007...2008...2009...2010 First Quarter...Second Quarter ...Third Quarter ...Fourth Quarter ...2011 First Quarter...Second Quarter ...Third Quarter ...Fourth Quarter ...Month ending: January 31, 2012 ...February 28, 2012 ...March 31, 2012... -

Page 112

...2009 ...2010 ...2011 ...2012 ...2013 (as at July 13, 2012) ...Total ... All Ordinary Shares repurchased have been cancelled. The maximum price at which the Company may repurchase Ordinary Shares, in accordance with the listing rules of the Irish Stock Exchange and of the Financial Services Authority... -

Page 113

... value 0.635 euro cent. Each Ordinary Share entitles the holder thereof to one vote in respect of any matter voted upon by Ryanair H oldings' shareholders. OPTIONS TO PURCHASE SECURITIES FROM REGISTRANT OR SUBSIDIARIES Ryanair Holdings' shareholders approved a stock option plan (referred to herein... -

Page 114

... money. These powers may be amended by special resolution of the shareholders. The directors are not required to retire at any particular age. There is no requirement for directors to hold shares. One-third of the directors retire and offer themselves for re-election at each annual general meeting... -

Page 115

... March 2013, as well as for options to purchase additional aircraft. See ―Item 4. Information on the Company-Aircraftâ€- and ―Item 5. Operating and Financial Review and Prospects-Liquidity and Capital Resourcesâ€- for a detailed discussion of the 2005 Boeing contract. EXCHANGE CONTROLS Except... -

Page 116

..., the directors will, from time to time, set a ―Permitted Maximumâ€- on the number of Ordinary Shares that may be owned by non-EU nationals at such level as they believe will comply with EU law. The Permitted Maximum is currently set at 49.9%. Ryanair Holdings maintains a separate register (the... -

Page 117

... the market price of the Ordinary Shares and ADRs. See also ―Item 3. Risk Factors--Risks Related to Ownership of the Company's Shares or ADRs-EU Rules Impose Restrictions on the Ownership of Ryanair Holdings' Ordinary Shares by Non-EU Nationals and the Company has Instituted a Ban on the Purchase... -

Page 118

.... If Ryanair Holdings pays dividends or makes other relevant distributions, the following is relevant: Withholding Tax. Unless exempted, a withholding at the standard rate of income tax (currently 20%) will apply to dividends or other relevant distributions paid by an Irish resident company. The... -

Page 119

... more companies, in either case the principal classes of shares of which is or are substantially and regularly traded on a recognized stock exchange in a tax treaty country or an EU member state including Ireland or on an approved stock exchange. In the case of an individual non-resident stockholder... -

Page 120

... hold Ordinary Shares or ADRs as capital assets and generally does not address the tax treatment of U.S. Holders that may be subject to special tax rules such as banks, insurance companies, dealers in securities or currencies, partnerships or partners therein, entities subject to the branch profits... -

Page 121

..., based on the Company's audited financial statements and its current expectations regarding the value and nature of its assets, the sources and nature of its income, and relevant market data, the Company does not anticipate becoming a PFIC for its 2012/13 taxable year. Under the U.S.-Ireland Income... -

Page 122

...of business at its Corporate Head Office, Dublin Airport, County Dublin, Ireland. Ryanair Holdings also files reports, including annual reports on Form 20-F, periodic reports on Form 6K and other information, with the SEC pursuant to the rules and regulations of the SEC that apply to foreign private... -

Page 123

... on Ryanair of fuel price increases in the short term, in the medium to longer-term, such strategies cannot be expected to eliminate the impact on the Company of an increase in the market price of jet fuel. The unrealized gains on outstanding forward agreements at March 31, 2012 and 2011, based on... -

Page 124

... of aircraft purchase commitments under the Boeing contracts, which arise from fluctuations in the U.K. pound sterling/U.S. dollar and euro/U.S. dollar exchange rates. Under IFRS, the Company generally accounts for these contracts as either cash-flow hedges or fairvalue hedges. Fair-value hedges are... -

