Rayovac 2002 Annual Report Download

Download and view the complete annual report

Please find the complete 2002 Rayovac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

POWERING TOMORROW’S WORLD

2002 Annual Report

Table of contents

-

Page 1

POWERING TOMORROW 'S WORLD 2002 Annual Report -

Page 2

...M A R K E T S I T S P R O D U C T S I N M O R E T H A N 1 1 5 C O U N T R I E S . T H E C O M PA N Y ' S S T O C K T R A D E S O N T H E N E W YO R K S T O C K E XC H A N G E U N D E R S Y M B O L R O V. RAYOVAC MANUFACTURES AND DISTRIBUTES PRODUCTS TO HIGH-PERFORMANCE POWER TOMORROW 'S WORLD -

Page 3

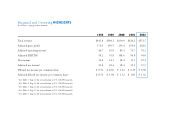

... amounts 1998 Total revenue Adjusted gross profit2 Adjusted operating income3 Adjusted EBITDA4 Net income Adjusted net income5... 108.6 38.4 38.4 $ 1.32 $ 1.32 2001 $616.2 255.0 76.7 96.8 11.5 31.1 $ 0.39 $ 1.05 2002 $572.7 238.6 76.2 94.0 29.2 37.5 $ 0.90 $ 1.16 $441.8 172.9 46.7 59.2 14.4 21.4 $ ... -

Page 4

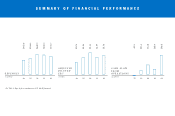

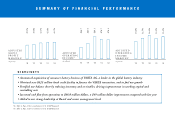

SUMMARY OF FINANCIAL PERFORMANCE $441.8 $504.2 $630.9 $616.2 $572.7 $0.74 $1.04 $1.32 $1.05 $1.16 $13.3 $32.8 REVENUES (in millions) ADJUSTED DILUTED EPS1 '98 '99 '00 '01 '02 (in dollars) C A S H F LOW FROM O P E R AT I O N S '98 '99 '00 '01 '02 (in millions) '98 '99 '00 '01 $18... -

Page 5

...VARTA's advanced battery products provide exciting benefits to consumers and retailers alike. We provide industry leading NiMH rechargeable battery and charger technology. We've improved the performance of our alkaline batteries by 33 percent since 1998. We're creating our most powerful zinc air... -

Page 6

...AT T E R Y I N D U S T R Y, P O S I T I O N I N G R A YO VA C A S O N E O F T H E L A R G E S T C O N S U M E R B AT T E R Y A N D L I G H T I N G C O M PA N I E S I N T H E W O R L D . " Rayovac now has sales and distribution capabilities in 115 countries and relationships with nine of the top 10... -

Page 7

... For RAYOVAC CORPORATION, fiscal 2002 was an exciting and challenging year, and one that will be remembered as a defining period in our growth story. During the year, we announced the most important transaction in our Company's history: the combination of Rayovac's business with the consumer battery... -

Page 8

... battery industry • Obtained new $625 million bank credit facility to finance the VARTA transaction, and to fuel our growth • Fortified our balance sheet by reducing inventory and receivables, driving improvements in working capital and controlling costs • Increased cash flow from operations... -

Page 9

.... For example, in 2001, we launched the world's first one-hour Nickel Metal Hydride (NiMH) charger, as well as long-lasting, high-capacity NiMH batteries. These products enabled us to retain more than a 60 percent share of the U.S. rechargeables market and solidified our position as the nation's top... -

Page 10

AN IMPROVED POWER COMBINATION OF AND PERFORMANCE -

Page 11

MAXIMUM PROF LE WE'VE UNVEILED A BOLD NEW LOGO THAT HELPS US TO S TA N D O U T F R O M O U R C O M P E T I T O R S AT R E TA I L AND BUILDS CONSUMER AWARENESS OF RAYOVAC 'S NEW AND I M P R O V E D A L K A L I N E P R O D U C T , M A X I M U M P L U Sâ„¢. -

Page 12

... percent) '98 '99 '00 '01 '02 • Introduced the Maximum Plus௣ high-performance alkaline battery, our longest lasting alkaline battery ever • Increased our alkaline battery life by 33 percent over our 1998 alkaline product • Launched a bold new Rayovac logo and package design across all... -

