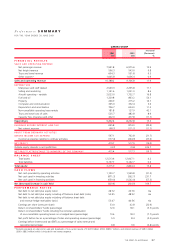

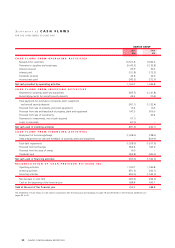

Qantas 2001 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2001 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

p32 QANTAS CONCISE ANNUAL REPORT 2001

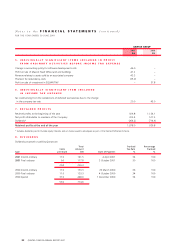

SHARE ENTITLEMENTS

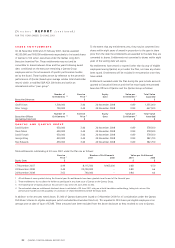

On 24 November 2000 and 21 February 2001, Qantas awarded

40,550,000

and 760,000 entitlements respectively to be issued shares

in Qantas to 162 senior executives under the Qantas Long-Term

Executive

Incentive Plan

. These entitlements may vest and be

convertible to shares between three and five years following award

date, conditional on the executive remaining a Qantas Group

employee and on the achievement of specific performance hurdles

set by the Board. These hurdles are set by reference to the percentile

performance of Qantas (based upon average relative total shareholder

return) within a modified S&P ASX 200 Index and within an

international airline “peer group”.

To the extent that any entitlements vest, they may be converted into

shares within eight years of award in proportion to the gain in share

price from the date the entitlements are awarded to the date they are

converted to shares. Entitlements not converted to shares within eight

years of the vesting date will expire.

No entitlements have vested or expired (other than by way of eligible

employees leaving Qantas) as yet under the Plan, nor have any shares

been issued. Entitlements will be included in remuneration once they

have vested.

Entitlements awarded under the Plan during the year include amounts

granted to Executive Directors and the five most highly remunerated

Executive Officers of Qantas and the Qantas Group as follows:

Directors’ REPORT (continued)

FOR THE YEAR ENDED 30 JUNE 2001

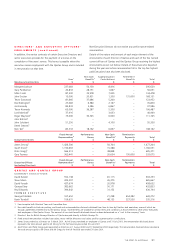

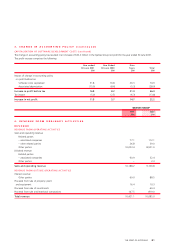

Number of Exercise Expiry Value per Total Value

Entitlements 1,2 Price 3Date Entitlement 4Awarded

Executive Directors $ $ $

Geoff Dixon 1,500,000 3.44 24 November 2008 0.89 1,335,000

Peter Gregg 750,000 3.44 24 November 2008 0.89 667,500

Number of Exercise Expiry Value per Total Value

Executive Officers Entitlements 1,2 Price 3Date Entitlement 4Awarded

(excluding Directors) $ $ $

QANTAS AND QANTAS GROUP

David Burden 650,000 3.44 24 November 2008 0.89 578,500

Steve Mann 650,000 3.44 24 November 2008 0.89 578,500

David Forsyth 650,000 3.44 24 November 2008 0.89 578,500

George Elsey 430,000 3.44 24 November 2008 0.89 382,700

Paul Edwards 430,000 3.44 24 November 2008 0.89 382,700

Total entitlements outstanding at 30 June 2001 under the Plan are as follows:

Exercise Number of Entitlements Value per Entitlement

Price 32001 2000 2001 2000

Expiry Date $ $$

17 November 2007 4.99 8,115,500 9,965,000 0.48 0.50

24 November 2008 3.44 35,250,000 – 0.89 n/a

24 November 2008 3.62 760,000 – 0.84 n/a

1All entitlements were granted during the financial year. No entitlements have been granted since the end of the financial year.

2These entitlements do not allow the holder to participate in any share issue of Qantas or the Qantas Group.

3The market price of Qantas shares at 30 June 2001 was $3.50 (30 June 2000: $3.38).

4The estimated value per entitlement disclosed above is calculated at 30 June 2001 using an acturial simulation methodology, taking into account the

performance hurdles and the possibility of conversion of vested entitlements before the expiry date.

In addition to the amounts noted above, $1,000 of Qantas shares were issued on 3 November 2000 for nil consideration under the Qantas

Profitshare Scheme to eligible employees (which excludes Non-Executive Directors). This equated to 259 shares per eligible employee at an

average price at date of issue of $3.86. These amounts have been excluded from the above disclosure as they involved no cost to Qantas.