North Face 1999 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 1999 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

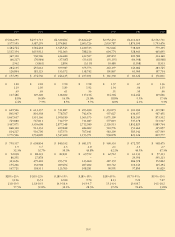

Note B Acquisitions

In 1999, the Company acquired the common stock of Horace Small

Holdings Corporation of Delaware, Inc., a manufacturer and marketer

of occupational apparel, for $57.7 million in cash, plus repayment of

$23.3 million in debt. The Company also acquired two other work-

wear and four jeanswear businesses for an aggregate cost of $78.4 mil-

lion, plus additional contingent consideration if future earnings targets

are attained. Intangible assets related to these acquisitions totaled

$87.4 million. The Company accrued various restructuring charges in

connection with certain of these businesses. The charges relate to sever-

ance, closure of manufacturing and distribution facilities, and lease and

contract termination costs. Cash payments related to these actions will

be substantially completed during 2000. Charges are summarized as

follows (in thousands):

Facilities Lease and

Exit Contract

Severance Costs Termination Total

Restructuring accrual $ 5,061 $1,622 $17,948 $24,631

Cash payments (1,362) (208) (2,218) (3,788)

Estimated remaining costs $ 3,699 $1,414 $15,730 $20,843

During 1998, the Company acquired Bestform Group, Inc. for

$184.3 million in cash, plus repayment of $44.4 million in debt. The

Company also acquired three other businesses in 1998 for an aggregate

cost of $76.1 million and three businesses in 1997 for an aggregate cost

of $16.0 million. Intangible assets related to these acquisitions totaled

$168.5 million in 1998 and $10.0 million in 1997.

The following unaudited pro forma results of operations assume

that acquisitions during the last two years had occurred at the

beginning of 1998:

In thousands, except per share amounts 1999 1998

Net sales $5,614,028 $5,826,443

Net income 363,097 383,933

Earnings per common share:

Basic $3.01 $3.13

Diluted 2.96 3.06

All acquisitions have been accounted for as purchases, and accord-

ingly, the purchase prices have been allocated to the net assets acquired

based on fair values at the dates of acquisition. The excess of cost

over fair value of the purchased businesses has been allocated to intangi-

ble assets and is being amortized over periods from 19 to 40 years.

Operating results of these businesses have been included in the con-

solidated financial statements since the dates of acquisition.

Note C Inventories

In thousands 1999 1998

Finished products $575,617 $552,729

Work in process 171,275 185,929

Materials and supplies 217,148 215,349

$964,040 $954,007

The current cost of inventories stated on the last-in, first-out method

is not significantly different from their value determined under the

first-in, first-out method.

[25]

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

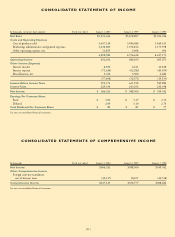

Note A Accounting Policies

Principles of Consolidation: The consolidated financial statements

include the accounts of VF Corporation and all majority owned sub-

sidiaries after elimination of intercompany transactions and profits.

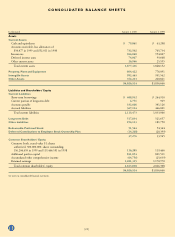

Inventories are stated at the lower of cost or market. Inventories

stated on the last-in, first-out method represent 42% of total 1999

inventories and 48% in 1998. Remaining inventories are valued

using the first-in, first-out method.

Property and Depreciation: Property, plant and equipment are

stated at cost. Depreciation is computed by the straight-line method

over the estimated useful lives of the assets, ranging up to 40 years

for buildings and 10 years for machinery and equipment.

Intangible Assets represent the excess of costs over the fair value of

net tangible assets of businesses acquired, less accumulated amortiza-

tion of $270.5 million and $243.5 million in 1999 and 1998. These

assets are amortized on the straight-line method over 10 to 40 years.

The Company’s policy is to evaluate intangible assets for possible

impairment whenever events or changes in circumstances indicate

that the carrying amount of such assets may not be recoverable. An

impairment loss may be recorded if undiscounted future cash flows,

net of income tax payments, are not expected to be adequate to

recover the assets’ carrying value.

Revenue Recognition: Sales are recorded when products are shipped

to customers, net of discounts and allowances.

Advertising Costs are expensed as incurred and were $257.6 mil-

lion in 1999, $287.5 million in 1998 and $309.3 million in 1997.

Stock-based Compensation: Compensation expense is recorded for

the excess, if any, of the market price of VF Common Stock at the

date of grant over the amount the employee must pay for the stock.

Other Comprehensive Income consists of certain changes in assets

and liabilities that are not included in Net Income but are instead

reported under generally accepted accounting principles within a

separate component of Common Shareholders’ Equity. All amounts

in Accumulated Other Comprehensive Income relate to foreign cur-

rency translation and are net of income taxes at a 35% rate.

Stock Split: During 1997, the Company declared a two-for-one

stock split. Common Stock increased and Retained Earnings

decreased by $61.1 million, representing the stated value of addition-

al shares issued. Amounts presented in the Consolidated Statements

of Common Shareholders’ Equity are based on actual share amounts

outstanding for each period presented.

Reclassifications: Certain amounts in prior years have been reclass-

ified to conform with the current year presentation.

Use of Estimates: In preparing financial statements in accordance

with generally accepted accounting principles, management makes

estimates and assumptions that affect amounts reported in the finan-

cial statements and accompanying notes. Actual results may differ

from those estimates.