Red Lobster 1999 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 1999 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion

of Results of Operations and Financial Condition

24

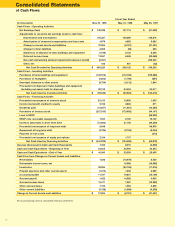

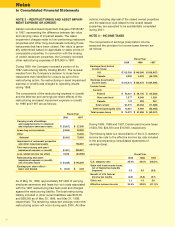

In 1999, the Company declared eight cents per share in

annual dividends paid in two installments. In December

1998, the Company’s Board approved an additional

authorization for the ongoing stock buy-back plan

whereby the Company may purchase on the open market

up to 13.8 million additional shares of Darden common

stock. This buy-back authorization is in addition to three

previously approved authorizations by the Board in

December 1997, September 1996 and December 1995

covering open market purchases of up to 15.0 million,

9.3 million and 6.5 million shares, respectively, of Darden

common stock. As of May 30, 1999, 32.6 million shares

were purchased under these programs.

The Company typically carries current liabilities in excess

of current assets, because the restaurant business

receives substantially immediate payment for sales

(nominal receivables), while inventories and other current

liabilities normally carry longer payment terms (usually

15 to 30 days). The seasonal variation in net working

capital is typically in the $10 million to $50 million range.

The Company requires capital principally for building new

restaurants, replacing equipment and remodeling existing

units. Capital expenditures were $124 million in 1999,

compared to $112 million in 1998, and $160 million in

1997 because of decisions to temporarily slow the growth

in new Olive Garden and Red Lobster units. The 1999,

1998 and 1997 capital expenditures and dividend require-

ments were financed primarily through internally generated

funds. The Company generated $348 million, $236 million

and $189 million in funds from operating activities during

1999, 1998 and 1997, respectively.

IMPACT OF YEAR 2000

Background

In the past, many computers, software programs other

information technology (IT systems), as well as other

equipment relying on microprocessors or similar circuitry

(non-IT systems), were written or designed using two

digits, rather than four, to define the applicable year. As a

result, date-sensitive systems (both IT systems and non-IT

systems) might recognize a date identified with “00” as

the year 1900 rather than the year 2000. This is generally

described as the Year 2000 issue. If this situation occurs,

the potential exists for system failures or miscalculations,

which could negatively impact business operations.

The Securities and Exchange Commission (SEC) has

asked public companies to disclose four general types

of information related to Year 2000 preparedness: the

company’s state of readiness, costs (historical and

prospective), risks and contingency plans. Accordingly,

the Company has included the following discussion in this

report, in addition to the Year 2000 disclosures previously

filed with the SEC.

State of Readiness

The Company began a concerted effort and established

a dedicated project team to address its Year 2000 issues

in fiscal year 1997. In fiscal year 1998, the Company

formalized a task force (the Year 2000 Project Office)

to coordinate the Company’s response to Year 2000

issues. The Year 2000 Project Office reports to the Chief

Executive Officer, his executive team and the Audit

Committee of the Company’s Board of Directors.

Under the auspices of the Year 2000 Project Office, the

Company believes that it has identified all significant IT

systems and non-IT systems that require modification in

connection with Year 2000 issues. Internal and external

resources were used to make the required modifications

and test Year 2000 readiness. The required modifications

and testing of all significant systems have been completed.

In addition, through its Year 2000 Project Office, the

Company has communicated with suppliers, banks,

vendors and others with whom it does significant

business (collectively, its business partners) to determine

their Year 2000 readiness and the extent to which the

Company is vulnerable to any other organization’s Year

2000 issues. Based on these communications and

related responses, the Company is monitoring the Year

2000 preparations and state of readiness of its business

partners. Although the Company is not aware of any

significant Year 2000 problems with its business

partners, there can be no guarantee that the systems

of other organizations on which the Company’s systems

rely will be converted in a timely manner, or that a failure

to convert by another organization, or a conversion that

is incompatible with the Company’s systems, would not

have a material adverse effect on the Company.

Costs

The total costs to the Company of Year 2000 activities

have not been and are not anticipated to be material to

its financial position or results of operations in any given

year. As of the end of 1999, the Company had spent

approximately $3.2 million on Year 2000 issues. This

amount does not include the costs incurred to develop

and install new systems resulting from the Company’s

seafood inventory accounting system project, which was

already contemplated for replacement. The total costs

to the Company of addressing Year 2000 issues are

estimated to be less than $5 million. These total costs

are based on management’s best estimates, which were

derived utilizing numerous assumptions of future events,

including the continued availability of certain resources,

third-party modification plans and other factors. However,

there can be no guarantee that these estimates will

be achieved, and actual results could differ from

those estimates.