Olympus 2015 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2015 Olympus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Interview with the President

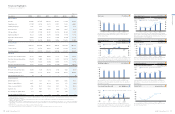

In fiscal 2015, consolidated net sales rose 7% year on year, to

¥764.7 billion, largely as a result of the continuation of strong per-

formance in the mainstay Medical Business. Operating income

similarly showed a massive 24% increase, to ¥91.0 billion,

demonstrating that our business operations are proceeding as

planned. However, I have the regrettable duty of reporting to our

stakeholders that the Company posted a net loss of ¥8.7 billion.

This outcome is largely due to the recording of loss related to the

investigation under U.S. Anti-kickback Act and the related Act of

¥53.9 billion as an extraordinary loss. This loss was associated

with U.S. Department of Justice investigations of a U.S. subsid-

iary and the progress in subsequent discussions on how to

resolve the issue in question. This, too, is unfortunate to report,

but rest assured in the knowledge that we have already rein-

forced global compliance systems to ensure that no such issues

occur in the future. On a more positive note, we have made

progress toward resolving the financial issues that have plagued

Olympus. In consideration of this accomplishment, as well as the

strong performance of our mainstay business and our improved

financial position, we decided to issue dividend payments for the

first time in four years. This is huge step forward, and we intend

to continue enhancing shareholder returns going forward.

With regard to the restructuring of corporate governance, resto-

ration of financial health, expansion of the mainstay Medical

Business, and reorganization of non-core business domains, the

speed of progress has exceeded our plans, and our goals in

these areas have been met.

In the Medical Business, we conducted additional upfront

investments, primarily for addressing the need to strengthen

surgical device field sales forces in North America, and I feel that

the benefits are apparent in terms of both business expansion

and increased prospects for the future. At the same time, we

realized smooth improvements in the profitability of the Scientific

Solutions Business by shifting from strategies based on product

lineups to pursue those oriented toward customer groups.

Other contributions to this improved profitability came from the

increased business efficiency achieved by integrating operating

sites in North America and other areas. The Imaging Business,

meanwhile, has recorded losses for five consecutive years, and

we are still in the process of fundamentally resolving the issues

facing this business. There are clearly still areas requiring im-

provement, and we are restructuring this business to address

these areas. Specific reforms planned include furthering the shift

toward mirrorless cameras to boost profitability and reallocating

management resources from the Imaging Business to business-

to-business (BtoB) operations and other growth fields.

As for our financial position, through the steady reduction of

interest-bearing debt, we have successfully increased the equity

ratio to above 30%, achieving our initial target for this indicator

earlier than planned.

The operating environment for the digital camera business

remains harsh due to the continuation of a market contract

trend that is exceeding all expectations. Faced with this

adversity, we transitioned to strategies that matched market

changes and undertook structural reforms. Specifically, this

process involved halving the staff of more than 10,000 that

was working in the business three years ago and consolidating

its five manufacturing sites into two. In addition, the Company

took steps to address projected future changes by withdrawing

from low-priced compact digital camera businesses and

accelerating the shift of its focus toward mirrorless cameras.

Despite our best efforts, however, we were unable to keep up

with the pace of market contraction.

In fiscal 2016, rather than pursuing sales expansion, we

will cut back on fixed costs in order to realize a departure from

the current state of unprofitability and ensure that the business

can break even. To this end, we will further narrow our product

lineup to reduce both R&D expenditures and advertising

and promotion expenses. In terms of manufacturing, we will

develop a more-efficient production system by leveraging the

strengths of our different manufacturing sites. For example,

lenses and other components requiring sophisticated tech-

nologies and masterful techniques could be produced at the

Shenzen plant in China, with assembly of cameras performed

at the Vietnam plant to take advantage of its low labor costs.

In addition, we will reform logistics procedures and conduct a

full range of other improvement measures.

At the same time, we realize that there still exist business

opportunities for us to use Olympus’ imaging technologies to

generate earnings. For this reason, we aim to create an operat-

ing structure that will ensure the Imaging Business can break

even, while utilizing this business’ superior technologies and

resources in other areas throughout the Company.

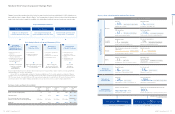

One main reason for the new organizational structure was the

integration of the development, manufacturing, and other func-

tions—previously dispersed among different businesses—into

a single unified axis of functional organizations that cater to all

businesses. I expect that this integration will enable us to more

effectively utilize management resources while also allowing for

additional strengthening of the development and manufacturing

functions that form the Company’s foundation. In addition, we

have established the Sales Group as a new functional organiza-

tion. Through this organization, we plan to enhance Olympus’

overall sales capabilities by sharing expertise and communicat-

ing information regarding issues throughout sales operations in

different businesses and regions, thereby instituting more ag

gres-

sive sales strategies on a global basis. At the same time, the

Business Development Office was established to facilitate

efforts

to expand operations in new fields, explore new businesses,

and conduct M&A activities. This office will aid us in creating

the new businesses that will support Olympus in the future.

Another main point was that the Medical Business was split

into five business units. Previously, we had developed our oper-

ations centered on the gastrointestinal, surgical device, and

endotherapy device fields, formulating various measures and

actively allocating resources to these fields. At the same time,

however, we were unable to conduct a sufficient amount of

investment and establish the necessary systems in the urology,

gynecology, and ear, nose, and throat (ENT) fields, despite their

potential for high growth and their compatibility with Olympus’

technologies. Under the new business unit structure, we aim to

accelerate investment and business development in these fields,

and thereby stimulate the future growth of the Company.

For more information, please refer to the “Special Feature” beginning on page 26.

Would you please provide an overview of performance in fiscal 2015?

Looking back at your three years as president, how would you evaluate

the Company’s progress?

What are the Company’s future plans for the digital camera business? Do you believe that this

business can be returned to profitability in the current harsh operating environment?

Olympus began operating under a new organizational structure in April 2015.

What has changed in this new structure and what was the aim of this transition?

Our mainstay Medical Business made massive contributions to overall performance, resulting in consolidated

operating income rising for the second consecutive year. Unfortunately, a net loss was posted due to the

recording of extraordinary loss. Regardless, we decided to issue dividend payments for the first time in four

years in recognition of the progress made toward resolving the financial issues that have plagued Olympus.

While there are still unresolved issues that need to be addressed, performance is in line with our plans,

and the Medical Business is even exceeding expectations.

In the digital camera business, rather than pursuing sales expansion, we will cut back on fixed costs in

order to realize a departure from the current state of unprofitability and ensure that the business can break

even on the operating income level. In addition, we will utilize the technologies of the Imaging Business

throughout the Company, and reallocate this business’ resources to growth fields.

The primary aim of the new organizational structure is to fully leverage the Company’s management

resources through a matrix style of business operation that is realized by forming a balanced union

between the divisions on the business axis and the functional axis of the organization.

Answer

Answer

Answer

Answer

Question

1

Question

3

Question

4

Question

2

17

OLYMPUS Annual Report 2015

16 OLYMPUS Annual Report 2015

Olympus’ Growth Strategies