Olympus 2014 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2014 Olympus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Special Feature: Reliable Growth in Global Markets

Americas

Q

Q

Q

Olympus provides technologies that support early diagnosis methods as well

as minimally invasive treatment therapies, which we believe are compatible

with the goals of the U.S. Affordable Care Act. In order to realize further growth

going forward, we will accelerate initiatives geared toward capturing the

business opportunities being created as a result of this act.

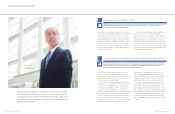

Nacho Abia

Division Manager of Medical

Business Div. of Americas,

Medical Business Group

(President of Olympus Corporation

of the Americas)

What is your view of the business environment in the North American

market? Also, would you please discuss the past year’s results?

What initiatives and policies will you focus on over the next year?

Finally, would you please discuss your medium-to-long-term business growth strategies?

A

A

AThe implementation of the Patient Protection and

Affordable Care Act—or ObamaCare—is rapidly chang-

ing the Medical Business environment in the United

States. The triple aim of healthcare reform is to reduce

overall costs, improve patient outcomes, and enhance

the patient healthcare experience. Olympus is ideally

suited to help healthcare facilities meet these goals by

delivering minimally invasive technologies aimed at early

detection, diagnosis, and treatment of disease. Moving

forward, we will continually strive to address pressure to

reduce costs where possible while demonstrating the

signifi cant clinical and economic advantages of our

solutions to healthcare provider networks. We will also

need to further invest in strengthening our strategies

for healthcare network management.

As Olympus has worked to adjust to this chang-

ing environment, we have seen our U.S. Medical

Business outpace the medical device industry. We

posted record sales in the fi scal year ended March

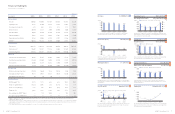

31, 2014(*1), with a 6% growth rate and a signifi cant

sales backlog to carry over into the current fi scal year.

Our core Gastroenterology (GI), Urology, and ENT

markets showed especially strong growth. Driven by

our high-margin leasing business and strict discount

controls, we saw our gross margins improve while

Operating Expenses (OPEX) also grew due to sales

team expansions in our GI Accessories (EndoTherapy)

and Corporate Accounts groups(*2). After the launch

ofa new sales strategy along with a signifi cant mate-

rial investment last year, our GI Accessories are now

experiencing quarterly growth rates between 15%

and18%.

What is the status of the new gastrointestinal

endoscopes and surgical endoscopes?

Launches of our EVIS EXERA III endoscopy platform

and VISERA ELITE surgical platform have done

remarkably well and have led to record sales of proces-

sors. With the rapid adoption of the CV-190 processor,

we anticipate signifi cant future growth in EVIS EXERA

190 endoscope sales for GI. Likewise, the ability to

connect and convert 2D systems into 3D imaging

systems using our surgical platform has proven to be

very appealing for surgical customers. We also have a

sizable share of the ENT market for fl exible nasopha-

ryngoscopy and sinus surgery, and we are the

dominant provider in the U.S. EndoUrology arena.

What is the status of the new electrosurgical device

THUNDERBEAT?

Our innovative THUNDERBEAT electrosurgical device

is unique to the industry and performs exceptionally

well in almost every aspect of surgery, including

grasping, dissecting, cutting, and sealing. Despite its

high-performance capabilities, some of the constraints

to the device’s widespread adoption have been contract

limitations due to preexisting, multiyear agreements

between hospital networks and competitors; physicians’

lack of familiarity with the new technology; and a

shortage of compatible disposables to meet all of the

needs for surgical applications using energy devices.

With this in mind, we have revised our THUNDER-

BEAT strategy to direct our sales resources to the most

appropriate accounts, customers, and procedures.

Moving forward, we are

also working to incorporate

training as a major part of

our Olympus strategy.

At Olympus, the Surgical fi eld is divided into Surgical

Endoscopy (SE), Urology / Gynecology (Uro / Gyn), ENT,

and Energy. Over the next year, each of these sectors

will be a primary area of focus for Olympus, and we will

work hard to build on our existing strengths. One of

those strengths is our ability to negotiate across our

entire Surgical portfolio, allowing preferential pricing

for customers using multiple Olympus products. We

also have strong competitive strengths in each sector.

For SE, Olympus is uniquely positioned to offer world-

class 3D visualization at a fraction of the cost of robotics

while providing a common platform for 2D / 3D imaging

and GI endoscopy. In Uro / Gyn, we are gaining compet-

itive ground with our stone management devices and

are investing in additional sales people and products.

For ENT, the additions of our DIEGO ELITE platform

and high-quality video endoscopes have greatly

improved our product portfolio and market positioning.

Finally, in the Energy market, we have made signifi cant

investments in our Corporate Accounts groups and

remain competitive in the OR (operating room). In

addition, we will continue investing in additional sales

staff and clinical specialists, and we will make surgeon

training an ongoing priority. We are working diligently

to take advantage of the opportunities offered by our

contract with Premier and are in negotiations with a

number of other group purchasing organizations

(GPOs) to secure their Energy contracts.

It is well-known that the U.S. has an aging population

and is experiencing increasing levels of chronic

disease, including obesity, back pain, and diabetes.

It is also generally agreed that ObamaCare initiatives

should result in a larger percentage of the U.S. popu-

lation being covered by insurance. Those two factors

make it reasonable to assume that demand for

Olympus medical and surgical products will continue

to increase for the foreseeable future.

What are the growth strategies for surgical

and endotherapy devices?

We have several strategies to grow our Surgical and

EndoTherapy devices. First, we will work to improve

market access through GPO and Integrated Delivery

Network (IDN) contracts. We will leverage the diversity of

our GI and Surgical portfolios to drive additional sales

volume and invest in dedicated sales resources to protect

our existing market share and increase device consump-

tion. Finally, we will work to provide solutions that offer

improved patient outcomes and/or reduce costs.

What are the future initiatives in Central

and South America?

We are optimistic about our expansion plans for Latin

America. We recently established a new Latin American

Division (LAD) headquartered in Miami and are invest-

ing in resources to support our South American

business. The expansion of LAD will allow us to

develop specialized products and services for the

region as we work to address each country’s specifi c

regulatory and compliance requirements and focus on

improving our customer service and our training

program for healthcare providers. In Brazil and Mexico,

our two largest markets, we have direct sales subsid-

iaries working to identify business opportunities.

A recent update to our pricing strategy in Brazil

resulted in signifi cant growth in our GI business, and

we will continue to refi ne our strategies in Latin America

as we learn how to best engage those markets.

Q1 Q2 Q3 Q4

0

5

10

15

20

25

1

7

19

12

EndoTherapy Quarterly Growth

(%)

*1. Figures for United States only (Canada and South America excluded)

*2. Specialized sales forces for approaching group purchasing organizations

(GPOs), integrated delivery networks (IDNs), other major hospital networks,

and U.S. veterans’ hospitals

2013/3 2014/3 Growth rate

1

2

3

23

OLYMPUS Annual Report 2014

22 OLYMPUS Annual Report 2014