Red Lobster 1999 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 1999 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes

to Consolidated Financial Statements

35

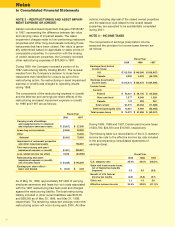

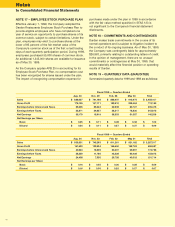

The tax effects of temporary differences that give rise to

deferred tax assets and liabilities are as follows:

May 30, May 31,

1999 1998

Accrued liabilities $ 14,042)$ 14,004)

Compensation and

employee benefits 43,784)39,575)

Asset disposition liabilities 24,701)32,104)

Operating loss and tax credit

carryforwards 1,900)8,461)

Net assets held for disposal 1,339)2,074)

Other 1,989)2,090)

Gross deferred tax assets 87,755)98,308)

Buildings and equipment (58,026) (68,405)

Prepaid pension asset (15,779) (14,979)

Prepaid interest (4,379) (4,696)

Deferred rent and interest income (10,194)

Other (5,801) (2,685)

Gross deferred tax liabilities (94,179) (90,765)

Net deferred tax asset (liability) $ (6,424) $ 7,543)

A valuation allowance for deferred tax assets is provided

when it is more likely than not that some portion or all of

the deferred tax assets will not be realized. Realization is

dependent upon the generation of future taxable income

or the reversal of deferred tax liabilities during the periods

in which those temporary differences become deductible.

Management considers the scheduled reversal of

deferred tax liabilities, projected future taxable income

and tax planning strategies in making this assessment.

As of May 30, 1999, and May 31, 1998, no valuation

allowance has been recognized in the accompanying

consolidated financial statements for the deferred tax

assets because the Company believes that sufficient

projected future taxable income will be generated to fully

utilize the benefits of these deductible amounts.

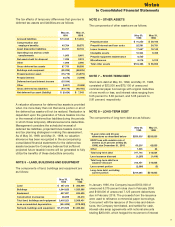

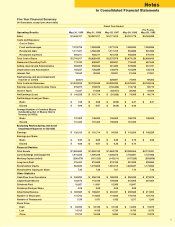

NOTE 5 – LAND, BUILDINGS AND EQUIPMENT

The components of land, buildings and equipment are

as follows:

May 30, May 31,

1999 1998

Land $ 387,050)$ 382,999)

Buildings 1,344,625)1,320,388)

Equipment 647,687)634,626)

Construction in progress 38,859)30,418)

Total land, buildings and equipment 2,418,221)2,368,431)

Less accumulated depreciation (944,686) (878,083)

Net land, buildings and equipment $1,473,535)$1,490,348)

NOTE 6 – OTHER ASSETS

The components of other assets are as follows:

May 30, May 31,

1999 1998

Prepaid pension $ 41,253 $ 39,160

Prepaid interest and loan costs 22,391 24,781

Liquor licenses 17,657 18,140

Intangible assets 10,504 9,459

Prepaid equipment maintenance 6,565

Miscellaneous 6,018 5,313

Total other assets $104,388 $ 96,853

NOTE 7 – SHORT-TERM DEBT

Short-term debt at May 30, 1999, and May 31, 1998,

consisted of $23,500 and $75,100 of unsecured

commercial paper borrowings with original maturities

of one month or less, and interest rates ranging from

5.05 percent to 5.80 percent, and 5.65 percent to

5.81 percent, respectively.

NOTE 8 – LONG-TERM DEBT

The components of long-term debt are as follows:

May 30, May 31,

1999 1998

10-year notes and 20-year

debentures as described below $250,000)$250,000)

ESOP loan with variable rate of

interest (5.31 percent at May 30,

1999), due December 31, 2018 60,200)62,000)

Other 7,546)24)

Total long-term debt 317,746)312,024)

Less issuance discount (1,295) (1,416)

Total long-term debt less

issuance discount 316,451)310,608)

Less current portion (2,386) (5)

Long-term debt, excluding

current portion $314,065)$310,603)

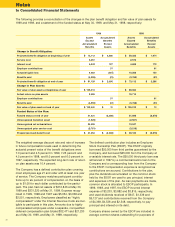

In January 1996, the Company issued $150,000 of

unsecured 6.375 percent notes due in February 2006

and $100,000 of unsecured 7.125 percent debentures

due in February 2016. The proceeds from the issuance

were used to refinance commercial paper borrowings.

Concurrent with the issuance of the notes and deben-

tures, the Company terminated, and settled for cash,

interest-rate swap agreements with notional amounts

totaling $200,000, which hedged the movement of interest