Page 13

...major technology achievement for Rayovac in 2002 was our launch of the new Maximum Plus௣ alkaline battery. Maximum Plus incorporates our latest advances in battery chemistry and internal cell construction, and is the longest lasting Rayovac alkaline product yet. Maximum Plus lasts an average of 11... -

Page 14

POWERFUL POPUL AR SOLUTIONS FOR CONSUMER PRODUCTS -

Page 15

TECHNOLOGY FOCUS WE'VE COMPLEMENTED OUR ADVERTISING, MARKETING, B R A N D I N G , P A C K A G E D E S I G N A N D P O I N T- O F - P U R C H A S E C A P A B I L I T I E S WITH INNOVATIVE TECHNOLOGY INITIATIVES THAT HAVE POSITIONED US A S THE INDUSTR Y LEADER IN SEVERAL PRODUCT CATEGORIES. -

Page 16

... segment of the overall battery market • Nickel Metal Hydride (NiMH) batteries are the most popular rechargeables • High-tech digital cameras are spurring the growth of NiMH rechargeable batteries • Rayovac is the number-one-selling rechargeable brand in the U.S. * Compound Annual Growth Rate... -

Page 17

... we boosted our cash flow from operations to $66.8 million, a $49 million increase year over year. 1 See Table 1‚ Page 12 for reconciliation to U.S. GAAP financials. The patent pending I-C 3 rechargeable NiMH battery can be charged in 15 minutes or less in our I-C 3 charger, providing consumers... -

Page 18

LEADERS L ATIN IN THE EUROPEAN AND AMERICAN BATTER Y MARKETS -

Page 19

NEW OPPORTUN TIES O U R A C Q U I S I T I O N O F V A R TA , A H I G H LY R E G A R D E D A N D W E L L - R E C O G N I Z E D E U R O P E A N B R A N D , H A S E S TA B L I S H E D A S T R O N G P L AT F O R M F O R O U R GROWTH IN EUROPE AND LEVERA GES FAVORABLE EUROPEAN MARKET DYNAMIC S TO ... -

Page 20

...3% 83% R AY O VA C COMBINED R AY O VA C / VA RTA VA RTA NORTH AMERICA L AT I N A M E R I C A EUROPE/REST OF WORLD • Creates a powerful global consumer battery competitor • Builds a base of manufacturing and distribution capabilities • Yields a combined revenue base of nearly $1 billion -

Page 21

... balance sheet, strongly position us to leverage the opportunities that will arise as we maximize the power of our synergistic union with VARTA. VARTA offers a full range of consumer batteries including, advanced alkaline, rechargeable, zinc carbon and photo. to our SHAREHOLDERS [continued] 8 9 -

Page 22

RAISING THE THE VOLUME FOR HEARING IMPAIRED -

Page 23

DRIVING INNOVATION W E ' R E E X PA N D I N G O U R I N D U S T R Y- L E A D I N G Z I N C A I R T E C H N O L O GY C A PA B I L I T I E S T O C R E AT E A N E W G E N E R AT I O N OF BATTERIES THAT WILL BE OUR MOST POWERFUL. -

Page 24

...RETAIL DISTRIBUTION 60+% 20% 80% TO TA L H E A R I N G A I D B AT T E R I E S 2001 WORLDWIDE MARKET SHARE TO TA L H E A R I N G A I D B AT T E R I E S 2001 NORTH AMERICA PROFESSIONAL MARKET SHARE ALL OTHER R AY O VA C • Rayovac has more than 60 percent of the worldwide hearing aid battery... -

Page 25

... in our future. 10 11 David A. Jones Chairman and Chief Executive Officer Kent J. Hussey President and Chief Operating Officer Rayovac's zinc air hearing aid batteries deliver powerful performance and excellent sound quality-the perfect solution for high-demand hearing aids. to our SHAREHOLDERS... -

