Rayovac 2013 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2013 Rayovac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

David R. Lumley

Chief Executive Officer

Anthony L. Genito

Chief Financial Officer

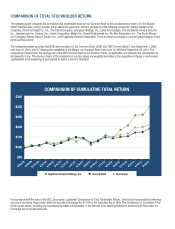

Spectrum Brands reported its fourth consecutive year

of record performance in fiscal 2013 with results that met

or exceeded financial guidance. Our Company expects fiscal 2014 to be

a fifth consecutive year of record results, including an increase in free

cash flow to at least $350 million, or about $7 per share, a significant

improvement from a record $254 million in fiscal 2013 and $208 million in

fiscal 2012. Our Company’s fiscal 2013 adjusted EBITDA margin of 15.8

percent was meaningfully greater than our peer group average.

In this annual report communication to shareholders, Chief Executive

Officer Dave Lumley and Chief Financial Officer Tony Genito answer

many frequently asked questions from analysts and investors.

What is Spectrum Brands’ strategy?

Lumley: We focus on and drive high cash-generating, consumer products

businesses by maximizing our Spectrum Value Model and our global

new product development and shared services infrastructures, increasing

distribution/shelf space at key retailers, adding new retail customers, and

expanding internationally. In fiscal 2014, we are launching “umbrella”

products in all divisions to help increase sales and distribution. Some of

them are shown in this annual report. And, we will maintain a continuous

improvement culture, a lean and efficient operating structure, and strong

expense controls.

What are the advantages of having such a diverse group of

businesses and brands?

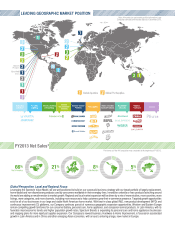

Lumley: Our Company is well-balanced seasonally and geographically.

We have diverse, valued-based, market-leading and largely non-

discretionary products that compete in multiple, large and stable

categories with attractive growth prospects. Our brands are widely

trusted, enduring and generally carry a low cash register ring. We have

a good retailer customer balance globally. This gives us timely and clear

insight into consumer trends and needs with our everyday, replacement

product portfolio. There are many cross-selling opportunities across the

businesses by geography and by retailer. We have a very experienced

and proven senior management team with a record of achievement not

only here at Spectrum Brands but also in previous executive roles at other

leading consumer companies.

Genito: It is important to note that our battery business, like our small

appliances and personal care division, generates significant free cash flow

that we can deploy in a number of ways to enhance shareholder value,

such as debt reduction or investing in our higher-margin businesses.

What are the priority uses of your free cash flow?

Genito: Our top priority is debt retirement and reducing our total leverage.

We plan to pay down at least $250 million of term debt in fiscal 2014.

We have a quarterly dividend currently at $0.25 per share to service.

Our Board recently authorized a $200 million common stock repurchase

program effective over 24 months. It will be used in conjunction with our

debt reduction goals and especially when our share value trades below

our view of “intrinsic value” based upon our free cash flow metrics. Finally,

we continue to look for accretive, bolt-on acquisitions. With the significant

increase we expect in our fiscal 2014 free cash flow, we have a lot more

flexibility and options.

Just what is the Spectrum Value Model?

Lumley: It is the heart of our Company – a game changer redefining

the value proposition for retailers and consumers and helping to provide

stability and sustainable earnings. It is a go-to-market strategy that delivers

genuine value to retailers and consumers with products that work as well

as, or better than, our competitors – and for a lower cost. It provides higher

margins and lower acquisition costs to our retail customers, with retail

category growth, market share gains and excellent category management

and merchandising. We concentrate on winning at point of sale and not

through brand advertising. So we can invest in product performance, R&D

and cost improvement. That’s our model and it is working. Our products

are performance-driven brands. This allows us to benefit from consumers’

increasing focus on value and openness to trial and brand conversion

against often slower-selling, and sometimes declining, premium-priced

products. What’s the takeaway? Value is winning in the marketplace with

today’s smart shoppers. We think Spectrum Brands is a very attractive

partner/leverage for retailers and a compelling option for consumers.

Why do you like your consumer battery business?

Lumley: It is our principal global platform for the growth of our many

product lines and the historic foundation for our brand strength, product

quality, customer value proposition, solid retailer relationships, consistent

profitability and strong cash flow. Its unit growth tends to track GDP rates.

Simply put, it is a strong EBITDA-producing, cash flow generator with

steady performance year-in and year-out. We like that.

What is your acquisition approach?

Lumley: As our Black Flag and FURminator acquisitions in late 2011

showed, we look for accretive, tuck-in acquisitions primarily in our Pet and

Home and Garden divisions that bring quick and major manufacturing

and SG&A cost synergies, along with commercial benefits such as new

Q&A