Public Storage 2009 Annual Report Download

Download and view the complete annual report

Please find the complete 2009 Public Storage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PUBLIC STORAGE

2009

ANNUAL

REPORT

Table of contents

-

Page 1

P UBLIC S TORAGE 2 0 0 9 A R N N UA L E P O RT -

Page 2

...Number of Properties(1) Net Rentable Square Feet UNITED STATES Alabama Arizona California Colorado Connecticut Delaware Florida Georgia Hawaii Illinois Indiana Kansas Kentucky Louisiana Maryland Massachusetts Michigan Minnesota Mississippi Missouri Nebraska Nevada New Hampshire New Jersey New York... -

Page 3

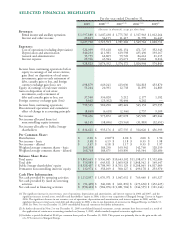

... 31, 2009 Revenues: Rental income and ancillary operations Interest and other income Expenses: Cost of operations (excluding depreciation) Depreciation and amortization General and administrative Interest expense Income from continuing operations before equity in earnings of real estate entities... -

Page 4

... of separation in the REIT industry. Business models were exposed and the quality of management revealed. As they say, "the tide went out" and many companies had "no swimsuits." I am happy to report that Public Storage and its affiliates, Shurgard Europe and PS Business Parks (PSB), distinguished... -

Page 5

... us and our partner, New York Common Retirement Fund, that Shurgard Europe would be better positioned if Public Storage extended the loan. Accordingly, the loan was extended by an additional three years to March 31, 2013, and, effective November 1, 2009, the interest rate was increased from 7.5% to... -

Page 6

...feet, or "REVPAF," and gross profit margin. (3) REVPAF measures how much revenue is generated per foot we have available for lease. To manage growth in REVPAF, we balance increased pricing with higher customer volumes (occupancy). Also impacting REVPAF are product quality, customer sales and service... -

Page 7

... we operate negatively impacted our U.S. portfolio. To offset the reduction in demand, we aggressively reduced rental rates, increased promotional discounts to new customers and expanded our marketing efforts. As a result, we were able to limit the decline in average occupancy from 2008 to 2009 to... -

Page 8

...lower 2009 Same Store revenue and NOI. Steven De Tollenaere, Shurgard Europe's Chief Executive Officer, and his management team deployed similar strategies of reducing asking rates, increasing promotional discounts and increasing media spend to drive move-in activity. Shurgard Europe started 2009 at... -

Page 9

We expect the commercial property market to continue to be challenging in 2010 as a result of lower "asking" rents, increased concessions and more customer failures. We have an excellent management team led by Joe Russell, PSB's President and Chief Executive Officer, to deal with these challenges ... -

Page 10

... of a Decade For many investors, 2009 was the end of a "lost decade" in terms of shareholder returns. Not for the owners of Public Storage. Cumulative Total Return Public Storage vs. NAREIT Index vs. S&P 500 Index $100 investment on 12/31/1999 Public Storage NAREIT Equity Index S&P 500 Index $700... -

Page 11

... coincided with the peaking of commercial property values. In early 2007, Public Storage common stock traded about $110 per share at the same time that Blackstone Real Estate Partners (a large private equity firm) was purchasing Equity Office Properties (then the largest REIT in the U.S.) for $30... -

Page 12

...The number of people moving in 2008 was the lowest since 1962, when the U.S. had 180 million people, as compared to over 300 million today. U.S. Population Mobility Rates 2000 - 2009 Total...13% 12.0% 12% 10.0% 2001 2002 2003 2004 2005 2006 2007 2008 Moving activity in 2008 was the lowest since 1962. -

Page 13

... 2000 - 2009 200 150 100 Peak 192 100 50 2000 2001 2002 2003 2004 2005 2006 2007 2008 114 2009 Source: Moody's Investor Services and Real Capital Analytics Commercial property values also have fallen 41% since peaking in 2007. Moody's/REAL expects prices to decline further in the months ahead. -

Page 14

... reported the largest decline in total loans outstanding in 67 years. According to the FDIC, the number of banks at risk of failing hit a 16-year high. More than 5% of all loans were at least three months past due, the highest level in the 26 years data has been collected. Commercial Real Estate... -

Page 15

...in challenging operating conditions for owners of commercial real estate during 2010 and possibly into 2011. Declining property NOIs will continue to impede private owners' ability both to refinance existing debt and to leverage up to fund acquisitions. Public real estate companies have demonstrated... -

