Rayovac 2014 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2014 Rayovac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

As I reflect upon fiscal 2014, it was a year of many successes and

accomplishments. It also saw significant challenges and changes as

in most years. I am proud we were very disciplined during the year and

“stuck to our knitting”. For example, we completed the accretive tuck-in

acquisition of The Liquid Fence Company for our Home and Garden

business. We did, however, “miss” many potential acquisitions, and I am

proud of this as well. A very smart investor once told me that “sitting on

one’s hands can be a very profitable exercise.” He mentioned this in the

context of not overpaying. At Spectrum Brands, we would much rather

“miss” on an acquisition than overpay for one. We will stay disciplined in

building our Company further.

Spectrum Brands achieved record financial performance again in fiscal

2014 and today enjoys the most powerful collection of global brands in

its history. We honored our commitment to pay down over $250 million

of term debt. Our businesses met or exceeded their internal goals for

the year, with the exception of our Pet division. We are taking actions

to further streamline our Pet business on the cost side, while at the

same time increasing investments to bolster and drive the growth of this

high-margin business in fiscal 2015 and beyond. I am especially excited

about adding the IAMS® and Eukanuba® pet food brands in Europe to this

segment. While this acquisition is a complex carve-out from The Procter

& Gamble Company, once we integrate and invest behind this business,

I am optimistic about its potential.

Investment will continue in our businesses, with an obsession to further

improve our margin structure and maximize our sustainable free cash

flow generation capacity. We operate our Company with an ownership

mentality. At times, we will make decisions that may hurt our “short-

term” performance because investments in our businesses today will

generate much higher returns on our capital in future periods.

As I noted earlier, every operating year has challenges or obstacles that

management must confront and work to mitigate or overcome with the

tools it has to deploy. Some hurdles, such as foreign currency headwinds

that come and go, have absolutely no bearing on the true earnings

strength of our Company over a longer time period. This is exactly how

we look at our business. I encourage investors to examine the earnings

power and free cash flow generation capacity of our Company not merely

for one or two years but truly over the long term.

Turning to our executive leadership, I congratulate Andreas Rouvé on

his appointment as Chief Operating Officer last February. He has been

a tremendous contributor to our success over the years and is a great

business leader. In addition, I want to thank Tony Genito and express

my deep gratitude to him for his seven years as CFO of Spectrum Brands.

We wish Tony every happiness and success in his future endeavors.

Last but not least, I am proud and excited to welcome Doug Martin to

Spectrum Brands as our new CFO. Doug comes to us after a long and

successful career with Newell Rubbermaid, where he had been CFO

since 2012. He is a high integrity person who shares my passion to

take Spectrum Brands to the next level. Doug is a true believer in the

ownership and accountability culture of our Company. He embraces our

low-cost and high-performance driven organization. He already has been

a pleasure to work with, and I know Doug will be a significant contributor

to our Company’s bright future. Welcome Doug!

It is an honor and privilege to serve our Company in my capacity. Without

the hard work, dedication and focus of our 13,500 employees around

the world, none of our accomplishments would be possible. So a big

thank you goes to each and every one of you. Spectrum Brands is a great

company to work for and we will ensure this remains so.

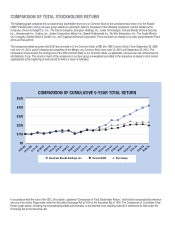

I view our investors and creditors as our partners. Without your trust

and capital, we could not succeed in achieving our vision and goals

for Spectrum Brands. Thank you for your support. I am proud of our

performance over the last five years. We will strive to allocate capital

even more efficiently in the years ahead. As always, I am confident our

Company’s best days are in front of us!

Sincerely,

David M. Maura

Chairman of the Board

December 19, 2014

TO OUR

SHAREHOLDERS

David M. Maura

Chairman of the Board, Spectrum Brands Holdings

Executive Vice President and Director, Harbinger Group Inc.