Qantas 2003 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2003 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

page 28

2003 Qantas Annual Report

CORPORATE GOVERNANCE STATEMENT

BOARD RESPONSIBILITIES

In preparing this Statement, the Qantas Board has focussed on the

structure and values which it has in place to ensure that the Board

protects and enhances shareholder value. The Board endorses each

of the ASX Corporate Governance Council’s Principles of Good

Corporate Governance and Best Practice Recommendations (ASX

Principles) published in M arch 2003.

On 1 September 2003, the Board adopted a formal Board Charter.

A copy of the Board Charter will be available on the Corporate

Governance section of the Qantas website (www.qantas.com).

The Board maintains, and ensures that Qantas management

maintains, the highest level of corporate ethics. The Board comprises

a majority of independent Non-Executive Directors who, together

with the BA Directors and Executive Directors, have extensive

commercial experience and bring independence, accountability and

judgment to the Board’s deliberations to ensure maximum benefit

to shareholders, employees and the wider community.

In particular, the Board:

promotes ethical and responsible decision-making

ensures compliance with laws, regulations and all appropriate

accounting standards

sets and reviews strategic direction and approves the annual

operating budget

oversees the Qantas Group, including its control and

accountability systems

monitors the operating and financial performance of the

Qantas Group

monitors the performance of the Chief Executive Officer,

Chief Financial Officer and executive management

ensures a clear relationship between performance and

executive remuneration

monitors risk management

ensures that the market and shareholders are fully informed

of material developments

recognises the legitimate interests of stakeholders

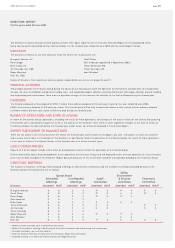

BOARD STRUCTURE

11 Directors

seven independent Non-Executive Directors elected by

shareholders other than British Airways – the independent

Non-Executive Directors are:

Margaret Jackson (Chairman)

Paul Anderson

Michael Codd

Trevor Eastwood

Jim Kennedy

Trevor Kennedy

John Schubert

a Qantas Non-Executive Director will be considered to be

independent if they:

are not a substantial shareholder of Qantas, or an officer

of, or otherwise associated directly with, a substantial

shareholder of Qantas (as such, the BA Directors are

not considered to be independent)

have not, within the last three years, been employed

in an executive capacity by the Qantas Group

have not, within the last three years, been a principal of

a material professional adviser or a material consultant to

the Qantas Group or an employee materially associated

with the service provided

are not a material supplier or customer of the Qantas Group,

or an officer of or otherwise associated directly or indirectly

with, a material supplier or customer

have no material contractual relationship with the Qantas

Group other than as a Director

are free from any interest and any business or other

relationship which could, or could reasonably be perceived

to, materially interfere with the Director’s ability to act in

the best interests of Qantas

materiality thresholds for determining the independence of

Non-Executive Directors are:

for Directors:

a relationship which accounts for more than 10% of

his/her gross income (other than Director’s Fees paid

by Qantas)

when the relationship is with a firm, company or entity,

in respect of which the Director (or any associate) has

more than a 20% shareholding if a private company

or 2% shareholding if a listed company

for Qantas:

in respect of advisers or consultants – where fees paid

exceed $2 million pa

in respect of suppliers – where goods or services

purchased by the Qantas Group exceed $100 million pa

(other than banks, where materiality must be

determined on a case by case basis)

in respect of customers – where goods or services

supplied by Qantas Group exceed $100 million pa

Qantas, as the principal Australian airline, has commercial

relationships with most, if not all, major entities in Australia.

As such, in determining whether a Non-Executive Director is

independent, simply being a non-executive director on the

board of another entity is not, in itself, sufficient to affect

independence. Nevertheless, any Director on the Board of

another entity is ordinarily expected to excuse themselves from

any meeting where that entity’s commercial relationship with

Qantas is directly or indirectly discussed. BA Directors must

consult with the Chairman on a case by case basis their

attendance during discussions concerning the relationship

between Qantas and British Airways