North Face 1999 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 1999 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

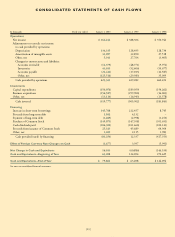

[18]

During 1999, the Company purchased 4.0 million shares of its

Common Stock in open market transactions at a cost of $149.1 mil-

lion. During 1998, the Company purchased 3.2 million shares for

$147.4 million. Under its current authorization from the Board of

Directors, the Company may purchase up to an additional 8.0 mil-

lion shares. Depending on the level of acquisition opportunities

during 2000, the Company intends to continue to invest available

cash flow to repurchase shares.

Cash dividends totaled $.85 per common share in 1999, compared

with $.81 in 1998 and $.77 in 1997. The dividend payout rate

was 28% in 1999, compared with 26% in 1998 and 28% in 1997.

The indicated annual dividend rate for 2000 is $.88 per share.

VF has paid dividends on its Common Stock annually since 1941

and intends to maintain a long-term payout rate of 30%.

Looking ahead to 2000, operating results should benefit from

steps taken to improve profitability in the Lee domestic business, the

European jeanswear businesses and the recently acquired companies.

Next year will bring continued investments in systems and technolo-

gy, as well as expenses related to further reducing our product cost

and operating cost structure. The combined effect of these actions

indicates that earnings in 2000 may be flat with 1999 and that cash

flow from operations should exceed $500 million. With our strong

financial position, unused credit lines and additional borrowing

capacity, the Company has substantial liquidity and flexibility to

meet investment opportunities that may arise.

Euro Currency Conversion Effective January 1, 1999, 11 of the

15 member countries of the European Union established fixed con-

version rates between their existing currencies and a single new cur-

rency, the “euro.” During a transition period through June 2002,

business transactions can be conducted in both the euro and the

legacy currencies. After that date, the euro will be the sole currency

of the participating countries. Approximately 11% of the

Company’s 1999 sales were generated in the European Union.

Management is evaluating the many areas involved with intro-

duction of the euro, including information technology systems.

As of January 1, 2000, substantially all of these systems were euro

compliant, with the remainder expected to be compliant by the end

of 2000. Management is also evaluating the strategic implications

of adoption of the euro, including pricing and distribution of the

Company’s products. Although this evaluation is ongoing, it is likely

that the euro will lead to a more uniform pricing in all European

markets, including those that have not adopted the euro as their

common currency.

The Company is unable to determine the financial impact of the

conversion on its operations, if any, because the impact will depend

on the competitive situations that exist in the various regional markets.

However, management believes that the conversion to the euro will

not have a material effect on the Company’s results of operations or

financial position. All costs relating to the conversion to the euro,

which are not significant, are being expensed as incurred.

Year 2000 Update The Year 2000 issue relates to computer

systems that may not properly recognize date-sensitive information

when the year changed to 2000. Since entering the year 2000, the

Company has not experienced any disruptions to its business, nor is

it aware of any significant Year 2000 issues impacting its suppliers

and customers. The Company will continue to monitor its critical

systems over the next several months but does not anticipate any

exposures from its internal systems or from the activities of its

suppliers and customers. The total cost of resolving the Year 2000

issues, including internal personnel and outside vendors and con-

sultants, was $26 million over the period 1997 through 1999, which

was expensed as incurred.

Risk Management The Company is exposed to a variety of market

risks in the ordinary course of business, including the effects of

changes in interest rates, foreign currency exchange rates and the

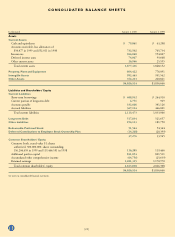

Return on Average

Common Equity

Percent

At 17.3%, our ROE

is within our target

of 17 – 20%.

18.2

19.7

17.3

97 98 99

Dividends Per Share

Dollars

VF’s dividend payout rose

5% for 1999, with an

indicated payout of $.88

per share for 2000.

0.77

0.81

0.85

97 98 99