Public Storage 2006 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2006 Public Storage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

u

r net income

d

ec

l

ine

d

in 2006 as compare

d

to 2005, principa

ll

y as a resu

l

t o

f

our mer

g

er

with Shur

g

ard Stora

g

e Centers, Inc. (“Shur

g

ard”). Our intrinsic or business value, however,

did

j

ust the opposite and increased, also as a result of the mer

g

er and improvements in all

of our business segments.

First let’s review the mer

g

er.

Shur

g

ard Mer

g

e

r

After nearly a decade of trying to combine the two companies, on August 23 we consummated the merge

r

w

ith Shurgard. This was just over a year after announcing our “unsolicited offer” to merge

.

S

h

urgar

d

,

l

i

k

e Pu

bl

ic Storage, starte

d

in 1972 an

d

grew in a simi

l

ar

f

as

h

ion. Bot

h

companies raise

d

capita

l

in t

h

e 1980’s t

h

rou

gh

l

imite

d

partners

h

ips an

d

continue

d

to expan

d

in t

h

e 1990’s as Rea

l

Estate Investmen

t

T

rusts (REITs). We compete

d

f

or many o

f

t

h

e same

d

eve

l

opment sites an

d

acquisition properties an

d

c

reated what was considered by many to be the two best franchises in the self-stora

g

e industry. While both

c

ompanies thou

g

ht they had the “best brand, best properties and best people,” both or

g

anizations respecte

d

and mimicked each other and considered the other “number two.”

Wh

en we approac

h

e

d

S

h

urgar

d

a

b

out merging, we i

d

enti

f

ie

d

t

h

ree areas o

f

opportunity

.

First, signi

f

icant genera

l

an

d

a

d

ministrative costs cou

ld

b

e e

l

iminate

d

as a resu

l

t o

f

com

b

ining corporat

e

an

d

executive

f

unctions an

d

mi

g

ratin

g

S

h

ur

g

ar

d

’s

d

omestic port

f

o

l

io onto Pu

bl

ic Stora

g

e’s centra

l

ize

d

operatin

g

system, WebChamp.

Second, there was an opportunity to eliminate redundant property operatin

g

costs such as duplicate

Y

ellow Pages, back office support functions and call centers. There was also an opportunity to use

Public Storage’s marketing and pricing programs to achieve higher revenues in Shurgard’s domestic

p

ort

f

o

l

io, w

h

ic

h

h

a

d

h

istorica

ll

y o

p

erate

d

at a

b

out 500 to 600

b

asis

p

oints

l

ower occu

p

ancy t

h

a

n

Pu

bl

ic Stora

g

e’s properties.

Th

ir

d

, Pu

bl

ic Stora

g

e

h

a

d

t

h

e

f

inancia

l

stren

g

t

h

to consummate t

h

e mer

g

er, retire a si

g

ni

f

icant amoun

t

of Shur

g

ard’s debt, absorb the operatin

g

losses from Europe and provide capital to

g

row both the domesti

c

and European platforms.

T

he Shurgard directors recognized the benefits of the merger and in March 2006 we signed a definitive

merger agreement w

h

ic

h

was approve

d

b

y

b

ot

h

companies’ s

h

are

h

o

ld

ers in August. From signing unti

l

cl

osing, t

h

e S

h

urgar

d

an

d

Pu

bl

ic Storage management teams wor

k

e

d

h

ar

d

to ma

k

e sure t

h

e merger

inte

g

ration went as smoot

hl

y as possi

bl

e.

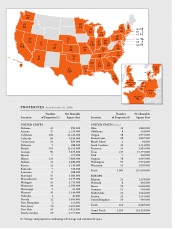

At closin

g

, Public Stora

g

e paid about

$

5.3 billion for the “second best” domestic portfolio and by far the

best portfolio and operatin

g

or

g

anization in Europe. We issued 39 million shares of common stock an

d

assumed

$

2 billion of debt. In the U.S., we acquired 487 properties consisting of 32 million net rentabl

e

square

f

eet. We are now

l

arger t

h

an our next

f

our

l

argest competitors COMBINED! In Europe, we are

a

l

so t

h

e

l

argest owner an

d

operator wit

h

103 properties consisting o

f

5.6 mi

ll

ion net renta

bl

e square

f

eet

an

d

j

oint venture interest wit

h

anot

h

er 63 properties, wit

h

3.1 mi

ll

ion net renta

bl

e square

f

eet.

TO OUR SHAREHOLDERS

O