Olympus 2014 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2014 Olympus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Interview with the President

Looking at efforts in our core businesses, I can proudly say

that progress in the Medical Business is in line with plans.

However, the same cannot be said of the Imaging Business

and the Scientifi c Solutions Business.

In the Imaging Business, we are faced with a need to

achieve a stable position of profi tability. We are accelerating

our shift toward high-margin mirrorless cameras to accom-

plish this objective. From a long-term perspective, we see

that the risk of the market for digital single-lens refl ex camera

maturing and contracting further will increase. This fact must

be considered in future business initiatives. The Scientifi c

Solutions Business, meanwhile, is facing harsh macro-

e conomic conditions. In this diffi cult environment, we are

introducing new strategic products in both the life science

and industrial fi elds while also advancing structural produc-

tion reforms in the pursuit of higher profi tability. However, the

business is deviating from our expectations in terms of profi t-

ability, and we therefore must quickly revise our strategies to

correct this situation. While I mentioned that the Medical

Business is progressing according to plan, I was referring to

its impressive performance, which set new records for both

net sales and operating income. Looking closely at the busi-

ness itself, we will see some divergence from our plans. New

gastrointestinal and surgical endoscope products were intro-

duced, and these products can be said to be generating

results. The energy device business, however, has failed to

live up to expectations. The strong overall performance in the

Medical Business was a result of other areas compensating

for the lackluster performance in the energy device business.

This, of course, is an issue needing to be addressed.

As all businesses are diverging from our plans, it is

imperative that we act to return them to the proper course.

Aiming to ensure the goals of the medium-term vision are

met, we will conduct strategic investment in the Medical

Business from a long-term perspective while working to

strengthen the foundations of the Scientifi c Solutions

Business and the Imaging Business.

Groupwide cost structures is also an area needing

prompt attention. For this reason, we are reviewing the

current business units and will undertake a Groupwide

reorganization. Through these efforts, we hope to boost

cost-competitiveness by strengthening head offi ce functions,

eliminating redundant functions throughout the Group, and

realizing more effi cient usage of management resources.

Would you please provide details regarding the Group’s strategic investments in the Medical Business?

The strategic investments are geared toward reinforcing the operating foundations of the Medical

Business to achieve the goals of the medium-term vision and continue growing thereafter. We will invest

approximately ¥18 billion in fi scal 2015 to strengthen sales forces and advance R&D ventures while

reducing manufacturing costs.

We have earmarked ¥18 billion for strategic investments.

Of this amount, ¥12 billion will be allocated to expanding

sales forces and conducting sales promotions in the surgi-

cal device fi eld, which has been positioned as a future

growth driver. These sales-oriented investments are

designed to ensure that we achieve the targets set for

fi scal 2017. The remaining ¥6 billion will be used for upfront

investment in R&D ventures for realizing future growth

following the completion of the medium-term vision.

For more information, please refer to the Medical Business section of Review

of Business Segments beginning on page 30.

In regard to expanding sales forces, we plan to intro-

duce an additional 1,000 people into our staff during fi scal

2015. However, we do not believe that sales will grow natu-

rally if we simply increase staff numbers. We are fully aware

of the importance of technologies, and we realize that prod-

ucts lacking in quality will not sell. Up to now, we have

developed our business centered on gastrointestinal endo-

scopes, so expanding our sales force for surgical devices

and endotherapy products is currently a major priority.

To compete effectively in markets in the United States and

Europe, we will need to foster specialized sales forces that

have been endowed with the techniques and other in-depth

knowledge necessary to properly explain the advantages of

Olympus surgical devices and how they are used. Accord-

ingly, we will hire new sales personnel in phases and work

toexpand sales while training these new personnel. I am

confi dent that this course of action will lead to the accom-

plishment of the medium-term vision’s goals.

At the same time, we must advance research and

development to create the products that will be needed

for long-term future growth. For this reason, we will actively

conduct R&D investments in growing areas, such as ENT

and gynecology, as well as in robotics and other advanced

technologies.

We hope to transform Olympus into a world-leading

medical equipment manufacturer over the medium-to-long

term. However, undergoing this transformation will require

that we make these strategic investments now, and this will

be a top priority in fi scal 2015.

Q

A

4

Olympus has a dominating share of the gastrointestinal endoscope market. As for the surgical device

market, competition from European and U.S. manufacturers is fi erce, making for a diffi cult operating

environment. How will Olympus differentiate itself in this environment?

Compared with the gastrointestinal endoscope market, where we have a dominant position, we will face

diffi culty in the surgical device market. However, Olympus possesses technologies for the development

and manufacture of devices that meet needs spanning from those for early diagnoses to those for

minimally invasive treatments, and these capabilities will be a power tool in this market.

Efforts aimed at limiting medical costs have become an

urgent priority around the world. Olympus is in a prime

position to support such efforts. Our success in the surgi-

cal device market will be determined by our how we utilize

this position. Success will also depend on our ability to

provide the devices needed for new minimally invasive

treatment methods and to propose the techniques and

training that will allow these methods to be employed.

In the surgical device fi eld, the 3D laparoscopy surgical

system we introduced in 2013 has been performing better

than expected, despite being more expensive than conven-

tional 2D systems. This strong performance is because the

depth of information provided by the 3D system is crucial in

operating the laparoscope and to the safety of surgical

procedures. I believe that this is how we should differenti-

ate Olympus from competitors.

Q

A

5

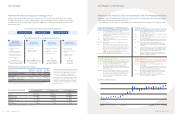

It would appear Olympus has been quite triumphant over the past two years. Conversely, what issues do

you believe remain to be faced?

We are faced with pressing issues to be addressed by management in all three core businesses.

Fiscal2015 has been deemed to be a crucial year for implementing measures to resolve these

issues and for setting the course for long-term growth on our quest to maximize shareholder value.

Specifi cally, we will advance fi ve initiatives to address pressing management issues during fi scal 2015.

Q

A

3

Issues in Core Businesses

Medical Business Conduct strategic investment targeting long-term growth to further strengthen the surgical device fi eld

Scientifi c Solutions Business Revise basic strategies to move away from strategies based on product lineups to pursue those oriented toward customer groups

Imaging Business Expand mirrorless camera operations by leveraging the OM-D series and pursue risk minimization by developing BtoB operations

in consideration of risks in the mirrorless camera market

Initiatives to Support Core Businesses

Cost structures Examine possible integration of business units to accelerate the optimization of Group organizations and the rationalization of

indirect departments

Risk management Secure a stable fi nancial base in preparation for securities litigation risks

11

OLYMPUS Annual Report 2014

10 OLYMPUS Annual Report 2014