Olympus 2015 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2015 Olympus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

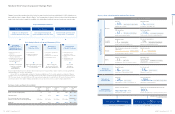

Main Areas and ProductsBusiness Segment Net SalesResults of Operations (2015/3) Operating Income (Loss) /

Operating Margin

Share of Net Sales Share of Net Sales

by Region

73.0%

Others

2.5%

Asia /

Oceania

18.2%

13.6%

11.0%

Company History

In order to allocate management resources to business domains in a more concentrated manner,

we reorganized non-core business domains, and withdrew from the biologics business in the

previous fiscal year. As a result, net sales in the Others Business amounted to ¥18.6 billion, down

29% year on year, and profitability was achieved with operating income of ¥1.2 billion.

Others

Europe

25.5%

North

America

32.7%

Japan

21.1%

1919

Established as

Takachiho Seisakusho

to manufacture micro-

scopes in Japan

1936

Semi-Olympus I, the first

Olympus camera intro-

duced, marking entry into

camera business

1920

Asahi 600x microscope

introduced

1975

Entry into medical surgical

endoscopy field

1949

Name changed

to Olympus Optical

Co., Ltd.

The Company listed

on the TSE

1996

Entry into digital camera

business

1950

Development of world’s

first practical gastrocamera

1968

Entry into industrial

endoscope field

2008

Acquisition of Gyrus Group

PLC to strengthen surgical

area of Medical Business

2009

Olympus launches its first

mirrorless interchangeable

lens camera, OLYMPUS

PEN E-P1

1969

Development of world’s

first microcassette

tape recorder

At a Glance

2.4%

33

OLYMPUS Annual Report 2015

32 OLYMPUS Annual Report 2015

Performance and Strategies by Business

Gastrointestinal Endoscopes

Endoscopy systems (videoscopes, video processors,

light sources, liquid crystal display (LCD) panels);

Peripheral equipment (image recording device,

endoscope cleaning systems, sterilization systems), etc.

Surgical Devices

Surgical video endoscopy systems, peripheral devices

for endoscopic surgery, electrosurgical knives, etc.

Endotherapy Devices

Endoscopic devices for all disciplines of endoscopy

(approximately 1,000 different devices for various

diagnostic and treatment procedures, including biopsy

forceps, high-frequency polypectomy snares, grasping

forceps, stone retrieval and lithotriptor baskets,

hemostasis accessories, etc.)

Life Science

Upright microscopes and polarizing microscopes,

inverted microscopes, laser confocal microscopes,

box-type fluorescence imaging devices, stereo

microscopes, fluorescence macromicroscopes,

microscope digital cameras, imaging software,

bio-imaging systems, virtual slide systems

Industrial

Metallurgical microscopes, semiconductor inspection

microscopes, laser microscopes, measuring

microscopes, microscopic 3D measurement systems,

industrial videoscopes, industrial fiberscopes, industrial

rigid scopes, ultrasonic flaw detectors, eddy current

flaw detectors, phased array flaw detectors, X-ray

diffraction analyzers, peripheral equipment

Digital Cameras

Mirrorless interchangeable-lens cameras, compact

digital cameras, digital camera-related products, digital

camera lens barrels, optical components

Others

IC recorders, binoculars

Double-digit sales growth was recorded in

the gastrointestinal endoscope, surgical

device, and endotherapy device fields. Sales

of mainstay gastrointestinal and surgical

endoscopes continued to increase, and sales

in North America, Europe, Asia, and other

overseas markets drove overall performance

improvements. As a result, the Medical Busi-

ness posted record-breaking figures for both

net sales and operating income for the

second consecutive year, with net sales of

¥558.3 billion, up 13% year on year, and

operating income of ¥124.9 billion, up 11%.

In the life science field, performance benefited

from contributions from the sales of our laser

scanning microscopes, which are used in

advanced life science research. In the indus-

trial field, corporate capital expenditures were

on the rise, and sales of industrial video-

scopes and ultrasonic flaw detectors were

strong as a result. In addition, structural re-

forms created improvements in profitability,

leading net sales in the Scientific Solutions

Business to increase 6% year on year, to

¥103.9 billion, and operating income to grow

39%, to ¥6.8 billion.

Net sales in the focus area of mirrorless cam-

eras increased 16% year on year following

higher sales of the OM-D series in Europe

aswell as favorable sales of interchangeable

lenses. Overall, net sales in the Imaging Busi-

ness were down 13%, to ¥83.8 billion, as

wereduced compact digital camera sales

volumes. Operating loss was ¥13.9 billion

asa result of forward-looking investments

inbusiness-to-business (BtoB) operations.

Medical Business

Scientific Solutions

Business

Imaging Business

(30)

(20)

(10)

0

10

2013/3 2014/3

(¥ Billion)

2016/3

(Forecast)

2015/3

0

(23.1)

(9.2)

(13.9)

(¥ Billion)

2013/3 2014/3 2016/3

(Forecast)

0

40

80

120

107.6

96.1

83.8

70.0

95.1

12.5

83.6

12.5

69.3

14.5

61.0

9.0

2015/3

Digital cameras

Others

Operating loss

(¥ Billion)

2013/3 2014/3 2015/3 2016/3

(Forecast)

0

250

500

750

394.7

492.3

558.3

615.0

218.7

176.1

274.0

218.3

313.3

245.1 277.6

337.4

0

50

100

150

(%)

0

5

10

15

20

25

(¥ Billion)

2013/3 2014/3 2016/3

(Forecast)

2015/3

112.7

87.1

22.1 22.9

124.9

22.4

137.0

22.3

Endoscopes

Surgical & endotherapy devices

Operating income

Operating margin (right)

(¥ Billion)

2013/3 2014/3 2016/3

(Forecast)

0

40

80

120

85.5

98.5 103.9 110.0

38.9

46.6

44.8

53.7

44.5

59.4 62.0

48.0

2015/3

Life science

Industrial

3.5

4.9

6.8

8.0

7.3

4.1

5.0

6.6

(%)

(¥ Billion)

2013/3 2014/3 2016/3

(Forecast)

2015/3

0

2

4

6

8

10

0

5

10

15

Operating income

Operating margin (right)