Olympus 2014 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2014 Olympus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

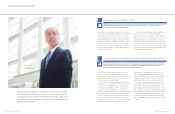

Would you please provide an overview of fi scal 2014?

Looking back at your two years as president, what would you say have been the Company’s triumphs?

While the global economy presented a harsh environment, particularly with regard to conditions in Europe

and China, we realized strong income improvements in fi scal 2014, with our core Medical Business

presenting a record-breaking performance.

Guided by the medium-term vision formulated by the new management team, we pushed forward with

business initiatives based on a strong sense of commitment toward keeping the promises we had made.

Over these two years, we worked to escape a very negative situation, and I believe we made great

progress in such a short period and that our triumphs are clear.

Olympus finds its strength in its technologies, and that will not change.

We will boldly push forward with aggressive management, paving the

road toward meeting the goals of the medium-term vision, and realizing

the growth that waits beyond, with strategic measures to overcome the

obstacles placed before us.

Interview with the President

In fi scal 2014, consolidated net sales declined 4% year on

year, to ¥713.3 billion, largely as a result of the transference

of the Information & Communication Business in fi scal

2013. Operating income, however, doubled over the year,

reaching ¥73.4 billion, and ordinary income showed even

more impressive growth, climbing to ¥50.9 billion, roughly

four times the fi gure for fi scal 2013. Net income suffered,

due to losses associated with litigation and the withdrawal

from the biologics business, but still exceeded the previous

year’s level at ¥13.6 billion.

A major contributing factor to these strong improve-

ments in income was our core Medical Business.

Supported by the strong foundation of its gastrointestinal

endoscope operations, this business turned in a record-

breaking performance, posting new highs for both net

sales and operating income. The Scientifi c Solutions Busi-

ness, previously known as the Life Science & Industrial

Business, recorded increases in both net sales and operat-

ing income, and the restructured Imaging Business saw a

substantial decrease in operating loss.

Two years ago, Olympus was in a state of crisis on all

fronts. The Company suffered from issues with its corpo-

rate governance systems and its fi nances and performance

were problematic with regard to its low equity ratio, poor

balance sheet, and lacking profi tability.

Today, I believe we are receiving fewer complaints

withregard to our corporate governance systems. In terms

of performance, the Medical Business, which has been

positioned as a major earnings driver, is making massive

contributions to the overall performance of the Group.

Inaddition, the reforms described for our business portfolio

in the medium-term vision are nearly complete. The imple-

mentation of business reforms has advanced at a speed

that exceeded expectations. These reforms include the

transference of the Information & Communication Business,

the withdrawal from the biologics business, and the sale

and liquidation of subsidiaries and affi liates from which

wecould not expect synergies with core businesses.

Wealso reduced the size of compact camera operations

inresponse to rapid market contraction. Furthermore,

weaddressed the issues with our fi nancial position by

commencing a business and capital alliance with Sony,

procuring approximately ¥110 billion in capital from over-

seas markets, and reducing interest-bearing debt. As a

result, the equity ratio improved substantially, to more than

30%, at the end of March 2014. Looking at specifi c perfor-

mance indices, we accomplished our fi scal 2017 targets

forthe operating margin and the equity ratio three years

inadvance, while return on invested capital (ROIC) and

freecash fl ow are improving smoothly and are in line with

our plans.

Q

Q

A

A

1

2

Hiroyuki Sasa

President and

Representative Director

9

OLYMPUS Annual Report 2014

8OLYMPUS Annual Report 2014