Qantas 2003 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2003 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2003 Qantas Annual Report

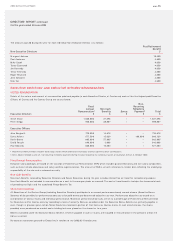

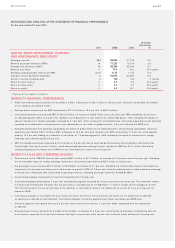

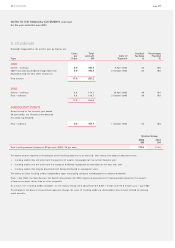

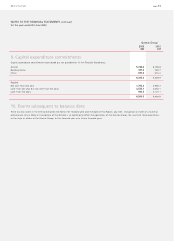

DISCUSSION AND ANALYSIS OF THE STATEMENT OF CASH FLOWS

for the year ended 30 June 2003

For the purposes of the Statement of Cash Flows, cash includes cash at bank and on hand, bank overdrafts, cash at call, short-term money market

securities and term deposits.

REVIEW OF CASH FLOWS FROM OPERATING ACTIVITIES

Cash flows provided by operations increased by 12.9 per cent to $1,290.8 million primarily due to favourable movements in working capital.

Borrowing costs paid increased by 58.5 per cent due to higher debt levels, while interest received increased by 65.6 per cent due to higher

cash held.

Income taxes paid were higher due to the timing of payments.

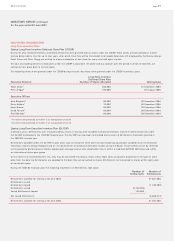

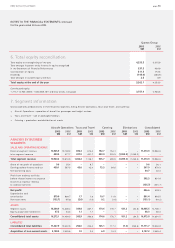

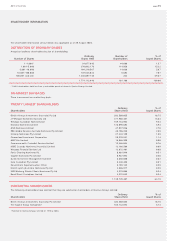

REVIEW OF CASH FLOWS FROM INVESTING ACTIVITIES

Cash flows used in investing activities increased by $689.6 million to $2,995.7 million.

To tal capital expenditure of $3,137.2 million for the year predominantly related to the acquisition of aircraft under the aircraft

fleet plan, aircraft progress payments, reconfigurations, product investment, engine modifications and spares.

Payments for investments made during the year of $92.9 million mainly comprised the initial 4.99 per cent investment in Air New Zealand.

Proceeds from the sale of property, plant and equipment mainly related to the sale of 12 Beechcraft 1900 aircraft which were originally

purchased as part of the acquisition of the Impulse Airlines Group in November 2001.

REVIEW OF CASH FLOWS FROM FINANCING ACTIVITIES

Cash flows provided by financing activities increased by $1,246.8 million to $2,935.6 million.

Repayments of borrowings/swaps of $798.3 million comprised repayments of short-term borrowings, swaps, loans and leases.

Proceeds from borrowings of $3,205.2 million included drawdowns of a syndicated bank loan facility and bond financing required to purchase

new aircraft under the fleet plan.

Proceeds from the issue of shares of $701.0 million reflected the proceeds received from the Institutional and Shareholder Equity Placements.

Dividend payments represent total dividends paid and is net of $110.3 million which was converted directly to shares via the Dividend

Reinvestment Plan.

page 46