Napa Auto Parts 2009 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2009 Napa Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Industrial Group

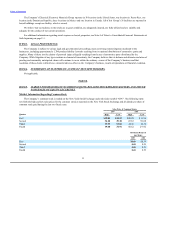

Net sales for Motion Industries, our Industrial Group (“Industrial”), were $2.9 billion in 2009, a decrease of 18% compared to

2008. Through the first three quarters of the year, sales were especially weak for this group due to the effects of very low manufacturing

activity, as evidenced by the reported levels of manufacturing industrial production and capacity utilization, and its negative impact on

demand for industrial products. This weakness was widespread, as we experienced sales declines in nearly all of our major customer

categories. The industrial indices we follow seemed to show some early signs of stabilization in the third quarter and we observed a slight

strengthening in these indicators as we entered the fourth quarter. Industrial sales were down 11% in the fourth quarter, which marks a

significant improvement from the declines of the first three quarters of the year. In 2009, sales were positively impacted by several

acquisitions, which accounted for approximately 3% of Industrial’s sales growth for the year.

Net sales were $3.5 billion in 2008, an increase of 5% compared to 2007. Through the first three quarters of the year, sales held

strong and were relatively consistent from quarter to quarter, increasing 6% in the first quarter and 7% in the second and third quarters.

The fourth quarter proved to be more difficult for this business, due to the deteriorating economic environment, including worsening

manufacturing production trends, and sales for the period were even with the fourth quarter of 2007. In 2008, sales were positively

impacted by several acquisitions, which accounted for nearly 2% of Industrial’s sales for the year.

Office Group

Net sales for S.P. Richards, our Office Products Group (“Office”), were $1.6 billion in 2009, down 5% compared to the prior year.

2009 represents the third consecutive year of decreased revenues for Office and reflects the negative impact of higher white collar and

service unemployment on office products consumption, a trend that began in 2007. During the year, sales improved sequentially, with

decreases of 7%, 6%, 5% and 4% in the first, second, third and fourth quarters, respectively. For the year, sales were positively

impacted by three acquisitions completed in 2008, which contributed nearly 3% to sales in Office. The increase in net sales due to

acquisitions, as well as our sales initiatives, was more than offset by the prevailing poor conditions in the office products industry.

Net sales for 2008 were $1.7 billion, down 2% compared to 2007. This decline was indicative of the industry-wide slowdown in

office products consumption. During the year, sales were down 2% in the first quarter and even with the prior year periods in the second

and third quarters. Demand in the fourth quarter worsened, consistent with the significant increase in unemployment for the period, and

sales were down 5% from the 2007 fourth quarter. For the year, sales were positively impacted by three acquisitions, which contributed

nearly 2% to sales in Office.

Electrical Group

Net sales for EIS, our Electrical and Electronic Group (“Electrical”), decreased to $346 million in 2009, down 26% from 2008.

Electrical sales declined by 25% in the first quarter, 34% in the second quarter and 30% in the third quarter. For the fourth quarter, sales

were down 12%. Manufacturing contraction, as measured by the Institute for Supply Management’s Purchasing Managers Index, was

evident through June and then began to stabilize and improve over the last half of the year. This factor, which we deem as positive for

2010, helps explain the quarterly sales trends at Electrical in 2009. Acquisitions had less than a 1% positive impact on Electrical sales in

2009.

Net sales increased by 7% to $466 million in 2008 compared to 2007. Electrical sales were strong through the first nine months of

the year, increasing 7% in the first quarter, 11% in the second quarter and 13% in the third quarter. The deteriorating economy had a

significant impact on this business in the fourth quarter and sales decreased 4% from the same period in 2007. Acquisitions during the

year had a positive 2% impact on Electrical sales in 2008 and, combined with Electrical’s sales initiatives, partially offset the weakening

conditions in the marketplace in the last quarter of the year.

Cost of goods sold was $7.0 billion, $7.7 billion and $7.6 billion in 2009, 2008 and 2007, respectively. The 9% decrease in cost of

goods sold from 2008 to 2009 is consistent with the sales decrease. Cost of goods sold

16