Qantas 2003 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2003 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

page 30

2003 Qantas Annual Report

CORPORATE GOVERNANCE STATEMENT continued

independent professional advice is available to the Directors

if necessary, at the expense of Qantas

formal Code of Conduct – including conflict of interest, formal

share trading procedures and compliance with legal and other

obligations to legitimate stakeholders. A copy of the Qantas

Code of Conduct will be available on the Corporate Governance

section of the Qantas website

all equity-based executive remuneration made in accordance

with plans approved by shareholders

formal Continuous Disclosure Policy – ensures compliance with

the Listing Rules and Corporations Act and that all shareholders

and the market has equal access to material information. A copy

of the Continuous Disclosure Policy will be available on the

Corporate Governance section of the Qantas website

EXTERNAL AUDITOR INDEPENDENCE

the Board and Audit Committee closely monitors the

independence of the external auditors

regularly reviews the independence safeguards put in place

by the external auditors

requires the rotation of the audit partner every five years

policies to restrict the type of non-audit services which can

be provided by the external auditors

undertakes a detailed monthly review of non-audit fees paid

to the external auditor

imposes restrictions on the employment of ex-employees

of the external auditor

the Audit Committee meets regularly with management without

the external auditors and with the external auditors without

management

external auditor attends the Annual General M eeting and is

available to answer shareholder questions about the conduct of

the audit and the preparation and content of the auditor’s report

SHAREHOLDERS

Shareholder Communications Policy – promotes effective

communication with shareholders and encourages effective

participation at general meetings. A copy of the formal Policy

will be available on the Corporate Governance section of the

Qantas website

ATTACHMENT 1

EXECUTIVE REMUNERATION PHILOSOPHY

AND OBJECTIVES

Qantas’ policy is to ensure that remuneration properly reflects the

duties and responsibilities of its executives, and that remuneration

is competitive in attracting, motivating and retaining people of the

highest calibre.

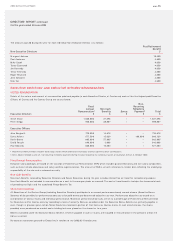

This is achieved via a mixture of:

Fixed Annual Remuneration;

The Performance Plan, comprising:

The Performance Cash Plan - a short term cash incentive; and

The Performance Equity Plan - made up of a medium-term

incentive (the Performance Share Plan) and a long-term incentive

(the Performance Rights Plan); and

Concessionary Travel Benefits, Service Payments and other

retention tools, and other discretionary benefits considered

appropriate from time to time.

The Chairman’s Committee play a critical role in reviewing and

recommending to the Qantas Board on matters of remuneration

policy, specific recommendations relating to Senior Executives

and all matters concerning equity plans and awards.

The guiding principles in managing remuneration for executives

are that:

all elements of remuneration should be set at an appropriate

level having regard to market practice for roles of similar scope

and skill;

the Performance Plan should be used to differentiate reward

for high performers and to encourage continuously higher levels

of performance;

the Performance Plan should be clearly linked to appropriate

goals via a robust performance management system; and

the Performance Equity Plan, comprising the Performance Share

Plan and Performance Rights Plan elements of the Performance

Plan, should be used to align the interests of executives with

shareholders, support a culture of employee share ownership

and act as a retention initiative.

Overall the mix of the Remuneration program is consistent with

market practice.

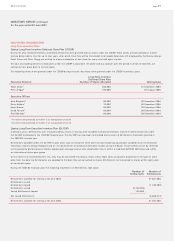

FIXED ANNUAL REMUNERATION (FAR)

Salary decisions are based on the concept of Fixed Annual

Remuneration (FAR), which involves a guaranteed salary level from

which superannuation and other benefits are able to be deducted,

at the election of the individual, on a salary sacrifice basis.

FAR is set with reference to market data, reflecting the scope of the

role, the unique value of the role and the performance of the person

in the role. FAR is reviewed annually and reflects a middle of the

market approach, defined as the top 50 ASX listed entities for senior

management and a broad selection of equivalent roles within Australia

for other executives.