Red Lobster 2014 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2014 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Darden

34 Darden Restaurants, Inc.

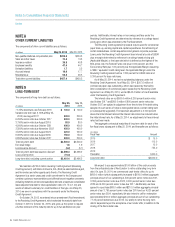

In April 2014, the FASB issued ASU No. 2014-08, Presentation of

Financial Statements (Topic 205) and Property, Plant and Equipment (Topic 360),

Reporting Discontinued Operations and Disclosures of Disposals of

Components of an Entity. This update modifies the requirements for reporting

discontinued operations. Under the amendments in ASU 2014-08, the

definition of discontinued operation has been modified to only include those

disposals of an entity that represent a strategic shift that has (or will have) a

major effect on an entity’s operations and financial results. This update also

expands the disclosure requirements for disposals that meet the definition

of a discontinued operation and requires entities to disclose information

about disposals of individually significant components that do not meet the

definition of discontinued operations. This update is effective for annual and

interim periods beginning after December 15, 2014, which will require us to

adopt these provisions in the first quarter of fiscal 2016. We are evaluating

the effect this guidance will have on our consolidated financial statements

and related disclosures.

In July 2013, the FASB issued ASU 2013-11, Income Taxes (Topic 740),

Presentation of an Unrecognized Tax Benefit When a Net Operating Loss

Carryforward, a Similar Tax Loss, or a Tax Credit Carryforward Exists. The

objective of this update is to eliminate the diversity in practice in the presen-

tation of unrecognized tax benefits when a net operating loss carryforward,

a similar tax loss, or a tax credit carryforward exists. Under this guidance, an

unrecognized tax benefit, or a portion of an unrecognized tax benefit, should

be presented in the financial statements as a reduction to a deferred tax

asset for a net operating loss carryforward, a similar tax loss, or a tax credit

carryforward, except in certain circumstances. This update does not require

any new recurring disclosures and is effective for annual and interim periods

beginning after December 15, 2013, which will require us to adopt these

provisions in the first quarter of fiscal 2015. We do not believe adoption

of this new guidance will have a significant impact on our consolidated

financial statements.

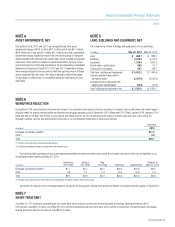

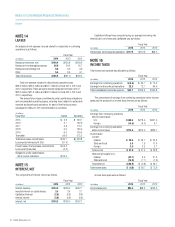

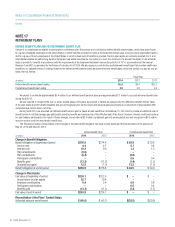

NOTE 2

DISCONTINUED OPERATIONS

On May 15, 2014, we entered into an agreement to sell Red Lobster and

certain related assets and associated liabilities for $2.11 billion in cash and

we expect the transaction to close during the first quarter of fiscal 2015.

These assets and liabilities are classified as held for sale on our consolidated

balance sheet as of May 25, 2014. Additionally, in the fourth quarter of fiscal

2014, in connection with the sale of Red Lobster, we closed two synergy

restaurants. During fiscal 2014, we recorded long-lived asset impairment

charges of $7.6 million, $7.4 million of which was recorded during the fourth

quarter as a result of these actions and $20.7 million of separation-related

costs which are included in earnings from discontinued operations. No

amounts for shared general and administrative operating support expense or

interest expense were allocated to discontinued operations. We expect all

direct cash flows related to operating these businesses to be eliminated at

the date of sale. Our continuing involvement will be limited to a transition

service agreement for up to two years with minimal impact to our cash flows.

For fiscal 2014, 2013 and 2012, all impairment charges and disposal

costs, along with the sales, direct costs and expenses and income taxes

attributable to restaurants classified as discontinued operations have been

aggregated to a single caption entitled earnings from discontinued operations,

net of tax in our consolidated statements of earnings for all periods presented.

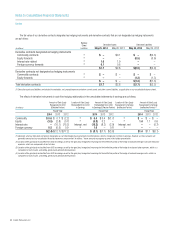

Earnings from discontinued operations, net of taxes in our accompanying

consolidated statements of earnings are comprised of the following:

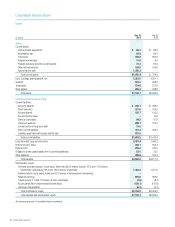

Fiscal Year Ended

May 25, May 26, May 27,

(in millions)

2014 2013 2012

Sales $2,472.1 $2,630.9 $2,671.6

Earnings before income taxes 135.3 247.3 281.2

Income tax expense 32.3 72.7 84.9

Earnings from discontinued

operations, net of tax $ 103.0 $ 174.6 $ 196.3

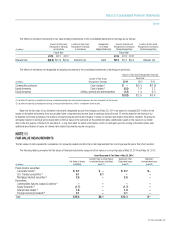

The following table presents the carrying amounts of the major

classes of assets and liabilities associated with the restaurants reported as

discontinued operations and classified as held for sale on our accompanying

consolidated balance sheet as of May 25, 2014:

(in millions)

May 25, 2014

Current assets $ 241.0

Land, buildings and equipment, net 1,084.8

Other assets 64.5

Total assets $1,390.3

Current liabilities $ 130.6

Other liabilities 84.9

Total liabilities $ 215.5

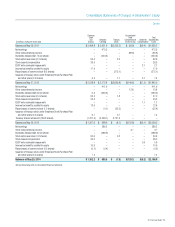

NOTE 3

RECEIVABLES, NET

Receivables from the sale of gift cards in national retail outlets, allowances

due from landlords based on lease terms, miscellaneous receivables and our

overall allowance for doubtful accounts are as follows:

(in millions)

May 25, 2014 May 26, 2013

Retail outlet gift card sales $39.6 $37.5

Landlord allowances due 22.5 26.5

Miscellaneous 22.0 21.7

Allowance for doubtful accounts (0.3) (0.3)

Receivables, net $83.8 $85.4