Olympus 2015 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2015 Olympus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

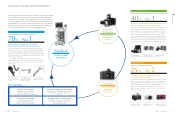

GI (Gastrointestinal)

Business Unit

GS (General Surgery)

Business Unit

Uro/Gyn (Urology / Gynecology)

Business Unit

ENT (Ear, Nose, and Throat)

Business Unit

Medical Service

Business Unit

Operating Environment

and Outlook

• Rising endoscope demand due to the

endorsement of endoscope usage for

stomach cancer examination in Japan

and growing colorectal cancer examina-

tion awareness in Europe and the United

States; high latent demand in Asia market

expected to grow

• Endotherapy device market forecast to

display double-digit growth due to rise in

minimally invasive therapy and surgical

procedures accompanying spread of

endoscope usage

• Rapidly changing operating environment

due to pressure to reduce medical costs

• Market expectations for products with

both medical and economic benefits

projected to represent a favorable

medium- to long-term trend for Olympus

and its minimally invasive therapy products

• Rising case numbers and higher mini-

mally invasive therapy needs in focus

urology field areas, including enlarged

prostate, bladder cancer, and urinary

tract stone treatment

• Ongoing increase in demand for early

diagnosis and minimally invasive therapy

methods for conditions such as uterine

myoma and endometrial polyps in the

gynecology field

• Medical equipment manufacturers are

increasingly being expected to provide

three forms of value—medical value,

economical value, and patient value—

making for a type of “Triple Value.” In this

environment, needs are rising in areas in

which Olympus can utilize its core com-

petencies, such as early diagnosis and

treatment of oropharynx cancer and hypo-

pharyngeal cancer and more minimally

invasive endoscopic sinusitis treatment.

• Strong global market share held by

Olympus due to high penetration of

gastrointestinal endoscopes in Europe

and the United States; slight increase in

repair orders anticipated; brisk increase

in order numbers anticipated to accom-

pany future gastrointestinal endoscope

growth in emerging countries

• Increase in repair needs expected in

anticipation of growth in the field of surgi-

cal devices resulting from future expan-

sion of Olympus’ sales and market share

Business Strategy • Pursue ongoing sales and income

growth by developing and supplying

gastrointestinal endoscope-related prod-

ucts designed to provide hospitals with

medical and economic value; strengthen

the training support ventures that are

crucial to market growth in Asia

• Expand market share in the endotherapy

product field by supporting spread of

techniques and strengthening approach

toward group purchasing organizations

and integrated delivery networks

(organizations that jointly purchase phar-

maceuticals, medical materials, medical

equipment, and related), an issue of

particular importance in the United States

• Launch new surgical endoscopy

systems, for which technologies were

developed by Sony Olympus Medical

Solutions Inc. during fiscal 2016, and

work to expand share of surgical

endoscope market

• Expand lineup of THUNDERBEAT energy

device products to provide support for

more treatment areas and procedures

and thereby increase market penetration

• Solidify position in the resectoscope and

flexible endoscope markets by further

soliciting Olympus’ technological prowess

• Expand currently low market share in the

highly competitive urinary tract stone treat-

ment device field by developing products

that are highly appealing to customers

• Expand operations in the gynecology

field by utilizing Olympus’ diagnosis and

treatment technologies and strengthen-

ing sales capabilities

• Provide ideal solutions to all stakehold-

ers in the ENT field by developing new

diagnosis and therapeutic procedures

through close coordination with medical

institutions and optimal products for use

with these procedures

• Strengthen sales capabilities to increase

Olympus’ global presence in the ENT field

• Improve profitability by increasing the per-

centage of Olympus products covered by

maintenance service contracts and reduc-

ing costs associated with repair activities

• Enhance service systems in the surgical

device field and in emerging countries

where future growth is anticipated

Shares of Net Sales

(As of fiscal year ended March 31, 2015)

Major Competitors Gastrointestinal endoscopes:

Fujifilm Corporation (Japan),

HOYA CORPORATION (Japan), etc.

Endotherapy devices:

Boston Scientific Corporation (U.S.), etc.

Surgical endoscopes:

Stryker Corporation (U.S.),

KARL STORZ GmbH & Co. KG (Germany),

etc.

Energy devices:

Ethicon Endo-Surgery Inc. (U.S.),

Medtronic, Inc. (U.S.), etc.

KARL STORZ GmbH & Co. KG (Germany),

Boston Scientific Corporation (U.S.), etc.

HOYA CORPORATION (Japan),

Medtronic, Inc. (U.S.),

KARL STORZ GmbH & Co. KG (Germany),

etc.

Special Feature: New Organizational Structure for New Corporate Strategic Plan

Business Units of

the Medical Business

EVIS LUCERA ELITE

(Gastrointestinal video

endoscopy system)

QuickClip Pro (Disposable

rotatable clip xing device) ENDOEYE FLEX 3D

(Deectable videoscope)

URF-V2

(Uretero-reno

videoscope)

THUNDERBEAT

(Surgical tissue management system)

ITknife nano (Disposable,

high-frequency knife)

In order to fuel the further expansion of the

Medical Business, the Uro/Gyn Business

Unit, ENT Business Unit, and Medical

Service Business Unit were established as

independent organizations for strengthen-

ing operations in the strategic areas of

urology; gynecology; ear, nose, and throat;

and medical services.

Rhino-Laryngo videoscope

OES Pro (Resectoscope) DIEGO ELITE (Multidebrider system)

29

OLYMPUS Annual Report 2015

28 OLYMPUS Annual Report 2015

Olympus’ Growth Strategies

GS URO/

GYN ENT Repair /

Service

GI

Endotherapy

devices (ET)