Red Lobster 2014 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2014 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2014 Annual Report 5

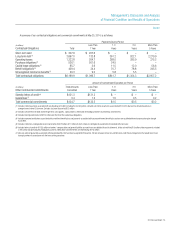

2014 Financial Review

6 Management’s Discussion and Analysis of Financial Condition

and Results of Operations

20 Report of Management’s Responsibilities

20 Management’s Report on Internal Control Over

Financial Reporting

21 Report of Independent Registered Public Accounting Firm

on Internal Control Over Financial Reporting

22 Report of Independent Registered Public Accounting Firm

23 Consolidated Statements of Earnings

23 Consolidated Statements of Comprehensive Income

24 Consolidated Balance Sheets

25 Consolidated Statements of Changes in Stockholders’ Equity

26 Consolidated Statements of Cash Flows

27 Notes to Consolidated Financial Statements

55 Five-Year Financial Summary

IMPORTANT ADDITIONAL INFORMATION

The Company, its directors and certain of its executive officers are participants in the solicitation of proxies from stockholders in connection with the Company’s 2014

annual meeting of stockholders (the “Annual Meeting”). Information regarding the names and interests of such participants in the Company’s proxy solicitation is set

forth in the Company’s preliminary proxy statement, filed with the SEC on July 31, 2014, as amended, and the Company revocation solicitation statement, filed with

the SEC on April 1, 2014. Additional information can be found in the Company’s Annual Report on Form 10-K for the year ended May 25, 2014, filed with the SEC on

July 18, 2014. These documents are available free of charge at the SEC’s website at www.sec.gov.

The Company will be mailing a definitive proxy statement and proxy card to the stockholders entitled to vote at the Annual Meeting. WE URGE INVESTORS TO READ ANY

PROXY STATEMENT (INCLUDING ANY SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS THAT THE COMPANY MAY FILE WITH THE SEC CAREFULLY

AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Stockholders will be able to obtain, free of

charge, copies of any proxy statement and any other documents filed by the Company with the SEC in connection with the proxy solicitation at the SEC’s website at

www.sec.gov. In addition, copies will also be available at no charge at the Investors section of the Company’s website at http://investor.darden.com/investors/

investor-relations/default.aspx.

INFORMATION ABOUT FORWARD-LOOKING STATEMENTS

Forward-looking statements in this communication regarding our expected ability to retire outstanding debt, improve our credit metrics, improve sales and earnings

growth, reduce earnings volatility, maintain our dividend policy and buy back stock and execute on our brand renaissance program and all other statements that are

not historical facts, including without limitation statements concerning our future economic performance, plans or objectives and expectations regarding the sale of

Red Lobster, benefits to Darden and its shareholders from such sale and related matters, are made under the Safe Harbor provisions of the Private Securities Litigation

Reform Act of 1995. Any forward-looking statements speak only as of the date on which such statements are made, and we undertake no obligation to update such

statements to reflect events or circumstances arising after such date except as required by law. We wish to caution investors not to place undue reliance on any

such forward-looking statements. By their nature, forward-looking statements involve risks and uncertainties that could cause actual results to materially differ from

those anticipated in the statements. The most significant of these uncertainties are described in Darden’s Form 10-K, Form 10-Q and Form 8-K reports (including all

amendments to those reports). These risks and uncertainties include the ability to achieve Darden’s strategic plan to enhance shareholder value, including realizing

the expected benefits from the sale of Red Lobster, actions of activist investors and the cost and disruption of responding to those actions, including any proxy contest

for the election of directors at our annual meeting, food safety and foodborne illness concerns, litigation, unfavorable publicity, risks relating to public policy changes and

federal, state and local regulation of our business including healthcare reform, labor and insurance costs, technology failures, failure to execute a business continuity

plan following a disaster, health concerns including virus outbreaks, intense competition, failure to drive sales growth, our plans to expand our smaller brands Bahama

Breeze, Seasons 52 and Eddie V’s, a lack of suitable new restaurant locations, higher-than-anticipated costs to open, close, relocate or remodel restaurants, a failure to

execute innovative marketing tactics and increased advertising and marketing costs, a failure to develop and recruit effective leaders, a failure to address cost pressures,

shortages or interruptions in the delivery of food and other products, adverse weather conditions and natural disasters, volatility in the market value of derivatives,

economic factors specific to the restaurant industry and general macroeconomic factors including unemployment and interest rates, disruptions in the financial markets,

risks of doing business with franchisees and vendors in foreign markets, failure to protect our service marks or other intellectual property, impairment in the carrying

value of our goodwill or other intangible assets, a failure of our internal controls over financial reporting, or changes in accounting standards, an inability or failure to

manage the accelerated impact of social media and other factors and uncertainties discussed from time to time in reports filed by Darden with the Securities and

Exchange Commission.