Polaris 2011 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2011 Polaris annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

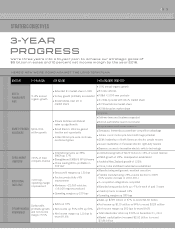

STRATEGIC OBJECTIVES

HERE’S HOW WE’RE DOING AGAINST THE LONG-TERM PLAN:

3-YEAR

PROGRESS

We’re three years into a 10-year plan to achieve our strategic goals of

$5 billion in sales and 10 percent net income margin by the year 2018.

OBJECTIVE 3–5-YEAR GOAL 2011 ACTIONS 3-YEAR PROGRESS (2009-2011)

BEST IN

POWERSPORTS

PLUS

5–8% annual

organic growth

Extended #1 market share in ORV

Victory growth profitably accelerated

Snowmobiles clear #2 in

marketshare

10% annual organic growth

83 new vehicles

PG&A >1,000 new products

#1 Side-by-sides with 40+% market share

#2 Snowmobiles market share

#2 Motorcycles market share

GROWTH THROUGH

ADJACENCIES

$200–500

million growth

Polaris Defense and Bobcat

sales up significantly

Small Electric Vehicles gained

traction andopportunity

Indian Motorcycle work continues;

excitementgrows

Organic:

Defense team and business expanded

Bobcat partnership launch successful

Acquisitions and Investments:

Swissauto: tremendous powertrain competitive advantage

Indian: iconic motorcycle brand with huge potential

GEM: leadership in North American electric people movers

Goupil: leadership in European electric light-duty haulers

Brammo: access to innovative electric vehicle technology

GLOBAL MARKET

LEADERSHIP

>25% of total

company revenue

International sales up 39%;

EMEAup 37%

Strengthened EMEA & AP/LA teams

China leading BICs; profitable in

2ndyear

International growth of $120 million to 16% of overallrevenue

EMEA growth of 28%; Headquarters established

Australia/New Zealand growth of 122%

China, India and Brazil subsidiaries established

OPERATIONAL

EXCELLENCE

>200 bps

operating margin

improvement

Gross profit margins up 130bps

Factory productivity >9%

improvement

Monterrey >22,000 vehicles;

>19,000 engines produced

Operating margins up 210bps

Manufacturing realignment: excellent execution

Flexible manufacturing: 29% volume decline in 2009;

56%volume increase in 2010-2011

2+ acquisition integrations completed

Manufacturing productivity up >7% for each of past 3years

Inventory turns increased 18%

Operating margins up 380 bps

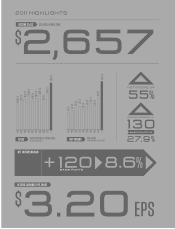

STRONG FINANCIAL

PERFORMANCE

Sustainable,

profitable growth

and net income

margin >9.5%

Sales up 33%

Net income up 55%; EPS up 50%

Net income margin up 120 bps to

record8.6%

Sales up $709 million or 37% to record $2.66 billion

Net income up $110 million or 94% to record $228million

Net income margin up 260 bps to record 8.6%

Total shareholder return up 330% on December 31, 2011

Market capitalization increased $2.92 billion to record

$3.86billion

3