Pepsi 2011 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2011 Pepsi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

on our strengths, while anticipating and planning

for challenges.

0VSUBTLUPEBZJTUPDSFBUFBOBEBQUJWFUFBN

and culture — one that can continually renew

itself and thrive on change. As a company,

webegan that journey of renewal in 2007. Aswe

gear up for the next decade, 2012 will be a year

in which PepsiCo takes the next step in our

transformation by reinvesting in our brands,

ourregions, our products and our people, to

ensure that we continue to deliver great results

forour shareholders.

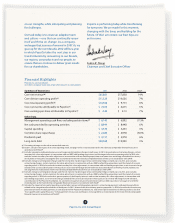

Financial Highlights

PepsiCo, Inc. and subsidiaries

(in millions except per share data; all per share amounts assume dilution)

(a) Percentage changes are based on unrounded amounts.

C*OFYDMVEFTUIFJNQBDUPGBOFYUSBSFQPSUJOHXFFL4FFQBHFGPSBSFDPODJMJBUJPOUPUIFNPTUEJSFDUMZDPNQBSBCMFöOBODJBMNFBTVSFJO

accordance with GAAP.

(c) Excludes corporate unallocated expenses and merger and integration charges in both years. In 2011, also excludes restructuring charges, certain

JOWFOUPSZGBJSWBMVFBEKVTUNFOUTJODPOOFDUJPOXJUIPVS8#%BOECPUUMJOHBDRVJTJUJPOTBOEUIFJNQBDUPGBOFYUSBSFQPSUJOHXFFL*OBMTP

excludes certain inventory fair value adjustments in connection with our bottling acquisitions and a one-time net charge related to the currency

EFWBMVBUJPOJO7FOF[VFMB4FFQBHFGPSBSFDPODJMJBUJPOUPUIFNPTUEJSFDUMZDPNQBSBCMFöOBODJBMNFBTVSFJOBDDPSEBODFXJUI(""1

(d) Excludes merger and integration charges and the net mark-to-market impact of our commodity hedges in both years. In 2011, also excludes

SFTUSVDUVSJOHDIBSHFTDFSUBJOJOWFOUPSZGBJSWBMVFBEKVTUNFOUTJODPOOFDUJPOXJUIPVS8#%BOECPUUMJOHBDRVJTJUJPOTBOEUIFJNQBDUPGBOFYUSB

reporting week. In 2010, also excludes certain inventory fair value adjustments in connection with our bottling acquisitions, a one-time net charge

related to the currency devaluation in Venezuela, an asset write-o charge for SAP software and a contribution to The PepsiCo Foundation, Inc.

4FF̓QBHFGPSBSFDPODJMJBUJPOUPUIFNPTUEJSFDUMZDPNQBSBCMFöOBODJBMNFBTVSFJOBDDPSEBODFXJUI(""1

(e) Excludes merger and integration charges and the net mark-to-market impact of our commodity hedges in both years. In 2011, also excludes

SFTUSVDUVSJOHDIBSHFTDFSUBJOJOWFOUPSZGBJSWBMVFBEKVTUNFOUTJODPOOFDUJPOXJUIPVS8#%BOECPUUMJOHBDRVJTJUJPOTBOEUIFJNQBDUPGBOFYUSB

reporting week. In 2010, also excludes a gain on previously held equity interests and certain inventory fair value adjustments in connection with

ourbottling acquisitions, a one-time net charge related to the currency devaluation in Venezuela, an asset write-o charge for SAP software,

a contribution to The PepsiCo Foundation, Inc. and interest expense incurred in connection with our debt repurchase. See pages 41 and 86 for

reconciliations to the most directly comparable nancial measures in accordance with GAAP.

(f ) Includes the impact of net capital spending, and excludes merger and integration payments, restructuring payments and capital expenditures

relatedto the integration of our bottlers in both years. In 2011, also excludes discretionary pension payments. In 2010, also excludes discretionary

pension and retiree medical payments, a contribution to The PepsiCo Foundation, Inc. and interest paid related to our debt repurchase. See also

i0VS̓-JRVJEJUZBOE$BQJUBM3FTPVSDFTwJO.BOBHFNFOUT%JTDVTTJPOBOE"OBMZTJT4FFQBHFGPSBSFDPODJMJBUJPOUPUIFNPTUEJSFDUMZDPNQBSBCMF

nancial measure in accordance with GAAP.

Summary of Operations 2011 2010 Chg(a)

Core net revenue(b) 14%

Core division operating prot(c) $ 10,626 7%

Core total operating prot(d) 6%

Core net income attributable to PepsiCo(e) %

Core earnings per share attributable to PepsiCo(e) $ 4.40 7%

Other Data

.BOBHFNFOUPQFSBUJOHDBTIøPXFYDMVEJOHDFSUBJOJUFNT(f) $ 6,892 (11)%

Net cash provided by operating activities $ 8,944 $ 8,448 6%

Capital spending %

Common share repurchases $ 2,489 $ 4,978 )%

Dividends paid $ 2,978 6%

Long-term debt $ 19,999 %

PepsiCo is performing today while transforming

for tomorrow. We are made for this moment,

changing with the times and building for the

GVUVSF0GUIJT*BNDFSUBJOPVSCFTUEBZTBSF

yetto come.

Indra K. Nooyi

$IBJSNBOBOE$IJFG&YFDVUJWF0óDFS

PepsiCo, Inc. Annual Report