Public Storage 2007 Annual Report Download - page 12

Download and view the complete annual report

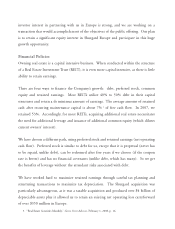

Please find page 12 of the 2007 Public Storage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.As a result, our earnings have been able to grow substantially without the need to increase

our common share dividend (REITs must distribute their taxable income to avoid paying

a corporate or entity level tax). In 2008, we expect to retain over $400 million of net

operating cash flow in the Company (after required maintenance capital expenditures and

our required distribution requirements) which can be “leveraged” with preferred stock to

provide “growth” capital.

Over the last ten years, we have generally issued common equity only in connection with

acquisitions and have aggressively repurchased shares when we believed it was more value

enhancing to our shareholders than acquiring additional properties. In 2008, we have

already used over $100 million of retained cash to repurchase common shares.

Conclusion

We are in a great business. Demand for our product is not directly dictated by the general

economy but by recurring lifestyle changes–marriages, divorces, births, deaths and

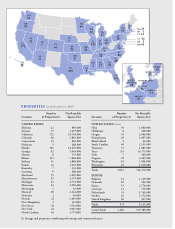

business expansions and contractions. We are geographically diversified with over 2,000

U.S. facilities across 38 states and nearly 200 facilities in Western Europe, with over one

million customers. The stability and predictability of our business is reflected in our 15-

year history of consistent Same Store growth. Over this period, Same Store NOI has

increased an average of 5.3% per year.

In summary, we have successfully integrated the Shurgard operations we acquired in 2006,

achieved stabilized occupancies across all portfolios and realized many of the anticipated

cost reductions from the acquisition. Going into 2008, we are in a solid financial position

and poised for opportunities.

Ronald L. Havner, Jr.

President and Chief Executive Officer

February 29, 2008