Page 125

...31, 2011. See Note 11 to the consolidated financial statements included in Item 18 for additional information. The Company also enters into interest rate swaps to hedge against floating rental payments associated with certain aircraft financed through operating lease arrangements. Through the use of... -

Page 126

... shares underlying ADSs (for example, stock transfer taxes, stamp duty or withholding taxes). Any charges incurred by the depositary or its agents for servicing the deposited securities. Reimbursement of Fees From April 1, 2011 to June 30, 2012 the Depositary collected annual depositary services... -

Page 127

... officer, as appropriate to allow timely decisions regarding required disclosure. MANAGEMENT‟S ANNUAL REPORT ON INTERNAL CONTROL OVER FINANCIAL REPORTINGThe Company's management is responsible for establishing and maintaining adequate internal control over financial reporting, (as defined in Rules... -

Page 128

... financial officer, chief accounting officer, controller and persons performing similar functions, as well as to all of the Company's other officers, directors and employees. The Code of Business Conduct and Ethics is available on Ryanair's website at http://www.ryanair.com. (Information appearing... -

Page 129

... of the issued share capital of the Company at March 31, 2012. See Note 26 to our consolidated financial statements for further information. See ―Item 8. Financial Information-Other Information-Share Buy-Back Programâ€- and ―Item 9. The Offer and Listing-Trading Markets and Share Pricesâ€- for... -

Page 130

... RYANAIR HOLDINGS PLC INDEX TO FINANCIAL STATEMENTS Consolidated Balance Sheets of Ryanair Holdings plc at March 31, 2012 ...Consolidated Income Statements of Ryanair Holdings plc for the year ended March 31, 2012 ...Consolidated Statement of Comprehensive Income of Ryanair Holdings plc for the year... -

Page 131

... financial instruments ...5 Deferred tax ...12 Other creditors ...14 Non-current maturities of debt ...11 Total non-current liabilities ...Shareholders‟ equity Issued share capital ...15 Share premium account...15 Capital redemption reserve ...Retained earnings...Other reserves ...16 Shareholders... -

Page 132

... and other...Icelandic volcanic ash related cost ...Total operating expenses ...Operating profit - continuing operations ...Other income/(expense) Finance income ...Finance expense ...20 Foreign exchange gain/(loss) ...Loss on impairment of available-for-sale financial asset ...4 Gain on disposal of... -

Page 133

Consolidated Statement of Comprehensive Income Year ended March 31, 2012 â,¬M Profit for the year ...560.4 Other comprehensive income: Net actuarial (loss)/gain from retirement benefit plans ...(6.3) Cash-flow hedge reserve-effective portion of fair value changes to derivatives: Effective portion of... -

Page 134

...Balance at March 31, 2010...1,478.9 Profit for the year...Other comprehensive income Net actuarial gains from retirement benefits plan...Net movements in cash-flow reserve...Net change in fair value of available-for -sale asset...Total other comprehensive income/(loss)...Total comprehensive income... -

Page 135

Consolidated Statement of Changes in Shareholders‟ Equity Continued Ordinary Shares M Profit for the year...Other comprehensive income Net actuarial losses from retirement benefits plan...Net movements in cash-flow reserve...Net change in fair value of available-for -sale asset...Total other ... -

Page 136

...020.3 Net cash provided by operating activities ...Investing activities Capital expenditure (purchase of property, plant and equipment)...Proceeds from sale of property, plant and equipment ...Decrease in restricted cash ...Decrease/(increase) in financial assets: cash > 3 months ...Net cash used in... -

Page 137

... the grant date of the relevant share options. Certain non-current assets classified as held for sale are stated at the lower of cost and fair value less costs to sell. Critical accounting policies The preparation of financial statements in conformity with IFRS requires management to make judgements... -

Page 138

... cost of the major airframe overhaul, engine maintenance checks, and restitution of major life-limited parts, calculated by reference to the number of hours flown or cycles operated during the year. Ryanair's aircraft operating lease agreements typically have a term of seven years, which closely... -

Page 139

... to govern the financial and operating policies of an entity so as to obtain benefit from its activities. All inter-company account balances and any unrealised income or expenses arising from intra-group transactions have been eliminated in preparing the consolidated financial statements. The... -

