Public Storage 2005 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2005 Public Storage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

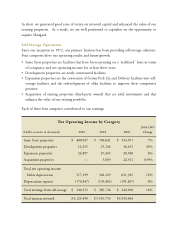

For the year ended December 31,

(Amounts in thousands, except per share amounts) 2005 2004 2003

Net income: $456,393 $366,213 $336,653

Depreciation and amortization 196,397183,063 184,063

Depreciation and amortization included in

discontinued operations 88 1,2823,940

Less - depreciation with respect to non-real estate assets (1,789) (4,252) (6,206)

Depreciation from unconsolidated real estate investments 35,425 33,72027,753

Gain on sale of real estate assets (8,279) (2,288) (6,128)

Less - our share of gain on sale of real estate included

in equity of earnings of real estate entities (7,858) (6,715) (2,786)

Minority interest share of income 32,651 49,913 43,703

Net cash provided by operating activities 703,028620,936 580,992

FFO to minority interest - common (18,782)(23,473) (23,125)

FFO to minority interest - preferred(17,021) (32,486) (26,906)

Funds from operations 667,225 564,977 530,961

Less: allocations to preferred and equity stock shareholders:

Senior Preferred(180,555) (166,649) (153,316)

Equity Stock, Series A (21,443) (21,501) (21,501)

FFO allocable to our common shareholders $465,227 $376,827 $356,144

Weighted average shares outstanding:

Common shares 128,159 127,836 125,181

Stock option dilution 660 845 1,336

Weighted average common shares for purposes of

computing fully-diluted FFO per common share 128,819 128,681 126,517

FFO per common share $ 3.61 $ 2.93 $ 2.81

Computation of Funds from Operations (unaudited)

Funds from operations (“FFO”) is a term defined by the National Association of Real Estate Investment

Trusts (“NAREIT”). FFO is a supplemental non-GAAP financial disclosure, and it is generally defined

as net income before depreciation and gains and losses on real estate assets. FFO is presented because

management and many analysts consider FFO to be one measure of the performance of real estate

companies and because we believe that FFO is helpful to investors as an additional measure of the

performance of a REIT. FFO computations do not consider scheduled principal payments on debt,

capital improvements, distribution and other obligations of the Company. FFO is not a substitute for

our cash flow or net income as a measure of our liquidity or operating performance or our ability to pay

dividends. Other REITs may not compute FFO in the same manner; accordingly, FFO may not be

comparable among REITs.