Qantas 2000 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2000 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6

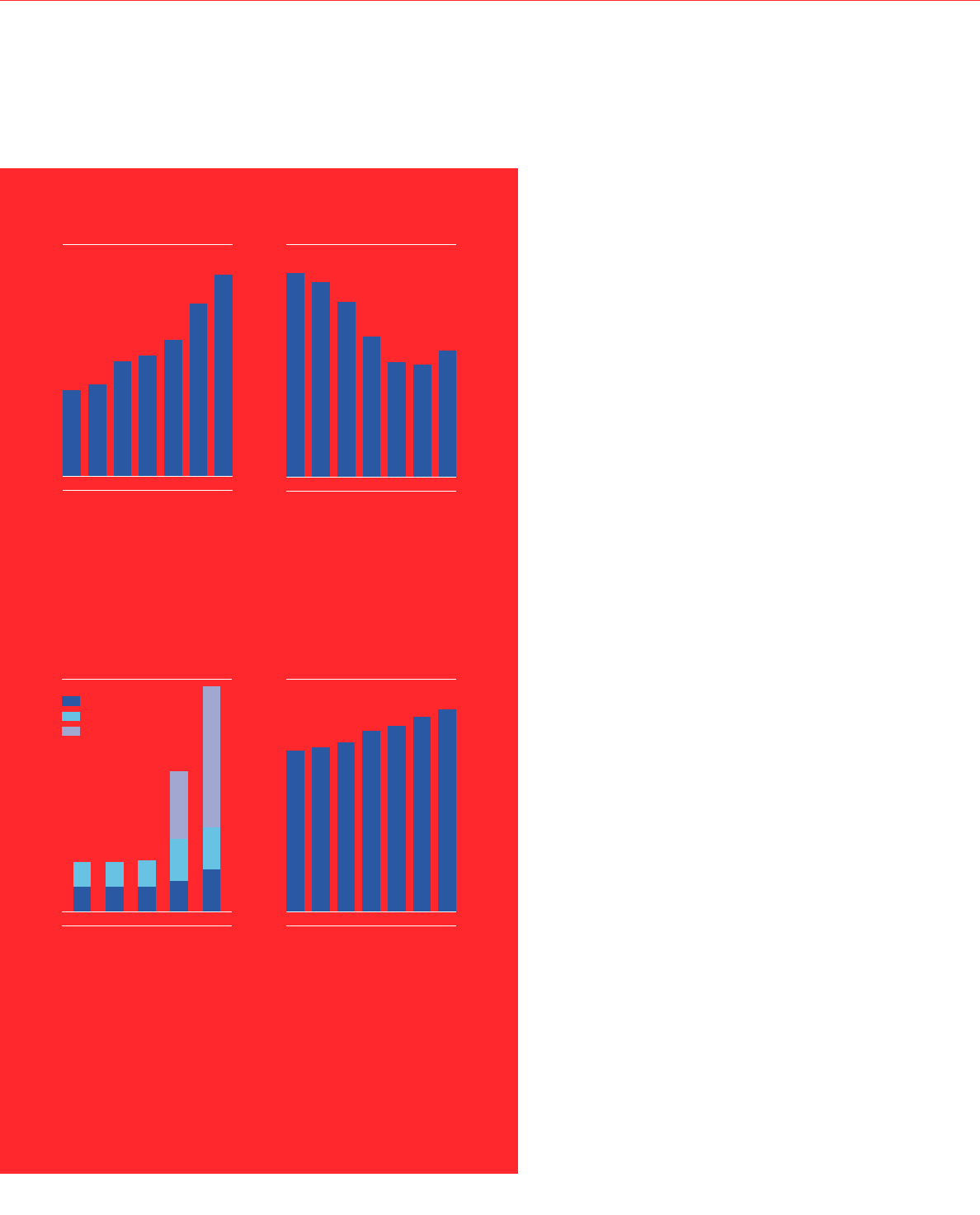

Operating Profit before Tax

and Abnormals ($ million)

94 95 96 97 98 99 00

301.8

320.4

401.4

420.9

478.0

601.7

705.0

Gearing – Adjusted for

Operating Leases (%)

94 95 96 97 98 99 00

71

68

61

49

40

39

44

Dividends

(cents per share)

96

6.56.5

97

6.56.5

98

76.5

99

11 13.58

00

371111

Interim

Final

Special

RPKs per Employee

(000)

94 95 96 97 98 99 00

1,749

1,793

1,844

1,968

2,026

2,121

2,196

THE SPIRIT OF AUSTRALIA

Chief Financial Officer’s Review

OPERATING PROFIT

"

Net profit after tax $517.9 million, up 23 percent

(1999: $420.9 million).

"

Operating profit before tax and abnormals $705 million,

up 17.2 percent (1999: $601.7 million).

"

Abnormal items after tax $82 million, up 110.8 percent

(1999: $38.9 million).

"

Sales and operating revenue $9,106.8 million,

up 7.8 percent (1999: $8,448.7 million).

CONTRIBUTIONS TO EARNINGS

"

International airline operations EBIT up 21.6 percent

to $374.8 million.

"

Domestic airline operations EBIT up 5.9 percent

to $272 million.

"

Subsidiary operations EBIT up 23.9 percent

to $169.4 million.

EARNINGS PERFORMANCE

"

Earnings per share of 42.8 cents, up 20.9 percent

(1999: 35.4 cents).

"

Final dividend of 11 cents per share, fully franked.

"

Special dividend of 37 cents per share, fully franked.

"

Total dividends per share of 59 cents, up 81.5 percent

(1999: 32.5 cents).

"

Qantas Shareholder Return since float of 140 percent,

56 percentage points higher than the All Industrials

and 89 percentage points higher than the All Ordinaries

over the same period.

REVENUE

"

Net passenger revenue $6,975.6 million, up 8.4 percent

(1999: $6,437.5 million).

"

Non-passenger revenue $2,131.2 million, up 6 percent

(1999: $2,011.2 million).

"

Increase in non-passenger revenue driven by

loyalty program revenue, contract work revenue and

tours and travel revenue.

A CONTINUOUS RECORD OF

PROFIT IMPROVEMENT

GEARING REMAINS AT AN

ACCEPTABLE LEVEL

SHAREHOLDER RETURNS

HAVE BEEN MAXIMISED

BY THE PAYMENT OF A

SPECIAL DIVIDEND

PRODUCTIVITY GAINS

CONTINUE TO BE ACHIEVED

ANOTHER RECORD PROFIT