Page 140

...Aircraft Type Boeing 737-800s Number of Owned Aircraft at March 31, 2012 235(a) Useful Life 23 years from date of manufacture Residual Value 15% of current market value of new aircraft, determined periodically _____ (a) The Company operated 294 aircraft as of March 31, 2012, of which 59 were leased... -

Page 141

... cost of the major airframe overhaul, engine maintenance checks, and restitution of major life-limited parts, calculated by reference to the number of hours flown or cycles operated during the year. Ryanair's aircraft operating lease agreements typically have a term of seven years, which closely... -

Page 142

... Company enters into these arrangements with the goal of hedging its operational and balance sheet risk. However, Ryanair's exposure to commodity price, interest rate and currency exchange rate fluctuations cannot be neutralised completely. Derivative financial instruments are recognised initially... -

Page 143

...are operating leases and the associated leased assets are not recognised on t he Company's balance sheet. Expenditure arising under operating leases is charged to the income statement as incurred. The Company also enters into sale-and-leaseback transactions whereby it sells the rights to an aircraft... -

Page 144

... interest rate, the expected volatility of the Ryanair Holdings plc share price over the life of the option and other relevant factors. Non-market vesting conditions are taken into account by adjusting the number of shares or share options included in the measurement of the cost of employee services... -

Page 145

... and costs associated with the Company's defined benefit pension schemes are assessed on the basis of the projected unit credit method by professionally qualified actuaries and are arrived at using actuarial assumptions based on market expectations at the balance sheet date. The discount rates... -

Page 146

... other comprehensive income" (effective for fiscal periods beginning on or after July 1, 2012).* IFRS 10, ―Consolidated Financial Statements" (effective for fiscal periods beginning on or after January 1, 2013). IAS 19 (amendment 2011) "Employee benefits" (effective for fiscal periods beginning on... -

Page 147

...The cost and net book value also includes capitalised aircraft maintenance, aircraft simulators and the stock of rotable spare parts. The net book value of assets held under finance leases at March 31, 2012, 2011 and 2010 was â,¬607.5 million, â,¬635.1 million and â,¬422.8 million respectively. Sale... -

Page 148

... using weighted average cost of capital, estimated to be 7.7% for 2012, 7.3% for 2011 and 6.1% for 2010. 4 Available-for-sale financial assets At March 31, 2011 â,¬M 114.0 2012 â,¬M Investment in Aer Lingus ...149.7 2010 â,¬M 116.2 As at March 31, 2012 Ryanair's total holding in Aer Lingus... -

Page 149

... ordinary shares of Aer Lingus plc that it does not already own. However, the Company was unable to secure the shareholders' support and accordingly on January 28, 2009 withdrew its offer for Aer Lingus. The United Kingdom's Office of Fair Trading (OFT) wrote to Ryanair in September 2010, advising... -

Page 150

...foreign exchange contracts to hedge U.S. dollar currency exposures that arise in relation to fuel, maintenance, aviation insurance, and capital expenditure costs and excess pounds sterling are converted into euro. Additionally, the Company swaps euro for U.S. dollars using forward currency contracts... -

Page 151

... in the Company's balance sheet, are analysed as follows: At March 31, 2011 â,¬M 383.8 383.8 2012 â,¬M Current assets 231.9 Gains on cash-flow hedging instruments - maturing within one year ...231.9 Non-current assets Gains on cash flow hedging instruments - maturing after one year ...3.3 3.3 Total... -

Page 152

... in the current or preceding years. The European Union Emissions Trading System (EU ETS) began operating for airlines on 1 January 2012. In order to manage the risks associated with the fluctuation in the price of carbon emission credits, the Company entered into swap arrangements to fix the cost of... -

Page 153

...Cash Flows 2011 2012 2013 2014 Thereafter â,¬M â,¬M â,¬M (44.2) 83.4 3.0 42.6 84.8 â,¬M (37.8) 24.4 (13.4) â,¬M (23.9) 0.1 (23.8) â,¬M (17.8) (17.8) â,¬M (25.5) (25.5) At March 31, 2010 Interest rate swaps ...(76.4) (149.2) U.S. dollar currency forward contracts...99.8 107.9 U.K. pounds... -