Page 16

... International Storage Self Storage Trust Self Storage Storage Dahn Corp. Metro Storage StorageMart 381 367 220 111 100 86 70 Source: Public companies based on 12/31/2009 SEC filings and other public disclosures; Private companies based on ISS 2009 Top Operators report 2/25/2009 The self-storage... -

Page 17

..., 2009 to the cumulative total return of the Standard & Poor's 500 Stock Index ("S&P 500 Index") and the National Association of Real Estate Investment Trusts Equity Index ("NAREIT Equity Index") for the same period (total shareholder return equals price appreciation plus dividends). The stock price... -

Page 18

..., generally defined as net income before depreciation expense and gains and losses on sale of real estate. Operating earnings represents FFO earned at our consolidated real estate locations, combined with FFO before EITF D-42 benefits from our equity investments (primarily PSB and Shurgard Europe... -

Page 19

... Number) 701 Western Avenue, Glendale, California 91201-2349 (Address of principal executive offices) (Zip Code) (818) 244-8080 (Registrant's telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: Title of each class Depositary Shares Each Representing... -

Page 20

...049,000 (computed on the basis of $65.48 per share which was the reported closing sale price of the Company's Common Shares on the New York Stock Exchange on June 30, 2009). Depositary Shares Each Representing 1/1,000 of an Equity Share, Series A, $.01 Par Value - $176,548,000 (computed on the basis... -

Page 21

DOCUMENTS INCORPORATED BY REFERENCE Portions of the definitive proxy statement to be filed in connection with the Annual Meeting of Shareholders to be held in 2010 are incorporated by reference into Part III of this Annual Report on Form 10-K. 3 -

Page 22

...feet of commercial space located in 11 states in the U.S., including our 41% ownership interest in PS Business Parks, Inc. ("PSB"), a publicly traded REIT whose common stock trades on the New York Stock Exchange under the symbol "PSB" (see "Investment in PSB" under "Equity in Earnings of Real Estate... -

Page 23

... revisions to our long-term growth strategies. Operationally, our occupancies and rental rates have come under pressure as demand for self-storage space has softened. We have responded by reducing rental rates, increasing promotional discounts, and increasing our marketing activities to stimulate... -

Page 24

...basis. National Telephone Reservation System: We operate a centralized telephone reservation system, which provides added customer service and helps to maximize utilization of available self-storage space. Customers calling either the toll-free telephone referral system, (800) 44-STORE, or a storage... -

Page 25

... occupancy, rental rates, and promotional discounting and d) controlling expense levels. We believe that our property management personnel and systems, combined with our national telephone reservation system and media advertising programs will continue to enhance our ability to meet these goals... -

Page 26

... of real estate facilities: We believe that in the long-run, development of new storage locations and expansion of our existing self-storage facilities represent an important part of our growth strategy. New locations can be developed to meet customer needs and expand our geographic reach, generally... -

Page 27

...) of our Senior Unsecured Debt. In addition, during the fourth quarter of 2008 and the first quarter of 2009, we acquired $352.7 million (face amount) of our preferred shares and units on the open market and in privately negotiated transactions for an aggregate acquisition cost of $237.4 million... -

Page 28

...by us under the "Public Storage" brand name in the U.S., as well as storage facilities managed in Europe under the "Shurgard Storage Centers" brand name which are owned by Shurgard Europe. Additional acquired interests in real estate (other than the acquisition of properties from third parties) will... -

Page 29

... program reinsures a program that provides insurance to certificate holders against claims for property losses due to specific named perils (earthquakes and floods are not covered by these policies) to goods stored by tenants at our self-storage facilities for individual limits up to a maximum of... -

Page 30

... in the credit markets; increases in insurance premiums, property tax assessments and other operating and maintenance expenses; transactional costs and liabilities, including transfer taxes; adverse changes in tax, real estate and zoning laws and regulations; and tenant and employment-related claims... -

Page 31

... overall business, financial condition or results of operations. There has been an increasing number of claims and litigation against owners and managers of rental properties relating to moisture infiltration, which can result in mold or other property damage. When we receive a complaint concerning... -

Page 32

...the national economy may adversely affect our access to capital and adversely impact earnings growth that might otherwise result from the acquisition and development of real estate facilities. We grow our business primarily through acquisitions of existing properties and are subject to risks related... -

Page 33

... less than wholly-owned partnerships and joint ventures; and the importance of local senior management and the potential negative ramifications of the departure of key executives. Based upon current market conditions and recent operating result trends of Shurgard Europe, the following specific risks... -