Page 26

... and the Management Discussion and Analysis for more information. (3) In fiscal 2002, the Company recognized a bad debt reserve of $12.0 million, net of recoveries, attributable to the bankruptcy filing of a key customer. (4) EBITDA represents income from operations plus other (income) expense, net... -

Page 27

... 2002, and 2003, respectively. INTRODUCTION Rayovac Corporation is one of the oldest battery companies in the United States, founded in 1906 as the French Battery Company. Rayovac's product portfolio includes alkaline, rechargeable, and heavy duty batteries, hearing aid batteries, lighting products... -

Page 28

... Latin America is consistent with the global market trend away from zinc carbon toward alkaline batteries. In October 2002, we announced the closure of operations at our Madison, Wisconsin packaging center and Middleton, Wisconsin distribution center and combination of the two operations into a new... -

Page 29

...Highlights of consolidated operating results Net Sales. Our net sales decreased $43.5 million, or 7.1%, to $572.7 million in fiscal 2002 from $616.2 million the previous year. Increases in hearing aid battery and lighting product sales were unable to offset declines in heavy duty and alkaline sales. -

Page 30

... in income from operations is related to a segment. Total segment assets are set forth in Note 12 of Notes to Consolidated Financial Statements filed herewith. North America 2001 Revenue from external customers Segment profit Segment profit as a % of net sales $448.8 80.8 18.0% 2002 $435.6 85.5 19... -

Page 31

... as a % of net sales $48.7 4.1 8.4% 2002 $52.5 5.1 9.7% Our revenue from external customers increased $3.8 million, or 7.8%, to $52.5 million in fiscal 2002 from $48.7 million the previous year, primarily reflecting increased sales of alkaline and hearing aid batteries, and favorable impacts of... -

Page 32

... and a favorable shift in product mix away from lower margin lithium, camcorder, and lighting products to more profitable alkaline and hearing aid batteries. Latin America 2000 Revenue from external customers Segment profit Segment profit as a % of net sales $112.2 20.3 18.1% 2001 $118.7 16.9 14.2% -

Page 33

... sales of zinc carbon batteries and unfavorable impacts of currency devaluation of $1.7 million. The alkaline sales growth in Latin America primarily reflects new distribution in mass merchandiser chains compounded by the expansion into the Southern region of South America. Heavy duty sales were... -

Page 34

... fiscal 2002, our board of directors granted 1,057,190 options to purchase shares of our Common stock to various employees of the Company under the 1997 Rayovac Incentive Plan. All grants were at an exercise price equal to the market price of our Common stock on the date of grant with prices ranging... -

Page 35

... P E R AT I O N S Rayovac Corporation and Subsidiaries On October 1, 2002, the Company entered into an Amended and Restated Agreement ("Third Restated Agreement") to finance the acquisition of the consumer battery business of VARTA AG. The Third Restated Agreement includes a $100 million seven-year... -

Page 36

...fiscal 2002, our pension liability increases, ultimately increasing future pension expense. See Notes 2(c) and 11 to the Consolidated Financial Statements for a more complete discussion of our employee benefit plans. Restructuring Restructuring liabilities are recorded for estimated cost of facility... -

Page 37

... liabilities: Wages and benefits Accrued interest Other special charges Other Total current liabilities Long-term debt, net of current maturities Employee benefit obligations, net of current portion Deferred income taxes Other Total liabilities Shareholders' equity: Common stock, $.01 par value... -

Page 38

... 29,702 $ $ 2002 $572,736 334,147 1,210 237,379 104,374 56,900 13,084 - 174,358 63,021 16,048 1,290 45,683 16,446 29,237 - $ 29,237 $ $ 0.92 - 0.92 31,775 0.90 - 0.90 32,414 Net sales Cost of goods sold Special charges Gross profit Operating expenses: Selling General and administrative... -

Page 39

...L I DAT E D S TAT E M E N T S O F C O M P R E H E N S I V E I N C O M E Rayovac Corporation and Subsidiaries Years Ended September 30, (In thousands) 2000 $38,350 (1,964) - - 415 $36,801 2001 $11,534 (1,141) (150) (2,929) (3,298) $ 4,016 2002 $29,237 (7,875) - (1,477) (3,639) $16,246 Net income... -