Page 154

... Amount 2011 2012 2013 2014 Thereafter â,¬M At March 31, 2010 Interest rate swaps ...(76.4) U.S. dollar currency forward contracts...40.3 U.S. dollar currency forward contracts capitalised in property plant and equipment - aircraft additions ...59.5 U.K. pounds sterling currency forward... -

Page 155

... is as follows: Balance at beginning of year â,¬M Year ended March 31, 2012 ...Year ended March 31, 2011 ...Year ended March 31, 2010 ...0.1 0.1 0.1 Additions charged to expenses â,¬M Balance at end of year â,¬M 0.1 0.1 0.1 Write-offs â,¬M No individual customer accounted for more than 10... -

Page 156

... are contractual agreements with a value that reflects price movements in an underlying asset. The Company uses derivative financial instruments, principally jet fuel derivatives, interest rate swaps, cross-currency interest rate swaps and forward foreign exchange contracts to manage commodity risks... -

Page 157

... 31, 2010 Available-for-sale financial assets ...116.2 Cash and cash equivalents ...Financial asset: cash > 3 months ...Restricted cash ...Derivative financial instruments - U.S. dollar currency forward contracts ...- U.K. pounds sterling currency forward contracts...-Jet fuel derivative contracts... -

Page 158

.... Discounted cash-flow analyses are based on forward interest rates. Derivatives - currency forwards, aircraft fuel contracts and carbon swaps: A comparison of the contracted rate to the market rate for contracts providing a similar risk management profile at March 31, 2012, 2011 and 2010 has been... -

Page 159

... the asset or liability. Level 3: Inputs for the asset or liability are not based on observable market data. Level 1 â,¬M At March 31, 2012 Assets measured at fair value Available-for-sale financial asset ...149.7 Cash-flow hedges - US dollar currency forward contracts ...Cash-flow hedges - jet fuel... -

Page 160

...Finance leases...Total fixed rate debt...Floating rate Secured long-term debt...Debt swapped from floating to fixed...Secured long-term debt after swaps...Finance leases...Total floating rate debt...Total financial liabilities...2.94% 3.96% 3.59% 2.81% 2013 â,¬M 78.9 154.7 233.6 233.6 2014 â,¬M 81... -

Page 161

...Company's financial liabilities (excluding aircraft provisions, trade payables and accrued expenses) at March 31, 2010 was as follows: Weighted average fixed rate (%) Fixed rate Secured long term-debt...Debt swapped from floating to fixed...Secured long-term debt after swaps...Finance leases...Total... -

Page 162

...term debt and finance leases - Fixed rate debt ...- Floating rate debt...Derivative financial instruments -U.S dollar currency Forward contracts ...- Interest rate swaps ...Trade payables ...Accrued expenses ...Total at March 31, 2011 ... Total Contractual Cash flows â,¬M 2012 â,¬M 2013 â,¬M 2014... -

Page 163

... 31, 2010 Long term debt and finance leases - Fixed rate debt ...3.89% - Floating rate debt...1.35% Derivative financial instruments - Interest rate swaps ...Trade payables ...Accrued expenses ...Total at March 31, 2010 ... Total Contractual Cash flows â,¬M 2011 â,¬M 2012 â,¬M 2013 â,¬M 2014... -

Page 164

... USD long term debt ...282.8 282.8 211.7 211.7 341.3 341.3 240.2 240.2 March 31, 2011 euro equiv. U.S.$ $M â,¬M March 31, 2010 euro equiv. U.S.$ $M â,¬M The Company has entered into cross currency interest rate swap arrangements to manage exposures to fluctuations in foreign exchange rates on... -

Page 165

... financial asset rather than an investment in an associate. Additional information in relation to the available-for-sale financial asset can be found in Note 4 to the consolidated financial statements. (f) Credit risk The Company holds significant cash balances, which are invested on a short-term... -

Page 166

...the Aer Lingus share price at March 31, 2012 would result in an increase of â,¬15.0 million in the fair value of the available-for-sale financial assets reserve (2011: â,¬11.4 million; 2010: â,¬11.6 million). Such an increase would be recognised in other comprehensive income. 12 Deferred and current... -