Page 34

...on hand or equity contributions from Public Storage and our joint venture partner. Further, it is also possible that Shurgard Europe's joint venture partner would be unable to contribute its pro rata share to repay the loans and may trigger, through its rights under the related partnership documents... -

Page 35

.... To preserve our status as a REIT under the Code, our declaration of trust contains limitations on the number and value of shares of beneficial interest that any person may own. These ownership limitations generally limit the ability of a person, other than the Hughes Family (as defined in our... -

Page 36

... based on Shurgard Storage Center, Inc.'s public filings and due diligence performed in connection with our acquisition of Shurgard, that Shurgard qualified as a REIT through the date of the Shurgard Merger on August 22, 2006. However, if Shurgard failed to qualify as a REIT, we generally would have... -

Page 37

... relating to loss of goods stored by tenants in the self-storage facilities in Canada in which the Hughes Family has ownership interests. We acquired the tenant insurance business on December 31, 2001 through our acquisition of PS Insurance Company, or PSICH. For the years ended December 31, 2009... -

Page 38

... could adversely impact our business and results of operations. In addition, we could be adversely impacted by efforts to reenact legislation mandating medical insurance for employees of California businesses and members of their families. ITEM 1B. Unresolved Staff Comments Not applicable. 20 -

Page 39

..., 2009 Number of Storage Net Rentable Square Feet Facilities (a) (in thousands) United States: California: Southern ...Northern ...Texas ...Florida ...Illinois ...Washington ...Georgia ...North Carolina ...Virginia ...New York ...Colorado ...New Jersey ...Maryland ...Minnesota ...Michigan ...Arizona... -

Page 40

...during business hours. On-site operation is the responsibility of property managers who are supervised by district managers. Some self-storage facilities also include rentable uncovered parking areas for vehicle storage. Storage facility spaces are rented on a month-to-month basis. Rental rates vary... -

Page 41

... overall business, financial condition, or results of operations. ITEM 3. Legal Proceedings Brinkley v. Public Storage, Inc. (filed April 2005) (Superior Court of California - Los Angeles County) The plaintiff sued the Company on behalf of a purported class of California non-exempt employees based... -

Page 42

... 45.35 53.32 61.35 70.76 2009 The following table sets forth the high and low sales prices of our Depositary Shares Each Representing 1/1,000 of an Equity Share, Series A on the New York Stock Exchange composite tapes for the applicable periods. Range Year 2008 Quarter 1st 2nd 3rd 4th 1st 2nd 3rd... -

Page 43

... shares are entitled to receive distributions when and if declared by our Board of Trustees out of any funds legally available for that purpose. In order to maintain our REIT status for federal income tax purposes, we are generally required to pay dividends at least equal to 90% of our real estate... -

Page 44

Equity Shares, Series A at a cash redemption price of $24.50 per depositary share, or an aggregate of $205.2 million. Since the initial issuance of these securities, the annual dividend paid has been $2.45 per depository share, representing an implied yield of 10%. In November 1999, we sold $100,000... -

Page 45

... 2009 Revenues: Rental income and ancillary operations ...Interest and other income ...Expenses: Cost of operations (excluding depreciation) ...Depreciation and amortization ...General and administrative ...Interest expense...Income from continuing operations before equity in earnings of real estate... -

Page 46

..., and we intend to continue to operate, as a qualifying REIT under the Internal Revenue Code and applicable state laws. We also believe that Shurgard, prior to merging with us, qualified as a REIT. A REIT generally does not pay corporate level federal income taxes on its REIT taxable income that is... -

Page 47

... development, ownership and operation of selfstorage facilities which offer storage spaces for lease, generally on a month-to-month basis, for personal and business use. We are the largest owner and operator of self-storage facilities in the U.S., and we have a 49% interest in Shurgard Europe, which... -

Page 48

... Parks, Inc. ("PSB"), a publicly traded REIT whose common stock trades on the New York Stock Exchange under the symbol "PSB" (as of December 31, 2009, PSB owned and operated 19.6 million rentable square feet of commercial space). See "Investment in PSB" under "Equity in Earnings of Real Estate... -

Page 49

... the deconsolidation of Shurgard Europe. Shurgard Europe's revenues and expenses after March 31, 2008 are excluded from our statement of operations and, instead, our 49% equity share of Shurgard Europe's operating results are included in the line item "equity in earnings of real estate entities" and... -