Page 40

... $ (467) - - - - 415 - (52 3,298) - - - (3,350 3,639) - - $(6,989) Notes Receivable from Officers/ Shareholders $ (890) - - - (2,300) - - (3,190 475 3,665) - - - - (540) - - - - $(4,205) Common Stock (In thousands) Shares 27,490 - (51) 131 - - - 27,570 - 3,500 277 (5) 701 32,043 - (24) 24 15... -

Page 41

... 158 1,601 9,757 $ 11,358 $ 28,938 8,166 $ 2002 $ 29...charges Net cash provided by operating activities Cash flows from investing activities: Purchases of property, plant and equipment Investments in available for sale securities Proceeds from sale of property, plant and equipment Proceeds from sale... -

Page 42

... Business Rayovac Corporation and its wholly owned subsidiaries (Company) manufacture and market batteries. Products include general (alkaline, rechargeables, heavy duty, lantern and general purpose), button cell and lithium batteries. The Company also produces a variety of battery powered lighting... -

Page 43

... O L I DAT E D F I N A N C I A L S TAT E M E N T S Rayovac Corporation and Subsidiaries (In thousands, except per share amounts) Bargaining agreements that expire in 2003 represent approximately 14% of the total labor force. The Mexico City, Mexico manufacturing facility was closed during the first... -

Page 44

... changes in accumulated foreign currency translation (gains) losses for 2001 and 2002, respectively, in these countries were: Argentina, ($1) and $2,616; Venezuela, ($32) and $3,411; and Mexico, $220 and $955. Exchange losses on foreign currency transactions aggregating $1,334, $2,091 and $2,412 for... -

Page 45

... when the hedged purchase of zinc metal-based items also affects earnings. The swaps effectively fix the floating price on a specified quantity of zinc through a specified date. During 2002, $2,645 of pretax derivative losses were recorded as an adjustment to cost of sales for swap contracts settled... -

Page 46

... of sales incentives including discounts, coupons, rebates and free products. In April 2001, the EITF reached a consensus on Issue No. 00-25, "Vendor Income Statement Characterization of Consideration Paid to a Reseller of the Vendor's Products or Services". This Issue addresses when consideration... -

Page 47

... No. 143 addresses financial accounting and reporting for obligations associated with the retirement of tangible long-lived assets and the associated asset retirement costs. The Company is required to adopt this statement no later than its fiscal year beginning October 1, 2002. Management believes... -

Page 48

...M E N T S Rayovac Corporation and Subsidiaries (In thousands, except per share amounts) (3) Inventories Inventories consist of the following: September 30, 2001 Raw materials Work-in-process Finished goods $ 24,271 14,015 53,025 $ 91,311 2002 $ 19,893 19,004 45,378 $ 84,275 (4) Property, Plant and... -

Page 49

...-annually Capitalized lease obligations Notes and obligations, weighted-average interest rate of 3.77% at September 30, 2002 9,075 257,977 Less current maturities Long-term debt 24,436 $233,541 3,810 201,871 13,400 $188,471 239 1,098 - 500 $213,200 34,365 2002 $174,500 23,061 In 1999, the Company... -

Page 50

... ("Notes"), initially scheduled to mature on November 1, 2006, were redeemed in connection with the Company's initial public offering of common stock, and a subsequent primary offering, with the final residual amount redeemed in November 2001. The Company entered into no new capital leases in 2002... -

Page 51

... B Senior Subordinated Notes. Concurrently, the Thomas H. Lee Group and its affiliates sold approximately 4,200 shares and certain Rayovac officers and employees sold approximately 900 shares in a secondary offering of Common stock. The Company did not receive any proceeds from the sales of the... -

Page 52

... the aggregate, may be granted to select employees and directors of the Company under either or both a time-vesting or a performance-vesting formula at an exercise price equal to the market price of the Common stock on the date of grant. The time-vesting options become exercisable primarily in equal... -

Page 53

... provide a reliable single value of its options and may not be representative of the future effects on reported net income or the future stock price of the Company. For purposes of pro forma disclosure, the estimated fair value of the options is amortized to expense over the option's vesting... -

