Red Lobster 2014 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2014 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Darden

2014 Annual Report 37

NOTE 10

DERIVATIVE INSTRUMENTS AND HEDGING ACTIVITIES

We use financial and commodities derivatives to manage interest rate,

equity-based compensation and commodities pricing and foreign currency

exchange rate risks inherent in our business operations. By using these

instruments, we expose ourselves, from time to time, to credit risk and market

risk. Credit risk is the failure of the counterparty to perform under the terms

of the derivative contract. When the fair value of a derivative contract is posi-

tive, the counterparty owes us, which creates credit risk for us. We minimize

this credit risk by entering into transactions with high-quality counterparties.

We currently do not have any provisions in our agreements with counterparties

that would require either party to hold or post collateral in the event that the

market value of the related derivative instrument exceeds a certain limit. As

such, the maximum amount of loss due to counterparty credit risk we would

incur at May 25, 2014, if counterparties to the derivative instruments failed

completely to perform, would approximate the values of derivative instruments

currently recognized as assets on our consolidated balance sheet. Market

risk is the adverse effect on the value of a financial instrument that results

from a change in interest rates, commodity prices, or the market price

of our common stock. We minimize this market risk by establishing and

monitoring parameters that limit the types and degree of market risk that

may be undertaken.

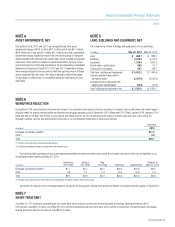

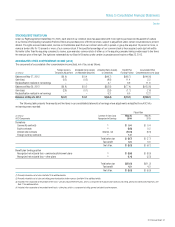

The notional values of our derivative contracts are as follows:

May 25, May 26,

(in millions)

2014 2013

Derivative contracts designated as

hedging instruments:

Commodities $ 0.9 $ 18.2

Foreign currency 0.3 20.3

Interest rate swaps 200.0 100.0

Equity forwards 20.6 24.9

Derivative contracts not designated as

hedging instruments:

Equity forwards $ 47.4 $ 49.1

Commodities – 0.6

We periodically enter into commodity futures, swaps and option contracts

(collectively, commodity contracts) to reduce the risk of variability in cash

flows associated with fluctuations in the price we pay for natural gas, diesel

fuel and butter. For certain of our commodity purchases, changes in the price

we pay for these commodities are highly correlated with changes in the

market price of these commodities. For these commodity purchases, we

designate commodity contracts as cash flow hedging instruments. For the

remaining commodity purchases, changes in the price we pay for these

commodities are not highly correlated with changes in the market price,

generally due to the timing of when changes in the market prices are

reflected in the price we pay. For these commodity purchases, we utilize

commodity contracts as economic hedges. Our commodity contracts

extended through May 2014.

We periodically enter into foreign currency forward contracts to reduce

the risk of fluctuations in exchange rates specifically related to forecasted

transactions or payments made in a foreign currency either for commodities

and items used directly in our restaurants or for forecasted payments of ser-

vices. Our foreign currency forward contracts extended through May 2014.

We are currently party to interest-rate swap agreements with

$200.0 million of notional value to limit the risk of changes in fair value of a

portion of the $400.0 million 4.500 percent senior notes due October 2021

and a portion of the $500.0 million 6.200 percent senior notes due October

2017. The swap agreements effectively swap the fixed-rate obligations for

floating-rate obligations, thereby mitigating changes in fair value of the

related debt prior to maturity. The swap agreements were designated as fair

value hedges of the related debt and met the requirements to be accounted

for under the short-cut method, resulting in no ineffectiveness in the hedging

relationship. During fiscal 2014, 2013 and 2012, $2.9 million, $3.0 million

and $3.3 million, respectively, was recorded as a reduction to interest

expense related to net swap settlements.

We enter into equity forward contracts to hedge the risk of changes in

future cash flows associated with the unvested, unrecognized Darden stock

units. The equity forward contracts will be settled at the end of the vesting

periods of their underlying Darden stock units, which range between four

and five years. The contracts were initially designated as cash flow hedges to

the extent the Darden stock units are unvested and, therefore, unrecognized

as a liability in our financial statements. As of May 25, 2014, we were party

to equity forward contracts that were indexed to 1.2 million shares of our

common stock, at varying forward rates between $31.19 per share and

$52.66 per share, extending through August 2018. The forward contracts can

only be net settled in cash. As the Darden stock units vest, we will de-designate

that portion of the equity forward contract that no longer qualifies for hedge

accounting and changes in fair value associated with that portion of the

equity forward contract will be recognized in current earnings. We periodically

incur interest on the notional value of the contracts and receive dividends on

the underlying shares. These amounts are recognized currently in earnings

as they are incurred or received.

We entered into equity forward contracts to hedge the risk of changes

in future cash flows associated with recognized, cash-settled performance

stock units and employee-directed investments in Darden stock within the

non-qualified deferred compensation plan. The equity forward contracts are

indexed to 0.3 million shares of our common stock at forward rates between

$46.17 and $51.95 per share, can only be net settled in cash and expire

between fiscal 2015 and 2019. We did not elect hedge accounting with the

expectation that changes in the fair value of the equity forward contracts

would offset changes in the fair value of the performance stock units and

Darden stock investments in the non-qualified deferred compensation plan

within selling, general and administrative expenses in our consolidated

statements of earnings.