Page 50

Real Estate Operations Self-Storage Operations: Our self-storage operations are by far the largest component of our operating activities, representing more than 90% of our revenues for the years ended December 31, 2009, 2008 and 2007, respectively. To enhance year-over-year comparisons, the table ... -

Page 51

... property operations of Shurgard Europe. (b) See "Net Operating Income or NOI" below. (c) Realized annual rent per occupied square foot is computed by annualizing the result of dividing rental income (which excludes late charges and administrative fees) by the weighted average occupied square feet... -

Page 52

... facilities ...Shurgard Europe facilities ...Total net operating income ...Ancillary operating revenue ...Interest and other income ...Ancillary cost of operations...Depreciation and amortization...General and administrative expense ...Interest expense ...Equity in earnings of real estate entities... -

Page 53

... admin fees collected ...Total revenues (a) ...Cost of operations: Property taxes ...Direct property payroll ...Media advertising ...Other advertising and promotion ...Utilities ...Repairs and maintenance ...Telephone reservation center ...Property insurance ...Other cost of management ...Total cost... -

Page 54

...dividing rental income (which excludes late charges and administrative fees) by the total available net rentable square feet for the period. (h) In place annual rent per occupied square foot represents annualized contractual rents per occupied square foot without reductions for promotional discounts... -

Page 55

... markets, located in North and South Carolina, Georgia, and Florida, as well as the West Coast, which includes Seattle, Portland, San Francisco and Los Angeles. See Analysis of Regional Trends table that follows. Cost of operations (excluding depreciation and amortization) decreased by 1.8% in 2009... -

Page 56

...in less staffing hours, as well as a shift from our California to our Arizona call center, resulting in lower average compensation rates. We expect future increases in our telephone reservation center to be based primarily upon general inflation. Insurance expense decreased 14.3% in 2009 as compared... -

Page 57

...cost of operations: 2009 $ 125,007 2008 $ 123,856 2007 $ 118,916 Property tax expense: 2009...,825 $ 132,411 Media advertising expense: 2009 $ 8,158 2008 $...advertising and promotion expense: 2009 $ 4,614 $ 2008 $ 4,426 $ 2007 $ 4,956 $ REVPAF: 2009...annual rent per occupied square foot (a): 2009 $... -

Page 58

... weighted average data) Same Store Facilities Operating Trends by Region Revenues: Southern California (176 facilities) Northern California (167 facilities) Texas (231 facilities) ...Florida (182 facilities) ...Illinois (119 facilities) ...Washington (88 facilities) ...Georgia (86 facilities) ...All... -

Page 59

... 31, Year Ended December 31, 2009 2008 Change 2008 2007 Change (Amounts in thousands, except for weighted average data) Realized annual rent per occupied square foot (a): Southern California ...Northern California ...Texas ...Florida ...Illinois ...Washington...Georgia ...All other states ...Total... -

Page 60

... the case of acquired facilities, do not include any operating results prior to our acquisition of these facilities. In 2009, we completed one newly developed facility with 64,000 net rentable square feet at a total cost of $11.9 million and four expansion projects to existing real estate facilities... -

Page 61

... of real estate entities At December 31, 2009, we have equity investments in PSB, Shurgard Europe and five affiliated limited partnerships. Due to our limited ownership interest and limited control of these entities, we do not consolidate the accounts of these entities for financial reporting... -

Page 62

... and operated 19.6 million rentable square feet of commercial space located in eight states. PSB also manages commercial space owned by the Company and affiliated entities at December 31, 2009 pursuant to property management agreements. Equity in earnings from PSB increased to $35,108,000 in 2009 as... -

Page 63

...Late charges and administrative fees collected ...Total revenues ...Cost of operations (excluding depreciation and amortization expense): Property taxes ...Direct property payroll ...Advertising and promotion ...Utilities ...Repairs and maintenance ...Property insurance ...Other costs of management... -

Page 64

... net rentable square feet for the period. (h) In place annual rent per occupied square foot represents annualized contractual rents per occupied square foot without reductions for promotional discounts and excludes late charges and administrative fees. Shurgard Europe's operations have been... -

Page 65

... of policies against losses to goods stored by tenants in our self-storage facilities in the U.S., (ii) merchandise sales in the U.S., (iii) commercial property operations, (iv) merchandise sales and tenant reinsurance operations conducted by Shurgard Europe, and (v) management of facilities... -

