North Face 1999 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 1999 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

[29]

The Company has $141.8 million of foreign operating loss carry-

forwards expiring at various dates; a valuation allowance has been

provided where it is more likely than not that the deferred tax assets

relating to certain of those loss carryforwards will not be realized.

Income taxes paid were $228.0 million in 1999, $215.2 million in

1998 and $230.1 million in 1997. Interest income includes $3.0

million in 1999 and $10.5 million in 1997 relating to settlements of

prior years’ tax examinations.

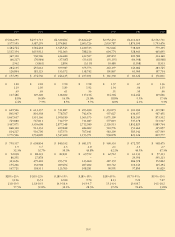

Note N Business Segment Information

The Company designs and manufactures apparel products marketed

primarily under Company-owned brand names. Customers are primar-

ily department, discount and specialty stores throughout the world.

The Company manages its businesses through separate marketing

companies that support specific brands. Manufacturing and product

sourcing needs are met by groups that support individual or in some

cases several different product types. These operations have been

aggregated into three reportable segments. The “Consumer Apparel”

segment includes jeanswear and related products, women’s intimate

apparel and swimwear, and children’s apparel, all having similar charac-

teristics of economic performance, product type, production process,

method of distribution and class of customer. The “Occupational

Apparel” segment is distinguished from the Consumer Apparel segment

because of a different class of customer. The “All Other” segment

consists of the Company’s knitwear, daypack and backpack operations,

which have different product or economic characteristics than those in

the other segments. The Occupational Apparel segment is separately

reportable for 1999 because of recent acquisitions; accordingly, prior

years’ segment information has been restated to conform to the

1999 presentation.

Management evaluates the operating performance of each of its

marketing companies based on their income from operations.

Accounting policies used for segment reporting are consistent with

those stated in Note A, except that inventories are valued on a first-in,

first-out basis and that interest income and expense and amortization of

intangible assets are not allocated to individual segments. Corporate

and other expenses include expenses incurred in and directed by the

Corporate offices that are not allocated to specific business units.

Segment assets are those used directly in the operations of each business

unit, such as accounts receivable, inventories and property, plant and

equipment. Corporate assets include investments and deferred income

taxes. Financial information for the Company’s reportable segments is

as follows:

In thousands 1999 1998 1997

Net sales:

Consumer Apparel $4,276,809 $4,313,082 $3,963,869

Occupational Apparel 640,227 482,931 461,940

All Other 634,580 682,794 796,437

Consolidated net sales $5,551,616 $5,478,807 $5,222,246

Segment profit:

Consumer Apparel $629,127 $693,638 $574,384

Occupational Apparel 79,164 80,988 72,626

All Other 57,715 38,686 73,517

Total segment profit 766,006 813,312 720,527

Interest, net (62,490) (55,871) (25,877)

Amortization of intangible assets (33,097) (32,890) (27,518)

Corporate and other expenses (74,843) (92,953) (81,252)

Consolidated income before

income taxes $595,576 $631,598 $585,880

Segment assets:

Consumer Apparel $1,783,225 $1,858,873 $1,506,035

Occupational Apparel 379,004 247,734 217,239

All Other 332,850 377,155 421,389

Total segment assets 2,495,079 2,483,762 2,144,663

Cash and equivalents 79,861 63,208 124,094

Intangible assets 992,463 951,562 814,332

Corporate assets 459,111 338,134 239,693

Consolidated assets $4,026,514 $3,836,666 $3,322,782

Depreciation expense:

Consumer Apparel $ 89,313 $ 83,382 $ 81,199

Occupational Apparel 14,958 11,769 11,631

All Other 23,555 26,165 29,993

Corporate 6,509 7,179 5,911

Consolidated depreciation expense $134,335 $128,495 $128,734

Capital expenditures:

Consumer Apparel $ 97,196 $129,532 $109,458

Occupational Apparel 20,845 19,362 16,821

All Other 8,358 11,480 15,856

Corporate 23,677 28,685 12,127

Consolidated capital expenditures $150,076 $189,059 $154,262

Information by geographic area is presented below, with sales based

on the location of the customer:

In thousands 1999 1998 1997

Net sales:

United States $4,605,624 $4,552,785 $4,368,474

Foreign, primarily Europe 945,992 926,022 853,772

Consolidated net sales $5,551,616 $5,478,807 $5,222,246

Long-lived assets, primarily

property, plant and equipment:

United States $650,577 $634,231 $596,125

Mexico 71,627 60,400 41,055

Other foreign, primarily Europe 83,029 83,842 73,253

Total long-lived assets $805,233 $778,473 $710,433