Red Lobster 1999 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 1999 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes

to Consolidated Financial Statements

36

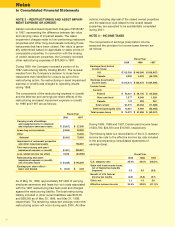

rates prior to the issuance of the notes and deben

tures.

The cash paid in terminating the interest-rate swap

agreements is being amortized to interest expense

over the life of the notes and debentures. The effective

annual interest rate is 7.57 percent for the notes and

7.82 percent for the debentures, after consideration

of loan costs, issuance discounts and interest-rate

swap termination costs.

The Company also maintains a revolving loan agreement

expiring May 19, 2000, with a consortium of banks under

which the Company can borrow up to $250,000. The

loan agreement allows the Company to borrow at inter-

est rates that vary based on the prime rate, LIBOR or a

competitively bid rate among the members of the lender

consortium, at the option of the Company. The loan

agreement is available to support our commercial paper

borrowing arrangements, if necessary. The Company is

required to pay a facility fee of nine basis points per

annum on the average daily amount of loan commit-

ments by the consortium. The amount of interest and the

annual facility fee are subject to change based on the

Company’s achievement of certain financial ratios and

debt ratings. Advances under the loan agreement are

unsecured. At May 30, 1999, and May 31, 1998, no

borrowings were outstanding under this agreement.

The aggregate maturities of long-term debt for each of

the five years subsequent to May 30, 1999, and there-

after are $2,386 in 2000; $2,513 in 2001; $2,647 in 2002;

$0 in 2003 and 2004; and $310,200 thereafter.

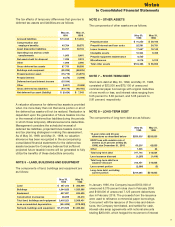

NOTE 9 – FINANCIAL INSTRUMENTS

The Company has participated in the financial derivatives

markets to manage its exposure to interest rate fluctua-

tions. The Company had interest-rate swaps with a

notional amount of $200,000 which it used to convert

variable rates on its long-term debt to fixed rates

effective May 30, 1995. The Company received the one-

month commercial paper interest rate and paid fixed-rate

interest ranging from 7.51 percent to 7.89 percent. The

interest-rate swaps were settled during January 1996 at

a cost to the Company of $27,670. This cost is being

recognized as an adjustment to interest expense over

the term of the Company’s 10-year notes and 20-year

debentures (see Note 8).

The following methods were used in estimating fair

value disclosures for significant financial instruments:

Cash equivalents and short-term debt approximate their

carrying amount due to the short duration of those items.

Long-term debt is based on quoted market prices or, if

market prices are not available, the present value of the

underlying cash flows discounted at the Company’s

incremental borrowing rates. The carrying amounts

and fair values of the Company’s significant financial

instruments are as follows:

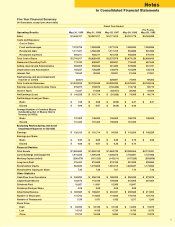

May 30, 1999 May 31, 1998

Carrying Fair Carrying Fair

Amount Value Amount Value

Cash and cash

equivalents $ 40,960 $ 40,960 $ 33,505 $ 33,505

Short-term debt 23,500 23,500 75,100 75,100

Total long-term debt $316,451 $306,806 $ 310,608 $314,502

NOTE 10 – EQUITY PUT OPTIONS

As a part of its stock repurchase program, the Company

issued equity put options that entitle the holder to sell

shares of Company common stock to the Company, at

a specified price, if the holder exercises the option. In

1999 the Company issued put options for 2,000,000

shares for $2,184 in premiums. At May 30, 1999, no

equity put options were outstanding.

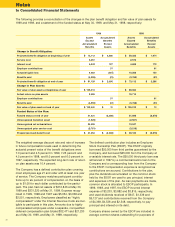

NOTE 11 – STOCKHOLDERS’ RIGHTS PLAN

The Company has a stockholders’ rights plan that enti-

tles each holder of Company common stock to purchase

one-hundredth of one share of Darden preferred stock

for each common share owned at a purchase price of

$62.50 per share, subject to adjustment to prevent

dilution. The rights are exercisable when, and are not

transferable apart from the Company’s common stock

until, a person or group has acquired 20 percent or

more, or makes a tender offer for 20 percent or more,

of the Company’s common stock. If the specified

percentage of the Company’s common stock is then

acquired, each right will entitle the holder (other than

the acquiring company) to receive, upon exercise,

common stock of either the Company or the acquiring

company having a value equal to two times the exercise

price of the right. The rights are redeemable by the

Company’s Board in certain circumstances and expire on

May 24, 2005.

NOTE 12 – INTEREST, NET

Interest expense on average ESOP debt of $61,270,

$62,688 and $65,850, in 1999, 1998 and 1997,

respectively, was included in compensation expense.

Capitalized interest was computed using the Company’s

borrowing rate. The Company paid $16,356 and $17,235

for interest (net of amount capitalized) in 1999 and

1998, respectively.