Page 66

... as hurricanes, that occur and affect our properties thereby increasing tenant insurance claims. Commercial operations: We also operate commercial facilities, primarily small storefronts and office space located on or near our existing self-storage facilities that are rented to third parties. We do... -

Page 67

... of Shurgard and Public Storage, and d) $2,000,000 in costs associated with reorganizing as a Maryland REIT. Following March 31, 2008, we record no further general and administrative e xpense incurred by Shurgard Europe's ongoing operations. We expect ongoing general and administrative expense to... -

Page 68

... the U.S. Dollar, the amount owed from Shurgard Europe and our continued expectation with respect to repaying the loan. Discontinued Operations: During 2009, we discontinued operations in our truck rental and containerized storage businesses. In addition, we disposed of one self-storage facility and... -

Page 69

...depending upon current market conditions, proceeds from the issuance of equity securities, and (iv) in the case of acquisitions of facilities, the assumption of existing debt. In general, our strategy is to continue to finance our growth with permanent capital, either retained operating cash flow or... -

Page 70

... good operating condition and maintain their visual appeal to the customer. Capital improvements do not include costs relating to the development or expansion of facilities that add additional net rentable square footage to our portfolio. During the year ended December 31, 2009, we incurred capital... -

Page 71

...10 per share (an 18% increase) from the previous quarter's distribution. Our consistent, long-term dividend policy has been to only distribute our taxable income. Taxable income attributable to our common shareholders has increased due to recent purchases of preferred securities and equity stock, as... -

Page 72

...can issue new preferred shares at a lower cost of capital than the shares that would be redeemed. Repurchases of Company's Equity and Preferred Securities: Dislocations in capital markets have provided opportunities for the repurchase of our preferred and debt securities. During 2009, we repurchased... -

Page 73

... our Equity Shares, Series A. These shares will be redeemed on April 15, 2010 for an aggregate of $205.2 million or $24.50 per share. These amounts are not included in the table above as they were not an obligation at December 31, 2009. Off-Balance Sheet Arrangements: At December 31, 2009 we... -

Page 74

.... Except under certain conditions relating to the Company's qualification as a REIT, the preferred shares are not redeemable by the Company pursuant to its redemption option prior to the dates set forth in Note 8 to our December 31, 2009 consolidated financial statements. Our market risk sensitive... -

Page 75

... Data The financial statements of the Company at December 31, 2009 and December 31, 2008 and for each of the three years in the period ended December 31, 2009 and the report of Ernst & Young LLP, Independent Registered Public Accounting Firm, thereon and the related financial statement schedule, are... -

Page 76

... in our internal control over financial reporting (as such term is defined in Rules 13a-15(f) and 15d-15(f) under the Exchange Act) during the fourth quarter of 2009 to which this report relates that have materially affected, or are reasonable likely to materially affect, our internal control over... -

Page 77

..., and the related consolidated statements of income, shareholders' equity and cash flows for each of the three years in the period ended December 31, 2009 and our report dated February 26, 2010 expressed an unqualified opinion thereon. /s/ Ernst & Young LLP Los Angeles, California February 26, 2010... -

Page 78

... for the real estate activities of Public Storage, including property acquisitions, developments, repackagings, and capital improvements. Before joining Public Storage, Mr. Doll was Senior Executive Vice President of Development for Westfield Corporation, a major international owner and operator of... -

Page 79

... to the material appearing in the Proxy Statement under the captions "Stock Ownership of Certain Beneficial Owners and Management." The following table sets forth information as of December 31, 2009 on the Company's equity compensation plans: Number of securities to be issued upon exercise of... -

Page 80

... in the Proxy Statement under the captions "Corporate Governance" and "Certain Relationships and Related Transactions and Legal Proceedings." ITEM 14. Principal Accountant Fees and Services The information required by this item with respect to fees and services provided by the Company's independent... -

Page 81

... The financial statements schedules listed in the accompanying Index to Financial Statements and Schedules are filed as part of this report. 3. Exhibits See Index to Exhibits contained herein. b. Exhibits: See Index to Exhibits contained herein. c. Financial Statement Schedules Not applicable. 63 -

Page 82

... a Maryland real estate investment trust. Filed herewith. Bylaws of Public Storage, a Maryland real estate investment trust. Filed with the Registrant's Current Report on Form 8-K dated June 6, 2007 and incorporated by reference herein. Articles Supplementary for Public Storage Equity Shares, Series... -

