Rayovac 2014 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2014 Rayovac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

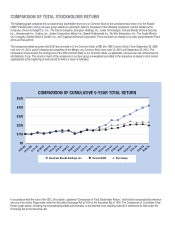

The following graph compares the cumulative total stockholder return on our Common Stock to the cumulative total return of (i) the Russell

2000 Financial Index, and (ii) our peer group selected in good faith, which is composed of the following companies: Central Garden & Pet

Company, Church & Dwight Co., Inc., The Clorox Company, Energizer Holdings, Inc., Exide Technologies, Fortune Brands Home & Security,

Inc., Hanesbrands Inc., Hasbro, Inc., Jarden Corporation, Mattel, Inc., Newell Rubbermaid Inc., Nu Skin Enterprises, Inc., The Scotts Miracle-

Gro Company, Stanley Black & Decker, Inc., and Tupperware Brands Corporation. There has been no change in our peer group between Fiscal

2013 and Fiscal 2014.

The comparison below assumes that $100 was invested in (i) the Common Stock of SBI (the “SBI Common Stock”) from September 30, 2009

until June 16, 2010, and (ii) following the completion of the Merger, our Common Stock from June 16, 2010 until September 30, 2014. The

comparison is based upon the closing price of the SBI Common Stock or our Common Stock, as applicable, and assumes the reinvestment of

all dividends, if any. The returns of each of the companies in our peer group are weighted according to the respective company’s stock market

capitalization at the beginning of each period for which a return is indicated.

COMPARISON OF CUMULATIVE 5-YEAR TOTAL RETURN

$500

$400

$300

$200

$100

$0

9/30/09

12/31/09

3/31/10

6/30/10

9/30/10

12/31/10

3/31/11

6/30/11

9/30/11

12/31/11

3/31/12

6/30/12

9/30/12

12/31/12

3/31/13

6/30/13

9/30/13

12/31/13

3/31/14

6/30/14

9/30/14

Spectrum Brands Holdings, Inc. Russell 2000 Peer Group

COMPARISON OF TOTAL STOCKHOLDER RETURN

In accordance with the rules of the SEC, this section, captioned “Comparison of Total Stockholder Return,” shall not be incorporated by reference

into any of our future filings made under the Securities Exchange Act of 1934 or the Securities Act of 1933. The Comparison of Cumulative Total

Return graph above, including any accompanying tables and footnotes, is not deemed to be soliciting material or deemed to be filed under the

Exchange Act or the Securities Act.