Public Storage 2007 Annual Report Download - page 11

Download and view the complete annual report

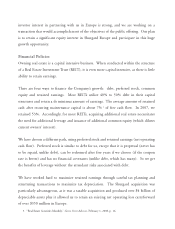

Please find page 11 of the 2007 Public Storage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.investor interest in partnering with us in Europe is strong, and we are working on a

transaction that would accomplish most of the objectives of the public offering. Our plan

is to retain a significant equity interest in Shurgard Europe and participate in this huge

growth opportunity.

Financial Policies

Owning real estate is a capital intensive business. When conducted within the structure

of a Real Estate Investment Trust (REIT), it is even more capital intensive, as there is little

ability to retain earnings.

There are four ways to finance the Company’s growth: debt, preferred stock, common

equity and retained earnings. Most REITs utilize 40% to 50% debt in their capital

structures and retain a de minimus amount of earnings. The average amount of retained

cash after recurring maintenance capital is about 7% 3of free cash flow. In 2007, we

retained 53%. Accordingly, for most REITs, acquiring additional real estate necessitates

the need for additional leverage and issuance of additional common equity (which dilutes

current owners’ interest).

We have chosen a different path, using preferred stock and retained earnings (net operating

cash flow). Preferred stock is similar to debt for us, except that it is perpetual (never has

to be repaid, unlike debt), can be redeemed after five years if we choose (if the coupon

rate is better) and has no financial covenants (unlike debt, which has many). So we get

the benefits of leverage without the attendant risks associated with debt.

We have worked hard to maximize retained earnings through careful tax planning and

structuring transactions to maximize tax depreciation. The Shurgard acquisition was

particularly advantageous, as it was a taxable acquisition and produced over $4 billion of

depreciable assets plus it allowed us to retain an existing net operating loss carryforward

of over $350 million in Europe.

3. “Real Estate Securities Monthly,” Green Street Advisors, February 1, 2008, p. 16.