Red Lobster 2014 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2014 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Darden

2014 Annual Report 41

STOCKHOLDERS’ RIGHTS PLAN

Under our Rights Agreement dated May 16, 2005, each share of our common stock has associated with it one right to purchase one thousandth of a share

of our Series A Participating Cumulative Preferred Stock at a purchase price of $120 per share, subject to adjustment under certain circumstances to prevent

dilution. The rights are exercisable when, and are not transferable apart from our common stock until, a person or group has acquired 15 percent or more, or

makes a tender offer for 15 percent or more, of our common stock. If the specified percentage of our common stock is then acquired, each right will entitle

the holder (other than the acquiring company) to receive, upon exercise, common stock of either us or the acquiring company having a value equal to two times

the exercise price of the right. The rights are redeemable by our Board of Directors under certain circumstances and expire on May 25, 2015.

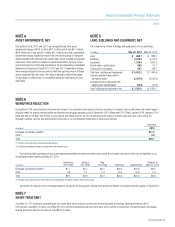

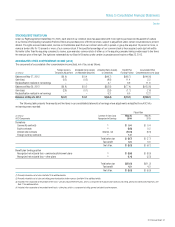

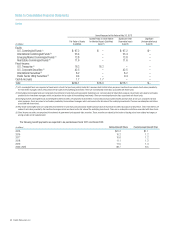

ACCUMULATED OTHER COMPREHENSIVE INCOME (LOSS)

The components of accumulated other comprehensive income (loss), net of tax, are as follows:

Foreign Currency Unrealized Gains (Losses) Unrealized Gains (Losses) Benefit Plan Accumulated Other

(in millions)

Translation Adjustment on Marketable Securities on Derivatives Funding Position Comprehensive Income (Loss)

Balances at May 27, 2012 $(1.6) $ 0.4 $(49.7) $(95.7) $(146.6)

Gain (loss) (0.2) (0.2) (8.8) 11.4 2.2

Reclassification realized in net earnings – – 4.7 6.9 11.6

Balances at May 26, 2013 $(1.8) $ 0.2 $(53.8) $(77.4) $(132.8)

Gain (loss) (2.9) (0.1) (2.9) (1.7) (7.6)

Reclassification realized in net earnings – – 6.3 6.0 12.3

Balances at May 25, 2014 $(4.7) $ 0.1 $(50.4) $(73.1) $(128.1)

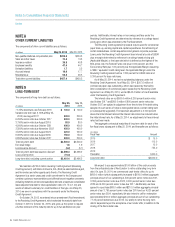

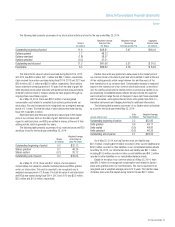

The following table presents the amounts and line items in our consolidated statements of earnings where adjustments reclassified from AOCI into

net earnings were recorded:

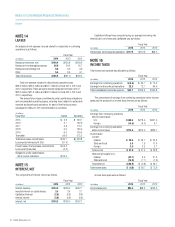

Fiscal Year

(in millions)

Location of Gain (Loss) May 25, May 26,

AOCI Components Recognized in Earnings 2014 2013

Derivatives

Commodity contracts (1) $ 0.4 $ 0.4

Equity contracts (2) (0.8) 0.2

Interest rate contracts Interest, net (10.3) (8.3)

Foreign currency contracts (2) 1.0 –

Total before tax $ (9.7) $ (7.7)

Tax benefit 3.4 3.0

Net of tax $ (6.3) $ (4.7)

Benefit plan funding position

Recognized net actuarial loss – pension/postretirement plans (3) $ (8.6) $ (8.9)

Recognized net actuarial loss – other plans (4) (1.4) (2.3)

Total before tax $(10.0) $(11.2)

Tax benefit 4.0 4.3

Net of tax $ (6.0) $ (6.9)

(1) Primarily included in cost of sales. See Note 10 for additional details.

(2) Primarily included in cost of sales and selling, general and administrative expenses. See Note 10 for additional details.

(3) Included in the computation of net periodic benefit costs – pension and postretirement plans, which is a component of restaurant labor expenses and selling, general and administrative expenses. See

Note 17 for additional details.

(4) Included in the computation of net periodic benefit costs – other plans, which is a component of selling, general and administrative expenses.