Napa Auto Parts 2009 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2009 Napa Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

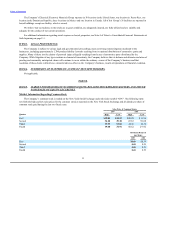

Set forth below is a line graph comparing the yearly dollar change in the cumulative total shareholder return on the Company’s

Common Stock against the cumulative total shareholder return of the Standard and Poor’s 500 Stock Index and a peer group composite

index structured by the Company as set forth below for the five year period that commenced December 31, 2004 and ended December 31,

2009. This graph assumes that $100 was invested on December 31, 2004 in Genuine Parts Company Common Stock, the S&P 500

Stock Index (the Company is a member of the S&P 500, and its cumulative total shareholder return went into calculating the S&P 500

results set forth in the graph) and the peer group composite index as set forth below and assumes reinvestment of all dividends.

Genuine Parts Company, S&P 500 Index and peer group composite index

Genuine Parts Company 100.00 102.57 114.23 114.91 97.62 102.71

S&P 500 100.00 104.91 121.48 128.14 80.73 102.09

Peer Index 100.00 118.13 111.08 122.65 60.17 149.46

In constructing the peer group composite index (“Peer Index”) for use in the stock performance graph above, the Company used the

shareholder returns of various publicly held companies (weighted in accordance with each company’s stock market capitalization at

December 31, 2004 and including reinvestment of dividends) that compete with the Company in three industry segments: automotive

parts, industrial parts and office products (each group of companies included in the Peer Index as competing with the Company in a

separate industry segment is hereinafter referred to as a “Peer Group”). Included in the automotive parts Peer Group are those companies

making up the Dow Jones Auto Parts and Equipment Index (the Company is a member of such industry group, and its individual

shareholder return was included when calculating the Peer Index results set forth in the performance graph). Included in the industrial

parts Peer Group are Applied Industrial Technologies, Inc. and Kaman Corporation and included in the office products Peer Group is

United Stationers Inc. The Peer Index does not break out a separate electrical/electronic peer group due to the fact that there is currently no

true market comparative to EIS. The electrical/electronic component of sales is redistributed to the Company’s other segments on a pro

rata basis to calculate the final Peer Index.

12