Public Storage 2005 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2005 Public Storage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204

|

|

•Low capital expenditures and no tenant improvement costs. A self-storage building is a

relatively simple design, requires a low amount of maintenance and has a very low

obsolescence factor. Since rental units are not finished with carpeting or interior paint,

no tenant improvements are required for new customers.

• Profits in cash. This is primarily a cash business, and our customers generally pay rent

a month in advance of their stay.

• Pricing power above inflation. Over the past five years, our Same Store rental rate has

grown 17.0%, compared with a 13.5% increase in the Consumer Price Index (“CPI”).

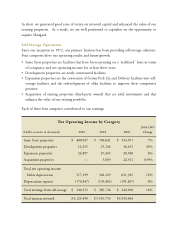

Five-Year

2001 20022003 2004 2005 Growth

Rental rate change 10.4% 1.2%(2.8%) 2.9% 4.7%17.0%

CPI change 2.8% 1.6% 2.3% 2.7% 3.4% 13.5%

In addition, certain competitive advantages within our industry differentiate us from the

competition.

• Brand name. We believe our name is the most recognized and established name in the

self-storage industry. We have national recognition since our storage operations are

conducted in 37 states and are located in major metropolitan markets.

• Scale of operations. We are the largest provider of storage space in the industry. By

managing over 1,500 facilities, our size and scope enable us to achieve higher profit margins

and a lower level of administrative costs relative to revenues.

•Media. We are the only self-storage company to use television to advertise and have been

doing so since the mid-1980s. We believe the high cost of television makes it impractical

for our competitors to use this form of advertising. Our scale of operations enables us to

do so cost effectively and to help us generate “above industry average” occupancy levels.

•Financial flexibility. With a conservative capital structure that utilizes a significant

amount of preferred stock, we are not subject to the volatility of the capital markets.

With our solid financial profile and credit rating, we are able to raise capital when

prudent versus when we “have to have it.”

Our actions and operating results demonstrate we are the leader of the self-storage industry.

Our operating model and our focus on the three P’s – People, Product and Pricing – set us