Page 83

... for Public Storage 6.750% Cumulative Preferred Shares, Series E. Filed with the Registrant's Current Report on ...Management Agreement between Registrant and Public Storage Commercial Properties Group, Inc. dated as of February 21, 1995. Filed with Public Storage Inc.'s ("PSI") Annual Report... -

Page 84

... of Limited Partnership of PS Business Parks, L.P. Filed with PS Business Parks, Inc.'s Quarterly Report on Form 10-Q for the quarterly period ended June 30, 1998 (SEC File No. 001-10709) and incorporated herein by reference. Amended and Restated Agreement of Limited Partnership of Storage Trust... -

Page 85

...). Shurgard Storage Centers, Inc. 2004 Long Term Incentive Compensation Plan. Incorporated by reference to Appendix A of Definitive Proxy Statement dated June 7, 2004 filed by Shurgard (SEC File No. 001-11455). Public Storage, Inc. 1996 Stock Option and Incentive Plan. Filed with PSI's Annual Report... -

Page 86

...July 28, 2008 between Registrant and Mark Good. Filed as Exhibit 10.1 to Registrant's Current Report on Form 8 -K dated September 9, 2008 and incorporated herein by reference. Statement Re: Computation of Ratio of Earnings to Fixed Charges and Preferred Stock Dividends. Filed herewith. Rule 13a - 14... -

Page 87

... STORAGE INDEX TO CONSOLIDATED FINANCIAL STATEMENTS (Item 15 (a)) Page References Report of Independent Registered Public Accounting Firm ...Consolidated balance sheets as of December 31, 2009 and 2008 ...For each of the three years in the period ended December 31, 2009: Consolidated statements... -

Page 88

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM The Board of Trustees and Shareholders Public Storage We have audited the accompanying consolidated balance sheets of Public Storage as of December 31, 2009 and 2008, and the related consolidated statements of income, shareholders' equity, ... -

Page 89

PUBLIC STORAGE CONSOLIDATED BALANCE SHEETS December 31, 2009 and 2008 (Amounts in thousands, except share data) December 31, 2009 ASSETS Cash and cash equivalents ...Real estate facilities, at cost: Land ...Buildings ...Accumulated depreciation...Construction in process ...$ 763,789 2,717,368 7,575,... -

Page 90

......Interest and other income ...Expenses: Cost of operations: Self-storage facilities...Ancillary operations ...Depreciation and amortization ...General and administrative ...Interest expense ...Income from continuing operations before equity in earnings of real estate entities, gains on disposition... -

Page 91

... interests ...Distributions to equity holders: Cumulative preferred shares (Note 8) ...Permanent noncontrolling interests in subsidiaries ...Equity Shares, Series A ($2.45 per depositary share) ...Holders of unvested restricted share units...Common shares ($2.80 per share)...Other comprehensive loss... -

Page 92

...(Note 8) ...Permanent noncontrolling interests in subsidiaries ...Equity Shares, Series A ($2.45 per depositary share) ...Holders of unvested restricted share units ...Common shares ($2.20 per share)...Other comprehensive income (Note 2) ...Balances at December 31, 2009 ...$ $ 16,929 (15,002) $ (232... -

Page 93

...provided by operating activities ...Cash flows from investing activities: Capital improvements to real estate facilities ...Construction in process ...Acquisition of real estate facilities ...Acquisition of common stock of PS Business Parks ...Proceeds from sales of real estate and other real estate... -

Page 94

PUBLIC STORAGE CONSOLIDATED STATEMENTS OF CASH FLOWS For each of the three years in the period ended December 31, 2009 (Amounts in thousands) (Continued) 2009 Supplemental schedule of non cash investing and financing activities: Foreign currency translation adjustment: Real estate facilities, net of... -

Page 95

... "our"), a Maryland real estate investment trust, was organized in 1980. Our principal business activities include the acquisition, development, ownership and operation of self-storage facilities which offer storage spaces for lease, generally on a month-to-month basis, for personal and business use... -

Page 96

...." Collectively, at December 31, 2009, the Company and the Subsidiaries own a total of 1,999 real estate facilities included in continuing operations, consisting of 1,990 self-storage facilities in the U.S., one self-storage facility in London, England and eight commercial facilities in the U.S. One... -

Page 97

... these tests during 2009, 2008 and 2007 and, accordingly, no provision for federal income taxes has been made in the accompanying consolidated financial statements on income produced and distributed on real estate rental operations. We have business operations in taxable REIT subsidiaries that are... -

