Public Storage 2005 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2005 Public Storage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204

|

|

0

50%

100%

150%

200%

250%

50%

0%

100%

150%

200%

250%

5% 3%

50%

247%

139%

102%

12%

One-Year Three-Year Five-Year

Public Storage

S&P 500 Index

NAREIT Equity Index

25%

135%

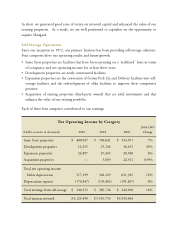

To maintain our income tax status as a REIT and avoid corporate income taxes, we are

required to distribute our taxable income. As a result of our operating results and the

expectation of continued positive performance, our Board of Directors increased the

common dividend by 11% to an annual level of $2.00 per share in August.

Our owners have enjoyed solid returns over the last several years. Looking at the one-year

(2005), three-year (2003-2005) and five-year (2001-2005) return to owners, we have

exceeded both the S&P 500 and NAREIT Equity indices for the short and long term.

Total Shareholder Returns

2001-2005

This is the “rear-view mirror.” While both our operating performance and growth

prospects have improved significantly over this period, it is almost certain that we will not

achieve these kinds of returns going forward.

Conclusion and Outlook

We have continuously said self-storage is a great business. Why? There are several reasons.

•Broad consumer awareness. A recent Wall Street Journal article cited a survey which

found one in 11 households now rents a self-storage unit compared to one in

17 households ten years ago.

•Low break-even point. A newly developed facility at a 30% to 35% occupancy level will

generally cover its fixed operating costs, consisting primarily of payroll, utilities,

property taxes and marketing costs. After “break-even,” the property generates positive

free cash flow.