Public Storage 2006 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2006 Public Storage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

For t

h

e year en

d

e

d

Decem

b

er 31

,

2006

(

1

)

2

00

5

(

1

)

2

004

(

1

)

2

00

3

(

1

)

2

00

2

(

1

)

(

Amounts in thousands, except per share data

)

R

even

u

es:

R

ental income and ancillary operations

$

$

1,043,600

$

952,766

$

890,350

$

845,27

3

1

,349,856

Interest and other income 31,799 16,447 5,391 2,537 5,210

31,799

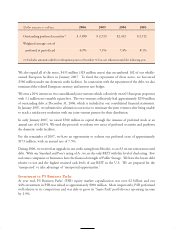

Total Revenues 1,381,655 1,060,047 958,157 892,887 850,483

1,381,655

E

xpenses

:

Cost of operations 500,560 378,301 361,944 340,871 309,491

500,560

Depreciation and amortization 437,984 196,232 182,890 183,863 175,524

437,984

General and administrative 84,661 21,115 18,813 17,127 15,619

84,661

Interest expense 33,062 8,216 760 1,121 3,809

33,062

603,864 564,407 542,982 504,44

3

1

,056,267

Income from continuin

g

operations before

equity in earnin

g

s o

f

rea

l

estate entities,

m

i

nor

i

t

y

i

nterest in income an

d

ot

h

e

r

456,183 393,750 349,905 346,04

0

325,388

Equity in earnings of real estate entities 11,895 24,883 22,564 24,966 29,888

11,895

Other 6,439 1,182 67 1,007 (2,541)

6,439

Minority interest in income (31,883) (32,651) (49,913) (43,703) (44,087)

(31,883)

Income from continuing operations 311,839 449,597 366,468 332,175 329,300

311,839

C

umu

l

ative e

ff

ect o

f

c

h

ange in accounting

principle 578 — — — —

578

Discontinued operations (2) 1,609 6,796 (255) 4,478 (10,562)

1,609

Net income $ 314,026 $ 456,393 $ 366,213 $ 336,653 $ 318,738

$

314,026

Net income allocable to common shareholders

$

$ 254,395 $ 178,063 $ 161,836 $ 141,42346,891

Per

C

ommon

Sh

are

:

Distributions $ 2.00 $ 1.90 $ 1.80 $ 1.80 $ 1.80

$

2.00

Net income - diluted $ 0.33 $ 1.97 $ 1.38 $ 1.28 $ 1.14

$

0.33

Weighted average common shares - diluted 143,715 128,819 128,681 126,517 124,571

143,715

B

alance Sheet Data

:

Total assets $ 11,198,473 $ 5,552,486 $ 5,204,790 $ 4,968,069 $4,843,662

$

11,198,473

Total debt $ 1,848,542 $ 149,647 $ 145,614 $ 76,030 $ 115,867

$

1,848,542

Minority interest (other

p

artnershi

p

interests) $$ 28,970 $ 118,903 $ 141,137 $ 154,499181,030

Minority interest (

p

referred

p

artnershi

p

interests)

$

$ 225,000 $ 310,000 $ 285,000 $ 285,00

0

325,000

Shareholders’ equity $ 8,208,045 $ 4,817,009 $ 4,429,967 $ 4,219,799 $4,158,969

$ 8,208,045

O

ther Data:

Net cash provided by operating activities $ 791,700 $ 692,048 $ 616,664 $ 571,387 $ 591,283

$

791,700

Net cash used in investing activities $ (487,496) $ (443,656) $ (157,638) $ (205,133) $ (325,786)

$

(487,496)

Net cash used in financing activities $ (244,395) $ (121,146) $ (297,604) $ (264,545) $ (211,720)

$

(244,395)

S

ELECTED FINANCIAL HIGHLIGHT

S

(

1) During 2006, 2005, 2004, 2003 and 2002, we completed several significant asset acquisitions, business combinations and equ

i

t

y

t

ransactions. See our conso

l

i

d

ate

d

f

inancia

l

statements an

d

notes t

h

ereto.

(

2) Commencing January 1, 2002, we adopted and modified a business plan that included the closure or consolidation of certain non-

strate

g

ic containerize

d

stora

g

e

f

aci

l

ities. We so

ld

two commercia

l

p

ro

p

erties—one in 2002, t

h

e ot

h

er in 2004. Durin

g

2003, we

sold five self-storage facilities. The historical operations of these facilities are classified as discontinued operations, w

i

th

the

rental

income, cost o

f

o

p

erations,

d

e

p

reciation ex

p

ense an

d

g

ain or

l

oss on

d

is

p

osition o

f

t

h

ese

f

aci

l

ities

f

or current an

d

p

rior

p

erio

ds

included in the line item “Discontinued Operations” on the consolidated income statement.