Red Lobster 2014 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2014 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Darden

2014 Annual Report 53

In September 2012, a collective action under the Fair Labor Standards

Act was filed in the United States District Court for the Southern District of

Florida, Alequin v. Darden Restaurants, Inc., in which named plaintiffs claim

that the Company required or allowed certain employees at Olive Garden,

Red Lobster, LongHorn Steakhouse, Bahama Breeze and Seasons 52 to work

off the clock and required them to perform tasks unrelated to their tipped

duties while taking a tip credit against their hourly rate of pay. The plaintiffs

seek an unspecified amount of alleged back wages, liquidated damages, and

attorneys’ fees. In July 2013, the United States District Court for the Southern

District of Florida conditionally certified a nationwide class of servers and

bartenders who worked in the aforementioned restaurants at any point from

September 6, 2009 through September 6, 2012. Unlike a class action, a

collective action requires potential class members to “opt in” rather than

“opt out” following the issuance of a notice. Out of the approximately

217,000 opt-in notices distributed, 20,225 were returned. In June 2014,

the Company filed a motion seeking to have the class de-certified. We

believe that our wage and hour policies comply with the law and that we

have meritorious defenses to the substantive claims and strong defenses

supporting de-certification. An estimate of the possible loss, if any, or the

range of loss cannot be made at this stage of the proceeding.

In November, 2011, a lawsuit entitled ChHab v. Darden Restaurants, Inc.

was filed in the United States District Court for the Southern District of

New York alleging a collective action under the Fair Labor Standards Act and

a class action under the applicable New York state wage and hour statutes.

The named plaintiffs claim that the Company required or allowed certain

employees at The Capital Grille to work off the clock, share tips with indi-

viduals who polished silverware to assist the plaintiffs, and required the

plaintiffs to perform tasks unrelated to their tipped duties while taking a tip

credit against their hourly rate of pay. The plaintiffs seek an unspecified

amount of alleged back wages, liquidated damages, and attorneys’ fees.

In September 2013, the United States District Court for the Southern

District of New York conditionally certified a nationwide class for the Fair

Labor Standards Act claims only of tipped employees who worked in the

aforementioned restaurants at any point from November 17, 2008 through

September 19, 2013. Potential class members are required to “opt in” rather

than “opt out” following the issuance of a notice. Out of the approximately

3,200 opt-in notices distributed, 541 were returned. As with the Alequin

matter, the Company will have an opportunity to seek to have the class

de-certified and/or seek to have the case dismissed on its merits. We believe

that our wage and hour policies comply with the law and that we have

meritorious defenses to the substantive claims in this matter. An estimate

of the possible loss, if any, or the range of loss cannot be made at this stage

of the proceeding.

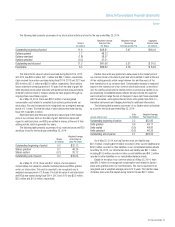

NOTE 20

SUBSEQUENT EVENT

On June 18, 2014, the Board of Directors declared a cash dividend of

$0.55 per share to be paid August 1, 2014 to all shareholders of record

as of the close of business on July 10, 2014.