Page 54

...683 2001 2002 40 41 In 2001, a tax benefit of $3,260 was recorded in conjunction with the loss on the early extinguishment of debt. The following reconciles the Federal statutory income tax rate with the Company's effective tax rate: 2000 Statutory Federal income tax rate Foreign Sales Corporation... -

Page 55

...deferred tax assets: Employee benefits Operating loss and credit carry forwards Property, plant and equipment Other...105 351 1,861 1,370 1,717 8,586 2002 At September 30, 2002, net noncurrent deferred tax assets of $12,343 are included in Deferred charges and other in the Consolidated Balance Sheets.... -

Page 56

... to annual inflationary increases. All of the leases expire during the years 2003 through 2014. Total rental expenses were $6,924, $7,137 and $7,341 for 2000, 2001 and 2002, respectively. During 2002, the Company entered into a long-term lease for a facility being built in Dixon, Illinois (see... -

Page 57

... DAT E D F I N A N C I A L S TAT E M E N T S Rayovac Corporation and Subsidiaries (In thousands, except per share amounts) Other Benefits The Company provides certain health care and life insurance benefits to eligible retired employees. Participants earn retiree health care benefits after reaching... -

Page 58

... America, and the Caribbean; Europe/Rest of World ("Europe/ROW") includes the United Kingdom, continental Europe and all other countries in which the Company does business. The Company manufactures and markets dry cell batteries including alkaline, zinc carbon, alkaline rechargeable, hearing aid... -

Page 59

... $ 13,266 5,253 1,504 $ 20,023 2001 $ 14,253 5,393 1,573 $ 21,219 2002 $ 15,401 2,879 715 $ 18,995 Segment profit 2000 North America Latin America Europe/ROW Total segments Corporate expenses Special charges Interest expense Other expense, net Income before income taxes and extraordinary items $ 57... -

Page 60

... 2000 Alkaline Heavy Duty Rechargeables Hearing Aid batteries Specialty batteries Lighting products and Lantern batteries Total revenues from external customers $280,700 142,300 29,700 60,800 41,400 76,000 $630,900 2001 $302,900 139,100 29,800 65,300 17,800 61,300 $616,200 2002 $295,700 96,500 31... -

Page 61

...528 of employee termination benefits for 43 employees related to organizational restructuring in the U.S. and Europe, (ii) $1,300 of charges related to the discontinuation of the manufacturing of silver-oxide cells at the Company's Portage, Wisconsin, facility, and (iii) $2,100 of charges related to... -

Page 62

... agreement with a Hong Kong company to sell certain inventory and for the exclusive right to use the Rayovac trade name for the manufacture, sale and distribution of the Company's camcorder battery product line. In exchange for the license, the Company received a $6,000 promissory note, payable over... -

Page 63

...the Mexico City, Mexico zinc carbon manufacturing plant; closure of operations at its Middleton, Wisconsin distribution center and its Madison, Wisconsin packaging center and combination of the two operations into a new leased complex being built in Dixon, Illinois. Transition to the new facility is... -

Page 64

INDEPENDENT AUDITORS' REPORT The Board of Directors and Shareholders Rayovac Corporation: We have audited the accompanying consolidated balance sheets of Rayovac Corporation and subsidiaries as of September 30, 2001 and 2002, and the related consolidated statements of operations, comprehensive ... -

Page 65

.... The Annual Report and filings with the U.S. Securities and Exchange Commission can be obtained upon request to Mellon Investor Services or: Investor Relations, Attention: John Daggett, Rayovac Corporation, P.O. Box 44960, Madison, WI 53744-4960, 608-275-4912. General Corporate Communications For... -

Page 66

... President and Chief Operating Officer Executive Vice President-Operations Executive Vice President-Europe Executive Vice President-Latin America Executive Vice President-North America Executive Vice President and Chief Financial Officer Executive Vice President-Global Sales Senior Vice President... -

Page 67

RAYOVAC CORPORATION WORLD HEADQUARTERS 601 Rayovac Drive Madison, Wisconsin 53711-2497 www.rayovac.com