Public Storage 2009 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2009 Public Storage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Businesses

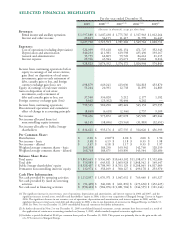

As reflected in the following table, operating earnings(2) were down from $1.24 billion in

2008 to $1.20 billion in 2009, or about 4%.

Operating Earnings(2)

Amounts in millions 2009 2008

U.S. self-storage operations $1,006 $1,034

European self-storage operations 66 84

Commercial properties 65 67

Ancillary operations 62 59

Operating earnings $1,199 $1,244

Self-Storage Operations

When evaluating our store operations, we bifurcate our domestic and European properties

into two groups–“Same Store” and other.

Same Store properties have been operated by the Company for the last three years at a

stabilized occupancy level. “Other” properties have been recently acquired or developed or

are being redeveloped. We consider the measurement of Same Store operations a key

barometer of both the fundamental strength of our business and the efficacy of our

personnel and operating strategies.

We use certain metrics to evaluate our performance, the most important being revenue

per available square feet, or “REVPAF,” and gross profit margin.(3) REVPAF measures

how much revenue is generated per foot we have available for lease. To manage growth

in REVPAF, we balance increased pricing with higher customer volumes (occupancy).

Also impacting REVPAF are product quality, customer sales and service, local

competition and the local economy. Gross profit margin is a function of our success at

generating more revenue while controlling expenses. Due to 2009’s challenging economic

conditions, both REVPAF and gross profit margin declined across the Same Store

portfolio in the U.S. and Europe, resulting in lower net operating income.

(2) See accompanying schedule “Supplemental Non-GAAP Disclosures” for a definition.

(3) Gross profit margin is the ratio of property net operating income before depreciation divided by total revenues.