Pepsi 2005 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2005 Pepsi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Whether it’s a new product, improvement to an existing product, new packaging or

a unique promotion, we’re relentless in our drive to keep our products relevant

to consumers.

March of New Products

Early in the year, Pepsi-Cola North America capitalized on our leading Aquafina brand

with FlavorSplash, a zero-calorie water made with natural fruit flavors and sweetened

with Splenda no-calorie sweetener.

Our SoBe team built on the strength of its South Beach Diet program-endorsed Lean

line with two new flavors: Lean Energy and Lean Mango Melon. The Pepsi-Lipton Tea

Partnership unveiled a new Diet Sweet version of ready-to-drink Lipton Iced Tea.

We also kept our carbonated soft drink brands top of mind. Building sales of our

flagship Pepsi brand, Pepsi-Cola introduced Pepsi Lime and Diet Pepsi Lime, a pair

of colas featuring the popular lime flavor. Pioneering a new category of “energy

sodas,” Pepsi-Cola launched MDX, a beverage touting the familiar citrus flavor of

Mountain Dew, but fueled by a “power pack” of ingredients including ginseng,

guarana, taurine and D-ribose.

The march of our new products continued when Tropicana introduced Tropicana

Pure Premium Essentials with Fiber — the first national orange juice with added

fiber. It delivers as much fiber as a whole orange in every 8-ounce glass. Then we

gave lemonade a new meaning with the introduction of a Gatorade Lemonade, a line

that combines the refreshing taste of lemonade with the scientifically supported

formula of Gatorade Thirst Quencher.

At Frito-Lay North America, we reformulated all our Quaker Chewy granola bars to

remove trans fat — plus we reformulated many of them to reduce sugar by 25% and

add calcium. Many of these bars now bear the Smart Spot symbol and our new

package graphics reinforce the linkage to Quaker Oatmeal. In our Oberto meat snacks

line, distributed by Frito-Lay, we introduced Oh Boy! Oberto Beef Jerky Crisps, a first-

of-its-kind snack that bridges the gap between beef jerky and traditional snack chips.

At our Quaker Foods business, we added to our successful Life Cereal line with the

introduction of Life Vanilla Yogurt Crunch — combining Life Cereal with yogurt-coated

clusters while delivering nine essential vitamins and minerals and providing a good

source of calcium and fiber. Quaker also introduced new Weight Control instant

oatmeal, a quick, convenient way to eat a nutritious breakfast that is high in fiber and

a good source of protein, and Quaker Oatmeal-To-Go bars, which provide all the

nutrition of a bowl of instant oatmeal.

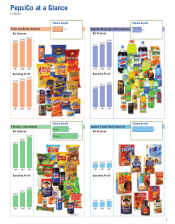

Pepsi-Cola

Mountain Dew (diet and regular)

Diet Pepsi

Gatorade Thirst Quencher

Lay’s Potato Chips

Lipton Tea

Tropicana Pure Premium Orange Juice

Doritos Tortilla Chips

7UP (outside U.S.)

Aquafina Bottled Water

Cheetos Cheese Flavored Snacks

Quaker Cereals

Ruffles Potato Chips

Mirinda

Tostitos Tortilla Chips

Sierra Mist (diet and regular)

Fritos Corn Chips

05101520

Largest PepsiCo Brands

Estimated Worldwide Retail Sales $ in Billions

PepsiCo now has 17 powerful brands known around the world

that each generate annual retail sales of more than $1 billion.

PepsiCo

15%

Kraft Foods

12%

Private

Label

8%

Hershey

6%

Kellogg

5%

General

Mills

5%

Master

Foods

4%

Procter &

Gamble

1%

Others

44%

U.S. Convenient Foods Sales

% Retail Sales in Measured Channels.

Includes chips, pretzels, ready-to-eat popcorn, crackers, dips,

snack nuts/seeds, meat snacks, yogurt, bars, cookies, pastry,

sweet, and other snacks.

Frito-Lay is the leading convenient snack food business

in measured channels in the United States.

PepsiCo estimated

worldwide retail

sales: $85 billion