Page 98

... grade (rated A1 by Standard and Poor's) short term commercial paper with remaining maturities of three months or less at the date of acquisition to be cash equivalents. Any such cash and cash equivalents which are restricted from general corporate use (restricted cash) due to insurance or other... -

Page 99

... identified in our annual evaluation at December 31, 2009. Revenue and Expense Recognition Rental income, which is generally earned pursuant to month-to-month leases for storage space, as well as late charges and administrative fees, are recognized as earned. Promotional discounts are recognized as... -

Page 100

... loan receivable from, Shurgard Europe, are translated at end-of-period exchange rates, while revenues, expenses, and equity in earnings in the related real estate entities, are translated at the average exchange rates in effect during the period. The Euro, which represents the functional currency... -

Page 101

PUBLIC STORAGE NOTES TO CONSOLIDATED FINANCIAL STATEMENTS December 31, 2009 51% of the aggregate interest on the loans, with the other 49%, reflecting our ownership interest in Shurgard Europe, classified as equity in earnings of real estate entities. Loan fees collected from Shurgard Europe are ... -

Page 102

... net income is allocated among our regular common shares, restricted share units, and our Equity Shares, Series A based upon the dividends declared (or accumulated) for each security in the period, combined with each security's participation rights in undistributed earnings. Net income allocated... -

Page 103

...our consolidated statements of income for the year ended December 31, 2007 and the three months ended March 31, 2008. Commencing on April 1, 2008, our pro rata share of operations of Shurgard Europe is reflected on our consolidated statement of income under equity in earnings of real estate entities... -

Page 104

PUBLIC STORAGE NOTES TO CONSOLIDATED FINANCIAL STATEMENTS December 31, 2009 4. Real Estate Facilities Activity in real estate facilities during 2009, 2008 and 2007 is as follows: 2009 Operating facilities, at cost: Beginning balance ...Capital improvements...Acquisition of real estate facilities ...... -

Page 105

... on disposition of real estate investments, net" in connection with PSB's sale of common stock in a public offerin g described below in "Investment in PSB." Investment in PSB PSB is a REIT traded on the New York Stock Exchange, which controls an operating partnership (collectively, the REIT and the... -

Page 106

...rata share. 2009 For the year ended December 31, Total revenue ...Costs of operations and general and administrative expense Depreciation and amortization ...Other items ...Net income ...As of December 31, Total assets (primarily real estate) ...Debt ...Other liabilities ...Preferred stock and units... -

Page 107

... FINANCIAL STATEMENTS December 31, 2009 2009 For the year ended December 31, Self-storage and ancillary revenues ...Interest and other income (expense) ...Self-storage and ancillary cost of operations ...Trademark license fee payable to Public Storage ...Depreciation and amortization ...General and... -

Page 108

... drawn on the Credit Agreement bear an annual interest rate ranging from the London Interbank Offered Rate ("LIBOR") plus 0.35% to LIBOR plus 1.00% depending on our credit ratings (LIBOR plus 0.35% at December 31, 2009). In addition, we are required to pay a quarterly facility fee ranging from 0.10... -

Page 109

...We incurred interest expense (including interest capitalized as real estate totaling $718,000, $1,998,000 and $4,746,000, respectively for the years ended December 31, 2009, 2008 and 2007) with respect to our notes payable, capital leases, debt to joint venture partner and line of credit aggregating... -

Page 110

... 31, 2009, 2008 and 2007, we paid distributions to these interests totaling $17,522,000, $16,381,000 and $18,955,000, respectively. In 2007, we sold an approximately 0.6% common equity interest in Shurgard Europe to various officers of the Company (the "PS Officers"), other than our chief executive... -

Page 111

PUBLIC STORAGE NOTES TO CONSOLIDATED FINANCIAL STATEMENTS December 31, 2009 8. Shareholders' Equity Cumulative Preferred Shares At December 31, 2009 and 2008, we had the following series of Cumulative Preferred Shares of beneficial interest outstanding: At December 31, 2009 Earliest Redemption Date ... -

Page 112

... of the Equity Shares, Series A of $0.6125 per share for each of the quarters ended March 31, June 30, September 30 and December 31. Except in order to preserve the Company's Federal income tax status as a REIT, we may not redeem the depositary shares representing the Equity Shares, Series A before... -

Page 113

...our common shares outstanding at December 31, 2009. We have a right of first refusal to acquire the stock or assets of the corporation that manages the 52 self-storage facilities in Canada, if the Hughes Family or the corporation agrees to sell them. However, we have no interest in the operations of... -

