Red Lobster 1999 Annual Report Download - page 1

Download and view the complete annual report

Please find page 1 of the 1999 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

22

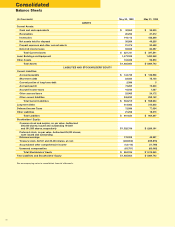

Darden Restaurants, Inc. (Darden or the Company) was

created as an independent, publicly held company in

May 1995 through the spin-off of all of General Mills’

restaurant operations to its shareholders. Darden

operates 1,139 Red Lobster, Olive Garden and Bahama

Breeze restaurants in the U.S. and Canada and licenses

38 restaurants in Japan. All of the restaurants in the

U.S. and Canada are operated by the Company with

no franchising.

This discussion should be read in conjunction with the

business information and the consolidated financial

statements and related notes found elsewhere in this

report. Darden’s fiscal year ends on the last Sunday

in May.

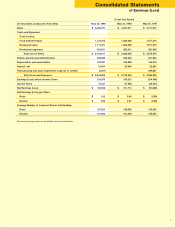

REVENUES

Total revenues in 1999 (52 weeks) were $3.46 billion,

a five percent increase from 1998 (53 weeks). Total

revenues in 1998 were $3.29 billion, a four percent

increase from 1997.

COSTS AND EXPENSES

Food and beverage costs for 1999 were 32.8 percent

of sales, a decrease of 0.2 percentage points from 1998

and a decrease of 1.2 percentage points from 1997. The

higher level of food and beverage costs for 1997, as a

percentage of sales, primarily resulted from the reposi-

tioning strategy at Red Lobster, initiated in 1997’s sec-

ond quarter, that lowered check averages and improved

food by providing larger portions and enhancing food

quality and presentation. Profit margins increased during

1999 and 1998 primarily as a result of increased sales,

higher margin food items and favorable food costs.

Restaurant labor was comparable year to year at

32.3 percent of sales in 1999 against 32.3 percent in

1998 and 32.1 percent in 1997.

Restaurant expenses (primarily lease expenses, property

taxes, utilities and workers’ compensation costs)

decreased in 1999 to 14.3 percent of sales compared

to 14.7 percent in 1998 and 15.2 percent in 1997. The

1999 and 1998 decreases resulted primarily from

increased sales levels.

Selling, general and administrative expenses declined in

1999 to 10.4 percent of sales compared to 10.9 percent

in 1998 and 11.4 percent in 1997. The 1999 and 1998

declines resulted from an overall decrease in marketing

costs each year and increased sales levels.

Depreciation and amortization expense of 3.6 percent of

sales in 1999 decreased from 3.8 percent in 1998 and

4.3 percent in 1997. The 1999 and 1998 decreases

resulted from increased sales levels, restaurant closings

and asset impairment write-downs that occurred during

1997’s fourth quarter. Interest expense of 0.6 percent of

sales in 1999 and 1998 decreased from 0.7 percent in 1997.

INCOME FROM OPERATIONS

Pre-tax earnings before restructuring credit increased

by 35 percent in 1999 to $207.4 million, compared to

$153.7 million in 1998 and $75.4 million before restruc-

turing and asset impairment charges in 1997. The

increase in 1999 was mainly attributable to annual

same-restaurant sales increases in the U.S. for both

Red Lobster and Olive Garden totaling 7.4 percent and

9.0 percent, respectively. Red Lobster and Olive Garden

have enjoyed six and 19 consecutive quarters of

same-restaurant sales increases, respectively. The

increase in 1998 was mainly attributable to substantially

higher earnings at Red Lobster resulting from actions

beginning in the second quarter of 1997 intended to

enhance long-term performance through new menu

items, bolder

flavors, more choices at lower prices and

service

improvements. Olive Garden also posted a solid

increase in earnings in 1998. Fiscal 1998 same-restaurant

sales increases in the U.S. for Red Lobster and Olive

Garden totaled 2.5 percent and 8.3 percent, respectively.

PROVISION FOR INCOME TAXES

The effective tax rate for 1999 before restructuring credit

was 34.8 percent compared to 33.8 percent in 1998 and

27.9 percent before restructuring and asset impairment

charges in 1997. The higher effective tax rate in 1999

resulted from higher pre-tax earnings. The 34.9 percent

rate in 1999, after restructuring credit, compared to

1998’s 33.8 percent rate and to 1997’s 41.1 percent

benefit after restructuring and asset impairment charges.

The unusual effective rate in 1997 resulted from operating

losses combined with federal income tax credits, both of

which created an income tax benefit.

NET EARNINGS AND NET EARNINGS PER

SHARE BEFORE RESTRUCTURING AND ASSET

IMPAIRMENT EXPENSE OR (CREDIT)

Net earnings before restructuring credit for 1999 of

$135.3 million or 96 cents per diluted share increased

33 percent, compared to 1998 net earnings of

$101.7 million or 67 cents per diluted share. 1998 net

earnings increased 87 percent, compared to net earnings

before restructuring and asset impairment charges for

1997 of $54.3 million or 35 cents per diluted share.

NET EARNINGS (LOSS) AND NET EARNINGS

(LOSS) PER SHARE

Net earnings after restructuring credit for 1999 of

$140.5 million (99 cents per diluted share) compared

with 1998’s net earnings of $101.7 million (67 cents per

diluted share) and 1997’s net loss after restructuring and

asset impairment charges of $(91.0) million (59 cents per

diluted share).

Management’s Discussion

of Results of Operations and Financial Condition