Napa Auto Parts 2009 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2009 Napa Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

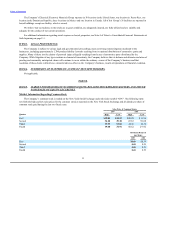

The following table sets forth certain selected historical financial and operating data of the Company as of the dates and for the

periods indicated. The following selected financial data are qualified by reference to, and should be read in conjunction with, the

consolidated financial statements, related notes and other financial information set forth beginning on page F-1, as well as in “Item 7.

Management’s Discussion and Analysis of Financial Condition and Results of Operations” of this report.

Net sales $11,015,263 $10,843,195 $10,457,942 $ 9,783,050

Cost of goods sold 7,742,773 7,625,972 7,353,447 6,884,964

Operating and non-operating expenses, net 2,504,022 2,400,478 2,333,579 2,189,022

Income before taxes 768,468 816,745 770,916 709,064

Income taxes 293,051 310,406 295,511 271,630

Net income $ 475,417 $ 506,339 $ 475,405 $ 437,434

Weighted average common shares outstanding during

year — assuming dilution 162,986 170,135 172,486 175,007

Per common share:

Diluted net income $ 2.92 $ 2.98 $ 2.76 $ 2.50

Dividends declared 1.56 1.46 1.35 1.25

December 31 closing stock price 37.86 46.30 47.43 43.92

Long-term debt, less current maturities 500,000 250,000 500,000 500,000

Total equity 2,393,378 2,782,946 2,610,707 2,751,004

Total assets $ 4,786,350 $ 4,774,069 $ 4,496,984 $ 4,771,538

Genuine Parts Company is a service organization engaged in the distribution of automotive replacement parts, industrial replacement

parts, office products and electrical/electronic materials. The Company has a long tradition of growth dating back to 1928, the year we

were founded in Atlanta, Georgia. In 2009, business was conducted throughout the United States, Puerto Rico, Canada and Mexico from

approximately 2,000 locations.

We recorded consolidated net sales of $10.1 billion for the year ended December 31, 2009, a decrease of 9% compared to

$11.0 billion in 2008. Consolidated net income for the year ended December 31, 2009 was $400 million, down 16% from $475 million

in 2008. The effects of the economic slowdown, which we began to experience in the final quarter of 2008, adversely impacted the results

in all four of our business segments throughout 2009. Our businesses were impacted by the effects of reduced consumer spending, lower

levels of industrial production and higher unemployment, which we discuss further below.

Our 2009 revenue decrease of 9% follows a 2% and 4% increase in revenues in 2008 and 2007, respectively. Our 16% decrease in

net income follows a 6% decrease in 2008 and a 7% increase in 2007. In each of the three years preceding 2007, the Company had

experienced double-digit earnings growth. Throughout these periods, the Company has implemented a variety of initiatives in each of our

four business segments to grow sales and earnings, including the introduction of new and expanded product lines, geographic expansion

(including acquisitions), sales to new markets, enhanced customer marketing programs and a variety of gross margin and cost savings

initiatives. The prevailing economic conditions of the last two years have offset these initiatives, as reflected in our earnings for 2008 and

2009.

The following discussion addresses the major categories on the December 31, 2009 consolidated balance sheet. The Company’s cash

balance of $337 million was up $269 million from $68 million at December 31, 2008.

14