Page 167

... levels of pre-tax income, material changes in the present relationship between income reported for financial and tax purposes, or material asset sales or other non-routine transactions. New temporary differences arising in the year to March 31, 2012 consisted of temporary differences of a charge... -

Page 168

... or credited to other comprehensive income were as follows: At March 31, 2011 â,¬M 0.7 25.6 26.3 2012 â,¬M Defined benefit pension obligations ...(0.9) (15.2) Derivative financial instruments ...Total tax charge in other comprehensive income ...(16.1) 2010 â,¬M 9.0 9.0 The majority of current and... -

Page 169

..., Ryanair returned 3 sale-and-leaseback aircraft and entered into sale-and-leaseback arrangements for 11 (2011: 6; 2010: 12) new Boeing 737-800 ―next generationâ€- aircraft, bringing total sale-and-leaseback aircraft to 59 as at March 31, 2012. 15 (a) Issued share capital, share premium account... -

Page 170

...08 â,¬3.11 The mid-market price of Ryanair Holdings plc's ordinary shares on the Irish Stock Exchange at March 31, 2012 was â,¬4.48 (2011: â,¬3.36, 2010: â,¬3.68). The highest and lowest prices at which the Company's shares traded on the Irish Stock Exchange in the 2012 fiscal year were â,¬4.48 and... -

Page 171

... segmental analysis The Company is managed as a single business unit that provides low fares airline-related services, including scheduled services, internet and other related services to third parties across a European route network. The Company operates a single fleet of aircraft that is deployed... -

Page 172

... Excludes the available-for-sale financial asset. At March 31, 2011 â,¬M 8,482.0 At March 31, 2010 â,¬M 7,447.2 8,851.3 Reconciliation of reportable segment profit or loss to consolidated profit after income tax is as follows: Year ended March 31, 2012 â,¬M Total adjusted profit or loss for... -

Page 173

...31, 2012 Flight and cabin crew (full time employees) ...2,888 Flight and cabin crew (contract staff) ...4,768 Sales, operations and administration ...782 8,438 Year ended March 31, 2011 2,883 4,356 824 8,063 Year ended March 31, 2010 2,859 3,304 869 7,032 At March 31, 2012 the company had a team of... -

Page 174

... reviews, employee benefit plan audits, and special procedures required to meet certain regulatory requirements. (iii) Tax services include all services, except those services specifically related to the audit of financial statements, performed by the independent auditor's tax personnel, supporting... -

Page 175

...Company defined -benefit plan. Michael O'Leary is now a member of a defined -contribution plan. The cost of the death-in-service and disability benefits provided during the accounting year is not included in the above figures. No pension benefits are provided for non-executive directors. The pension... -

Page 176

... Shares and share options (i) Shares Ryanair Holdings plc is listed on the Irish, London and NASDAQ stock exchanges. The beneficial interests as at March 31, 2012, 2011 and 2010 of the directors and of their spouses and minor children in the share capital of the Company are as follows: No. of Shares... -

Page 177

...-benefit schemes The Company funds the pension entitlements of certain employees through defined-benefit plans. Two plans are operated for eligible Irish and UK employees. In general, on retirement, a member is entitled to a pension calculated at 1/60th of the final pensionable salary for each year... -

Page 178

..., 2012 â,¬M Included in payroll costs Service cost ...0.7 Year ended March 31, 2011 â,¬M 0.8 Year ended March 31, 2010 â,¬M 0.6 Included in finance expense Interest on pension scheme liabilities ...1.9 Expected return on plan assets ...(2.0) Net finance (income)/expense...(0.1) Net periodic pension... -

Page 179

...Total fair value of plan assets ...30.3 2010 â,¬M 19.2 4.3 0.6 1.5 25.6 The plans' assets do not include any of our own financial instruments, nor any property occupied by, or other assets used by us. The expected long-term rate of return on assets of 6.15% (2011: 6.75%; 2010: 6.67%) for the Irish... -