Page 114

... acquisition in 1998 and 1999 of a total of 638 limited partnership units by Tamara Hughes Gustavson and H-G Family Corp., a company owned by Hughes Family members, the Company was granted an option to acquire the limited partnership units acquired at cost, plus expenses. During the fourth quarter... -

Page 115

... the units. The total value of each restricted share unit grant, based upon the market price of our common shares at the date of grant, is amortized over the service period, net of estimates for future forfeitures, as compensation expense. The related employer portion of payroll taxes is expensed as... -

Page 116

... Commercial Segment with other ancillary activities such as reinsurance of policies against losses to goods stored by tenants in our self-storage facilities, merchandise sales, truck rentals, and containerized storage. Due to the termination of our containerized storage and truck rental operations... -

Page 117

... management team that makes the financing, capital allocation, and other significant decisions for this operation. The Europe Self-Storage segment presentation includes all of the revenues, expenses, and operations of Shurgard Europe to the extent consolidated in our financial statements, and... -

Page 118

......Interest and other income ...Expenses: Cost of operations: Self-storage facilities ...Ancillary operations ...Depreciation and amortization...General and administrative ...Interest expense ...Income from continuing operations before equity in earnings of real estate entities, gains on disposition... -

Page 119

...income ...Expenses: Cost of operations: Self-storage facilities ...Ancillary operations ...Depreciation and amortization...General and administrative ...Interest expense ...Income (loss) from continuing operations before equity in earnings of real estate entities, gains on disposition of real estate... -

Page 120

...income ...Expenses: Cost of operations: Self-storage facilities ...Ancillary operations ...Depreciation and amortization...General and administrative ...Interest expense ...Income (loss) from continuing operations before equity in earnings of real estate entities, gains on disposition of real estate... -

Page 121

... over transfers accounted for as a sale. 13. Commitments and Contingencies Legal Matters Brinkley v. Public Storage, Inc. (filed April 2005) (Superior Court of California - Los Angeles County) The plaintiff sued the Company on behalf of a purported class of California non-exempt employees based... -

Page 122

PUBLIC STORAGE NOTES TO CONSOLIDATED FINANCIAL STATEMENTS December 31, 2009 Operating Lease Obligations We lease land, equipment and office space under various operating leases. At December 31, 2009, the approximate future minimum rental payments required under our operating leases for each ... -

Page 123

PUBLIC STORAGE NOTES TO CONSOLIDATED FINANCIAL STATEMENTS December 31, 2009 15. Subsequent Events (unaudited) We are calling for redemption all outstanding depositary shares, each representing 1/1,000 of an Equity Share, Series A (NYSE: PSAA) on April 15, 2010 at $24.50 per share. The aggregate ... -

Page 124

... ended December 31, 2008. As described in Note 3 to the Company's December 31, 2009 consolidated financial statements, Shurgard Europe was deconsolidated as of March 31, 2008. No further interest expense for Shurgard Europe is reflected in our financial statements after March 31, 2008. Exhibit - 12 -

Page 125

... financial statement schedule of Public Storage and the effectiveness of internal control over financial reporting of Public Storage, included in this Annual Report (Form 10-K) of Public Storage for the year ended December 31, 2009. /s/ Ernst & Young LLP February 26, 2010 Los Angeles, California... -

Page 126

...fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal controls over financial reporting. /s/ Ronald L. Havner, Jr. Name: Ronald L. Havner, Jr. Title: Chief Executive Officer & President Date: February 26, 2010 Exhibit 31... -

Page 127

... information; and b) any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal controls over financial reporting. /s/ John Reyes Name: John Reyes Title: Chief Financial Officer Date: February 26, 2010 Exhibit 31.2 -

Page 128

... with the Annual Report on Form 10-K of Public Storage (the "Company") for the year ended December 31, 2009 as filed with the Securities and Exchange Commission on the date hereof (the "Report"), Ronald L. Havner, Jr., as Chief Executive Officer and President of the Company and John Reyes, as... -

Page 129

-

Page 130

-

Page 131

... Legal Officer Candace N. Krol Senior Vice President, Human Resources Corporate Headquarters 701 Western Avenue Glendale, CA 91201-2349 Investor Relations Additional information contact Clemente Teng Vice President of Investor Services (818) 244-8080 Transfer Agent Computershare Trust Company... -

Page 132

P UBLIC S TORAGE 701 Western Avenue, Glendale, California 91201-2349 (818) 244-8080 • www.publicstorage.com (SKU 002CS-1A437)