Olympus 2015 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2015 Olympus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Contribute to the development of

society through products and solutions

Back to Basics

Strive for protable growth through the

complete revision of cost structures

Profitable Growth

Share management strategies with

employees worldwide and work as a team

One Olympus

Olympus is promoting a medium-term vision for the ve years from the scal year ended March 31, 2013. Acting in accor-

dance with the vision’s slogan of “Back to Basics,” the Company aims to return to the basic values it had at founding and

make a fresh start in order to regain the credibility of its stakeholders, build itself anew, and create new corporate value.

Corporate Management Policies

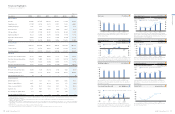

Performance Indices and Targets (Consolidated)

Results of implementing these basic strategies will be monitored based on four performance indices: return on invested capital (ROIC)*,

operating margin, free cash flow, and equity ratio.

In fiscal 2015, the operating margin, an indicator of business profitability, was 11.9% and the equity ratio, an indicator of financial

soundness, was 32.9%. Both of these were an improvement from fiscal 2014, in which the Company achieved levels targeted for fiscal

2017 three years ahead of schedule. ROIC was 8.0%, representing steady progress toward the fiscal 2017 goal for this index, while free

cash flow amounted to ¥27.2 billion, declining substantially year on year due to increases in accounts receivable and inventories.

* Return on invested capital (ROIC): At Olympus, ROIC is calculated using the following assumptions: Return (Operating income after taxes) / IC (Shareholders’ equity + Interest-bearing debt)

FY ended March

2012

(Results)

FY ended March

2013

(Results)

FY ended March

2014

(Results)

FY ended March

2015

(Results)

FY ending March

2017

(Targets)

Return on invested capital (ROIC)* 2.7% 2.7% 5.9% 8.0% 10% or more

Operating margin 4.2% 4.7% 10.3% 11.9% 10% or more

Free cash flow (Cash flows from operating

activities + Cash flows from investing activities) ¥(4.8) billion ¥58.7 billion ¥52.1 billion ¥27.2 billion ¥70.0 billion or

more

Equity ratio 4.6% 15.5% 32.1% 32.9% 30% or more

Medium-Term Vision (Corporate Strategic Plan)

* All principles of the Corporate Governance

Code will be implemented.

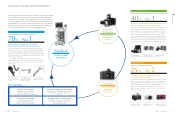

Change from Fiscal 2012 to Fiscal 2015

Rebuilding of Business Portfolio /

Optimizing Allocation of Management Resources

Medical

Net sales

+60% ¥349.2 billion ¥558.3 billion

Rapid growth in all fields

Operating margin

+3pt 19.5% 22.4%

Contributions from higher sales

R&D expenditures

+61% ¥26.9 billion ¥43.3 billion

Enhancement of product lineup

Capital expenditures

+136% ¥15.6 billion ¥36.8 billion

Reinforcement of domestic manufacturing sites

Scientific

Solutions

Operating margin

+1pt 5.9% 6.6%

Closure of plant in the Philippines, etc.

Net sales by industrial eld

+19% ¥49.8 billion ¥59.4 billion

Expansion of industrial field operations

Imaging

Ratio of mirrorless camera sales to total digital

camera sales

More than Double

Accelerated shift to mirrorless cameras

Manufacturing sites

–3sites 5 sites 2 sites

Revision of manufacturing systems

Others

Number of subsidiaries

–33% 208 139

Reorganization of non-core business domains

Operating income

Profitability

Achieved

Reorganization of unprofitable businesses

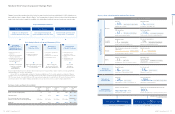

Review and

Reduction of Costs

Operating margin

+8pts 4.2% 11.9%

Improvement of Groupwide profitability

Cost of sales ratio

–18pts 54.8% 35.9%

Ongoing cost reductions

Restoration of

Financial Health

Equity ratio

+28pts 4.6% 32.9%

Capital alliances, issuance of new shares, etc.

Interest-bearing debt

–¥300billion

¥642.4 billion ¥354.4 billion

Halved due to early repayment

Restructuring of

Corporate Governance

Number of outside directors

More than Half

8 / 13

Management soundness ensured

Response to the Corporate Governance Code*

100%

Proactive strengthening of corporate governance system

1

2

3

4

Market capitalization 4 times higher Year-end dividend payment ¥10 per share

(1st time in 4 years)

Success Over 3-Year Period of Medium-Term Vision

¥367.3 billion ¥1,530.0 billion ¥0 ¥10

Rebuilding of

Business Portfolio /

Optimizing Allocation of

Management Resources

Restoration of

Financial Health

Review and

Reduction of Costs

Restructuring of

Corporate Governance

Basic Strategies Based on Corporate Management Policies

1. Clarification of our core

businesses

2. Identification and liquidation

of non-core businesses

3. Establishment of mechanisms

to drive optimal allocation of

management resources

Contribute to total wellness

of people as a company

centered on the

Medical Business

Improve protability of the entire

Group through drastic review

of cost structures

Improve equity ratio

as soon as possible and

realize stable management

Recover trust

and improve

corporate value

1. Cost reduction

2. Significant curtailment

of indirect expenses

1. Steady flow of profits from

businesses

2. Maximization of cash flows

3. Streamlining of assets

1. Restructuring of the

governance system

2. Reinforcement of internal

controls

3. Strengthening of the

compliance system

1 2 3 4

¥(8.0) billion ¥1.2 billion

34.2% 71.8%

13

OLYMPUS Annual Report 2015

12 OLYMPUS Annual Report 2015

Overview of Olympus