Page 180

... million to our defined -benefit plans in 2013. Defined-contribution schemes The Company operates defined-contribution retirement plans in Ireland and the UK. The costs of these plans are charged to the consolidated income statement in the period in which they are incurred. The pension cost of these... -

Page 181

... 230 Firm Aircraft Deliveries Fiscal 2013/ 2014 15 15 Total "Firm" Aircraft 245 245 Basic price per aircraft (U.S.$ million) 51.0 The ―Basic Priceâ€- (equivalent to a standard list price for an aircraft of this type) for each aircraft governed by the 2005 Boeing contract will be increased by... -

Page 182

... 30 of the Boeing 737-800 aircraft delivered between March 2005 and March 2012 with 13-year euro-denominated Japanese Operating Leases with Call Options (―JOLCOsâ€-). These structures are accounted for as finance leases and are initially recorded at fair value in the Company's balance sheet. Under... -

Page 183

... Ryanair currently expects that they will conclude within the next 12 months, with any European Commission's decisions appealable to the EU General Court. State aid complaints by Lufthansa about Ryanair's cost base at Frankfurt (Hahn) have been rejected by German courts, as have similar complaints... -

Page 184

... capital in the parent Company. See note 15 to the consolidated financial statements for further details. On October 1, 2010, following shareholder approval at the Company's annual general meeting on September 22, 2010, Ryanair Holdings plc paid a special dividend of â,¬500 million, (33.57 euro... -

Page 185

... to senior key management (defined as the executive team reporting to the Board of Directors) and directors amounted to â,¬ 5 million in the fiscal year ended March 31, 2012, (2011: â,¬6.5 million, 2010: â,¬7.4 million), t he majority of which comprises short-term employee benefits. Year ended March... -

Page 186

Company Balance Sheet 2012 â,¬M 101.5 At March 31, 2011 â,¬M 102.2 2010 â,¬M 98.9 Note Non-current assets Investments in subsidiaries ...30 Current assets Loans and receivables from subsidiaries ...Cash and cash equivalents ... 31 1,517.5 ...683.0 759.6 2.1 4.1 1,621.1 789.3 858.5 Total assets ... -

Page 187

... Cash Flows Year ended March 31, 2012 â,¬M Operating activities Profit for the year ...Net cash provided by operating activities Investing activities (Increase)/decrease in loans to subsidiaries ...Net cash from/(used) in investing activities ...Financing activities Shares purchased under share buy... -

Page 188

... ordinary shares...(36.5) Share-based payments...Transfer of exercised and expired share based awards...Balance at March 31, 2012...1,455.6 Issued Share Capital â,¬M 9.4 Share Capital Premium Retained Redemption Account Earnings Shares â,¬M â,¬M â,¬M 617.4 154.6 0.5 Other Reserves â,¬M 22.0 - Total... -

Page 189

... of financial statements in conformity with IFRS requires management to make judgements, estimates and assumptions that affect the application of policies and reported amounts of assets, liabilities, income and expenses. These estimates and associated assumptions are based on historical experience... -

Page 190

... of the Company's balance sheet and all transactio ns entered into by the Company are euro denominated. As such, the Company does not have any significant foreign currency risk. The credit risk associated with the Company's financial assets principally relates to the credit risk of the Ryanair group... -

Page 191

... Ryanair Limited declared a dividend of â,¬950 million to Ryanair Holdings plc. during the fiscal year to March 31, 2012. 36 Post-balance sheet events On March 29, 2012, the Company agreed to buy back 15.0m ordinary shares at a cost of â,¬67.5m. This is equivalent to 1.0% of the issued share capital... -

Page 192

... Street Dublin 2 Ireland Solicitors & Attorneys at Law A&L Goodbody - Solicitors International Financial Services Centre North Wall Quay Dublin 1 Ireland Cleary, Gottlieb, Steen Hamilton 1 Liberty Plaza, New York NY 10006, United States Chairman Chief Executive Secretary Registered Office Auditors... -

Page 193

... average fare paid by a fare-paying passenger who has booked a ticket. Represents the average number of flight hours flown in service per day per aircraft for the total fleet of operated aircraft. Represents the average cost per U.S. gallon of jet fuel for the fleet (including fueling charges) after... -

Page 194

194