Pepsi 2005 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2005 Pepsi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4

flavored potato chips contributed to solid growth

with our Lay’s brand.

But it also means balancing investment between

carbonated and non-carbonated beverages, and

balancing between “close-in” ideas like line exten-

sions, and entirely new product platforms that don’t

exist today. We’ve implemented new ways of

coordinating the collection of insights from

consumers and retail partners so we can better

share those insights across our businesses, and

generate ideas that have a greater chance of suc-

cess in the marketplace.

I think it’s important to understand that

innovation isn’t limited to products. Across

PepsiCo, we’re constantly innovating to strengthen

our go-to-market systems and to find structures

that drive faster, more efficient and more cost-

effective decision making. A current example is our

Business Process Transformation, or BPT, a

comprehensive, multi-year initiative that centers

on moving all of PepsiCo to a common set of

processes for key business activities, with current

efforts focused on North America.

More than a year ago, you announced PepsiCo’s

Business Process Transformation (BPT) initiative.

What are the objectives of this program, and

what is its status?

Through larger acquisitions and mergers over the

years, such as Tropicana and Quaker, we’ve recog-

nized the need to seamlessly integrate formerly

independent information systems. We’re also

committed to harmonizing key business processes

such as Finance, Consumer Insights, Purchasing

and Supply Chain and continuously improving our

customer service.

We’re supporting these processes with common

Information Technology applications, linking our

systems so that key pieces of data supporting all

our businesses flow seamlessly from system to

system. 2005 was a big year of preparation for the

first deployment of our new, integrated system,

which started its phased roll out in early 2006.

In fact, on January 16, the very first of these

new capabilities began its roll out. Several of our

North American plants, along with our Global

Procurement team, now have streamlined tools and

processes used for purchasing materials other than

commodities, packaging and ingredients.

Additional capabilities will be rolled out over the

next several years.

When complete, we expect to have an infra-

structure that will support better, faster decisions,

allowing us to capture more growth opportunities,

and better serve our customers. Importantly, it

will also leverage PepsiCo’s scale for efficiency

and effectiveness.

On the cost side, a number of key commodities

have seen high rates of inflation. How is PepsiCo

managing in an environment of increasing costs?

There is no doubt that 2005 was a challenging

year for input costs — especially energy and plas-

tics resin. Between several major hurricanes hitting

the United States and inflation, we saw some

expected and some unexpected pressure on our

margins, but we managed those cost pressures and

met our financial targets.

And we expect 2006 to be challenging as well,

largely reflecting increased energy and commodity

costs. However, we have solid plans in place to off-

set these rising costs through productivity programs

and hedging strategies, and expect to carefully

manage pricing to help offset some of the inflation.

PepsiCo’s businesses generate a great deal of

cash, and the Company’s balance sheet is very

conservative. Why don’t you put more debt on the

balance sheet and use the proceeds to increase

the dividend or increase share repurchases?

PepsiCo does generate considerable cash, and we

are disciplined about how cash is reinvested in the

business. Over the past three years, $5.7 billion has

been reinvested in the businesses through capital

expenditures and acquisitions, and $12.0 billion has

been returned to shareholders through a combination

of dividends and share repurchases. In essence, any

cash we have not reinvested in the business has

been returned to our shareholders. And, we are

pleased with our current capital structure and

debt ratings, which give us ready access to capital

markets and keep our cost of borrowing down.

PepsiCo’s focus on people — specifically diversity

and inclusion — has been a priority in previous

reports. What results have you delivered through

this focus and what changes have you made?

In terms of the diversity of our workforce, we’ve

seen a significant increase in the number of women

and people of color who’ve joined PepsiCo in

various functions and at various levels. Since 2000,

the percentage of women in management positions

in the United States has risen from 20% to 25%.

The number of people of color in management

positions has climbed from 15% to almost 22% —

we made a gain of about 2 points of growth in

2005 alone. This change in the workforce has

contributed to our growth through product ideas,

greater insights about consumers and connections

into growing urban and ethnic communities.

While a diverse workforce is important, we must

also create an inclusive environment where every-

one — regardless of race, gender, physical ability

or sexual orientation — feels valued, engaged, and

wants to be part of our growth. It is only through

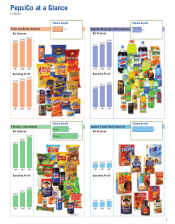

#1

Potato

Chips

#1

Tortilla

Chips

#1

CornChips

#1

Extruded

Snacks

#1

Multigrain

Snack

#2

Pretzels

U.S. Category Leaders