Qantas 2001 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2001 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

p2QANTAS ANNUAL REPORT 2001

Report from the Chairman and Chief Executive Officer

Solid results

Qantas delivered a profit of $597.1 million before tax for the

year ended 30 June 2001 and a profit after tax of $415.4 million.

The Directors declared a fully franked final dividend of 9 cents

per share, bringing total fully franked dividends for the year to

20 cents per share and maintaining the payout ratio of 60 per cent.

Revenue totalled $10.2 billion, a record for Qantas and an

increase of $1.1 billion, or 11.9% on last year. Total expenditure

for the year, however, increased by 15%. Higher jet fuel prices

were a major factor; in addition, Qantas commenced investing

in new aircraft and improved services for customers.

Qantas International operations continued to make a strong

contribution to the Group’s performance during the year,

with earnings before interest and tax rising 22.4 per cent to

$458.7 million. While this significant profit was assisted by the

Sydney Olympics, it was delivered in a year in which many airlines

around the world reported losses or small profits.

Qantas’ Australian domestic operations were placed under

great pressure, with earnings before interest and tax down

53.2 per cent to $127.4 million. This reflected significant price

discounting, a weak Australian dollar, an overall slowing in the

Australian and international economies, introduction of the GST

and, as indicated above, high fuel prices.

Qantas has a range of subsidiary operations, including regional

airlines, Qantas Holidays and Qantas Flight Catering. The overall

contribution of these subsidiary operations was reduced over the

year, due mainly to the difficult operating environment faced by

the regional airlines.

Australia’s global airline

Qantas goes forward with the aim of retaining and enhancing

its status as Australia’s global airline. The company draws strength

from its Australian identity and global reputation for safety,

reliability, engineering excellence and customer service.

Over the year Qantas carried more than 22 million passengers,

operating a fleet of 178 aircraft across a network spanning 129

destinations in 34 countries. The Qantas network expanded, with

increased services on our major routes including London, Rome,

Los Angeles and New York. Less profitable routes were replaced

by codeshare services with partner airlines.

In November 2000, Qantas announced it would purchase 31 new

aircraft as part of a substantial long-term fleet strategy. Qantas

will be one of the first airlines in the world to acquire the Airbus

380, the world’s largest commercial aircraft. These investments

will allow Qantas to replace older aircraft, provide capacity for

growth and ensure we maintain our long-held reputation for

leadership in industry innovation.

Customer service is being upgraded. Qantas commenced

installation of a $300 million Total Entertainment inflight system

on its international fleet of Boeing 747-400 aircraft. The Cityflyer

express service, with flights every half hour between Sydney and

Melbourne, was launched. And Qantas introduced a new range

of domestic Economy Class meals, inspired by renowned chef

and restaurateur Neil Perry.

Qantas employs 31,000 staff of more than 100 nationalities

in over 30 countries. We thank each and every one of them

for their dedication and hard work during a year of tremendous

change. During the year, Qantas won awards for customer service

and product and maintained its reputation as Australia’s best

known company.

Qantas continued to rely on strategic alliances to create the scale

and scope to deliver greater benefits to customers and improve

its return to shareholders. Qantas is a foundation member of the

oneworld alliance that brings together eight of the world’s leading

airlines. Qantas also maintained bilateral agreements with British

Airways, American Airlines and Japan Airlines and codeshare

arrangements with a number of other airlines.

Board changes

Since the last Annual Report, we welcomed Rod Eddington to the

Qantas Board in February 2001. We would like to record Qantas’

Board and Management’s gratitude to Lord Marshall, who retired

from the Board during the year.

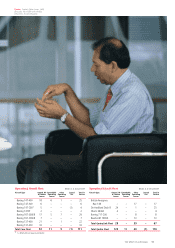

Geoff Dixon was appointed Chief Executive Officer in March 2001,

following the retirement of James Strong. As a member of the

Board for 10 years and Chief Executive and Managing Director

for more than seven years, James Strong made an outstanding

contribution to Qantas. We wish to record the Board’s appreciation

to James and wish him all the best for the future.

Going forward

The company’s performance in 2000/01 confirms that Qantas

is a disciplined and robust airline, ready to meet all challenges.

In the coming years, Qantas’ success will depend not just on

superior operational reliability and service but also on developing

strong economies of scale and scope through global alliances

and partnerships.

The Board and Management of Qantas will continue to invest

wisely, and seek out the cost efficiencies, structural changes and

the legislative and regulatory freedoms to ensure the company

is well placed to build on its record of success.

Chief Executive Officer Geoff Dixon

Chairman Margaret Jackson